Mobileye NV (NYSE: MBLY) – market cap as of 30/03/2017: $13.63bn

Intel Corporation (NASDAQ: INTC) — market cap as of 30/03/2017: $171.80bn

Introduction

On March 13, 2017, Intel Corporation announced the acquisition of the Israeli tech company Mobileye NV for $14.7bn. The U.S. chipmaker is paying one of the highest takeover premiums of the century, with a EV/Revenues multiple that is over 6x more expensive than the semiconductor industry’s average. The rationale lies in Intel’s desire to catch-up in the market for self-driving cars, which could be worth as much as $70bn by 2030.

About Mobileye NV

Mobileye is a Jerusalem-based technology company, founded in 1999 by Amnon Shashua and Ziv Aviram. Today, it is one of the main global players in the market for safety systems for drivers. More specifically, the firm operates in the field of software for “Advanced Driver Assist Systems” (ADAS) and has more than 27 automaker partners, including BMW and Volkswagen. As of today, the original idea of the funders to provide safety systems through a single–lensed camera has grown in importance in the automotive market and 313 car models (15m vehicles worldwide) are now equipped with Mobileye technology.

Mobileye offers both active and passive ADAS products. Passive systems alert the driver of a potentially dangerous situation but it is up to the driver to intervene and prevent a collision. On the other hand, an active system not only alerts the driver, but also takes action and prevents potentially dangerous situations from happening in the first place. Intuitively, what makes Mobileye a forward-looking company, is that its active systems constitute the base for semi/fully autonomous self–driving, which is a market expected to reach $70bn by 2030.

After a $130m investment round by Goldman Sachs in 2007, Mobileye went public in August 2014 on the NYSE, as the largest ever IPO of an Israeli company in the United States, with an IPO price of $25 per share, valuing the firm at $5.31bn. As of FY2016, Mobileye reported $358m in Revenues, EBIT at $120m and Net Income for the year of $108m.

About Intel Corporation

Intel is a California–based multinational, founded in 1968 by Bob Noyce and Gordon Moore. Despite being famous for its chip business, Intel scope reaches far beyond this single market: Intel is also involved in designing and manufacturing the essential products and technologies powering countless hardware and, more broadly, the smart and connected world.

Because of the complexity and depth of its business, Intel has articulated its operations in several operating segments. The main ones are Client Computing (which is responsible for 55.4% of total revenues), Data Centre, IoT (i.e. Internet of Things), Non–Volatile Memory Solutions, Intel Security and Programmable Solutions.

Intel reported FY2016 revenues of $59.4bn, up 7.2% from the previous year, and Net Income of $3.6bn, down 10.6% compared to FY2015 due to higher cost of sales and R&D efforts. Looking at business unit trends, we notice that the fastest growing divisions are IoT (up 15% from the previous year, but accounting for just 4.3% of total revenues), Intel Security (up 9% from 2015) and Data Center (growing at 8% rate and responsible for one third of total sales).

Industry Overview

The self-driving automobile manufacturing industry is dominated by well-known automotive and technology companies as these two sectors are merging different, but complementary, technical competencies used for the realization of driverless cars. This blend between automotive and tech companies is eased by the fact that semiconductors makers are swarming over this rising industry in the hope that increasing electronic cars use will offset the reduction in revenues from PCs and mobiles.

As of today, the key industry incumbents are Alphabet (through its self-driving car unit – Waymo), Tesla (which has gathered more than 1.3 billion miles of data from its autopilot vehicles and is considered by most analyst as the pole positioner in autonomous driving) and Mercedes-Benz (through its partnership with Uber Technologies).

Other important automotive players are Volvo, Ford, Toyota, BMW, Audi and Volkswagen. However, a series of lesser known companies, in addition to the big likes of Alphabet, supply the technology and know-how required for the successful development of driverless cars. Companies like Mobileye, Nvidia, Qualcomm, and in-house technology groups within big automotive companies take the lead in this subsector.

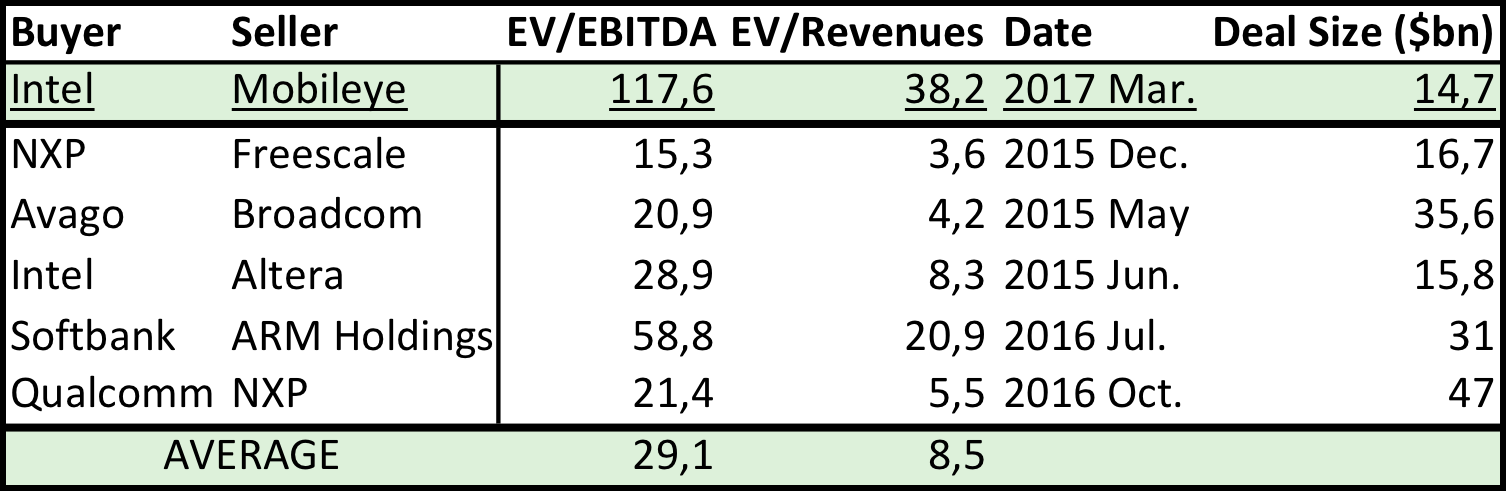

Looking more closely at semiconductor companies’ endeavours in IoT ventures, we notice that most companies have concluded that it is cheaper to obtain the know-how and technology through acquisitions rather than to develop it from scratch. For this reason, the market is experiencing a surge in M&A deals. We remember Avago’s acquisition of Broadcom for $35.6bn, Softbank acquisition of ARM Holdings for $31bn and Qualcomm takeover of NXP for $47bn, among the others.

The overall self-driving car market is expected to experience the biggest growth in the next two decades, with 12m fully autonomous vehicles and 18m partially autonomous vehicles expected to be sold annually by 2035. The sector is expected to be worth between $42bn and $77bn in the period 2025 – 2035. Reaching such results will also depend on the company’s ability to meet regulators’ concerns, especially regarding customers’ security, cyber security and liability claims, which are for now left mostly unanswered.

Deal Structure

According the terms of the deal, a subsidiary of Intel will launch a tender offer for all the issued and outstanding ordinary shares of Mobileye. Intel will pay $63.54 per share in cash, a 34.7% premium over Mobileye’s closing price on March 10, 2017, implying a fully-diluted equity value of $15.3bn and an EV of $14.7bn. This is the second most expensive acquisition in Intel’s history (just behind the $16.7bn acquisition of Altera in 2015) and represents the largest offer ever made for an Israeli company.

The acquisition has been criticized by many analysts for being too expensive. Indeed, Intel is paying 38.2x Mobileye’s 2016 revenues of $385.2m and 29.4x its projected 2017 revenues of $500m, much higher multiples than the 5x industry average and the 8.5x of comparable transactions. The LTM EV/EBITDA multiple of 117.6x, compared to the average 29.1x of comparable companies, highlights even more clearly the huge premium paid.

Moreover, the transaction is expected to be immediately accretive to Intel’s non-GAAP EPS and FCF, but it will not make any major difference in Intel’s revenues or profits.

The acquisition, which is expected to close within the next 9 months, will be mostly funded with offshore cash and should therefore not impact the company’s investment grade rating. Intel’s combined automotive unit, which will consist of Mobileye and Intel’s Automated Driving Group, will be headquartered in Israel and led by Mr. Shashua, Mobileye’s Cofounder, Chairman and CTO.

Source: BSIC

Deal Rationale

According to Brian Krzanich, CEO of Intel, the deal is a “merger of the eyes (Mobileye) and the brains (Intel)”.

Autonomous driving (AD) is a complex industry relying on algorithms, digital maps and a variety of sensors. Clearly, the hardware component of this technology is fundamental but also the ability to rapidly analyse data and to support a continuous exchange of data between the autonomous car and the central server is of extreme relevance. Given the expertise and leadership positions held by the two companies, their willingness to provide both services as a single entity is one of the most compelling reasons supporting the merger. Moreover, despite Intel being at the forefront of the chip market, building a valid team to constantly operate in the autonomous driving market would have been more time consuming, expensive and risky than merging with a top–tier firm as Mobileye. From this standpoint, therefore, Mobileye would bring to the table the expertise and Intel wold provide the required hardware to operate in the business.

Moreover, this acquisition holds a strategic value as it will allow Intel to accelerate innovation in the AD industry and will generate an end-to-end technology provider, holding leadership in both the sectors of artificial intelligence and state-of-the-art hardware. As more economically measurable reasons to merge, Intel is expecting to generate incremental recurring revenue opportunities and cost synergies rising to $175m per year by 2019.

Even though the deal potentially provides many upsides for both Intel and Mobileye, there are also some risks. The most important one may be related to the previous partnership between Tesla and Mobileye: the Israeli firm was in charge of providing Tesla with the AD technology but the collaboration was badly ended because of the death of a pedestrian in 2016 caused by a Tesla in self–driving mode. This is a proof of the fact that Mobileye ADAS, and especially active ones, are still lagging behind the products offered by competitors (such as Nvidia) and this will require further research and conjunct effort in order to provide a product able to meet customers’ expectations and not prompt to generate negative externalities for both firms.

Market Reaction

On March 13, 2017, the Israeli firm shares peaked 28.2% to $60.62 and have been trading on such levels since. Intel shares, on the other hand, suffered a 2.1% plunge to $35.16, probably due to concerns about Intel overpaying for the acquisition.

Advisors

Citigroup and Rothschild advised Intel on the transaction. On the sell-side, Raymond James served as financial advisor for Mobileye.

0 Comments