US

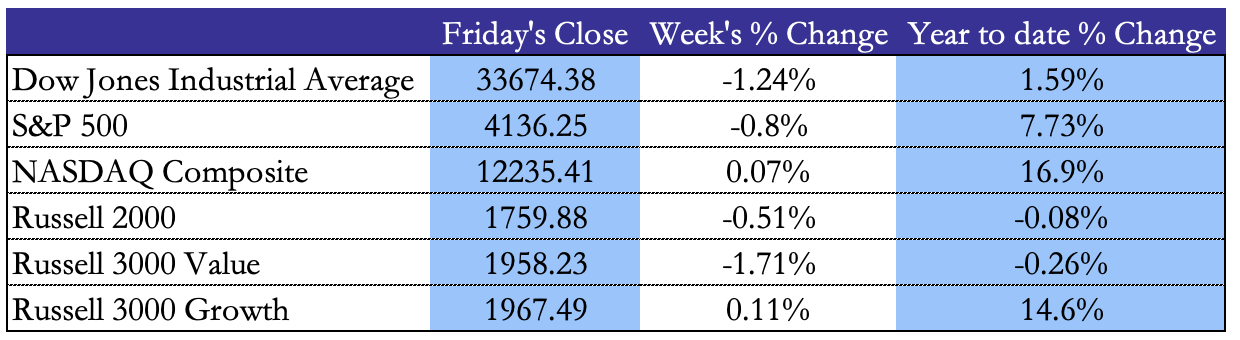

The week in the US market was marked by big losses in regional banks stocks, as First Republic failed. The S&P500 lost 0.8% for the week, the Dow Jones was down 1.24% and the Russell 3000 Value was down 1.71%. While the Nasdaq and Russell 3000 Growth gained 0.07% and 0.11% respectively. The CBOE Volatility Index closed the week at 17.19, 4.88% higher than the previous week.

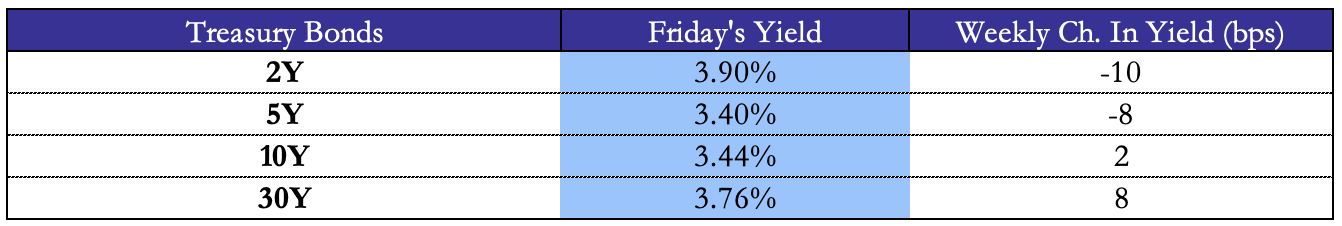

The week started with regional banks’ shares dropping sharply after regulators arranged for JP Morgan Chase to buy distressed bank First Republic Bank. JP Morgan bought all $93.5bn of First Republic’s deposits and the bank’s assets in a deal that represents the second largest bank failure in US history following the failure of Washington Mutual in 2008. JP Morgan’s shares jumped 2.2% after the deal was announced, while the wider KBW of regional banks index fell 2.6% as PatWest fell 10% and PNC and Citizens both lost more than 6% after bidding for First Republic. The S&P closed flat for Monday while the Nasdaq slid 0.1% as the market awaited a busy week of economic releases. Treasuries came under pressure with 2-year yields rising by 8bps and 10-year yields rising by 13bps as Treasury secretary warned that the Treasury estimates the US government will be unable to meet its obligations as soon as June if the debt ceiling is not lifted.

The losses in treasuries suffered on Monday were regained on Tuesday as 2-year yields fell 15bps and 10-year yields by 12bps as investors rushed to purchase US treasuries amid the banking turmoil. The KBW Regional Banking Index fell by 5.5%, driven by PacWest losing 27.8% and Western Alliance down 15%. This marked the worst day for the index since March 13, when SVB collapsed. The S&P lost 1.2% with the energy sector being the worst performer, down 4.3% on Tuesday.

Stocks fell on Wednesday as Powell warned that cuts may not come as soon as expected and future hikes will be dependent of economic data and developments. The Fed’s decision was to raise interest rates by 25bps, as widely anticipated by the market, to a range of 500-525bps. While this may well be the last step of the Fed’s hiking cycle, the imminent easing priced in by the market is unlikely to come if inflation continues to be elevated. The S&P closed the day 0.7% lower and the Nasdaq fell by 0.5% while regional banks continued their free fall, with the KBW down 0.9% on Wednesday.

The drop in US regional bank was not over, with PacWest announcing a possible sale on Thursday causing a 50% drop for the day and First Horizon shares falling 32% after the planned merger with TD was halted, with the KBW index down, once again, by 3.5% as the S&P and Nasdaq repeated their performance from the previous day and treasuries continued rising, as yields dropped once again, with 2-year yields down 7bps for the day.

Friday marked a strong reversal in the US banking sector, with PacWest gaining 82% for the day, as the KBW finally closed its losing streak, adding 4.7%. The S&P gained 1.9% and the Nasdaq 2.3%, closing virtually flat for the week. Treasuries fell sharply, with 2-year yields gaining 19bps as the US job market remains tighter than expected, maintaining inflationary pressures high and indicating that cuts might not be coming soon. The NFP showed that the US economy added 253,000 jobs versus expectations of 180,000 from Reuters polls. The unemployment rate was 3.4%, down from 3.5% in March, and reaching a 53-year low. Hourly wages rose more than expected, gaining 0.5% from March’s 0.3%, once again indicating a tight labor market, inconsistent with the 2% inflation target. Apple was up more than 4% after beating Q1 forecasts.

EU

European markets were mostly down for the week as the continent-wide STOXX 600 lost 0.29%, with Germany’s DAX and Italy’s FTSE MIB being the only indexes in the green, closing 0.24% and 1% higher than the previous Friday respectively.

European markets opened on Tuesday with the STOXX 600 down 1.2%, reaching its lowest levels in almost a month and the CAC 40 down 1.5% as Eurozone inflation came in higher than anticipated. Headline inflation was 7%, higher than flat expectations from last month’s 6.9%. Core inflation, however, experienced the first slowdown since June 2022, reaching 5.6% after March’s record of 5.7%. The FTSE fell by 1.2% as big oil companies fell sharply, with BP down 8.6% after announcing a slowdown of its share buyback scheme. Oil and gas shares (STXE O&GAS P INDEX) plunged 4.5%. Much like in the US, education stocks were hit by worsening forecasts as ChatGPT becomes more and more used by students, with Pearson down 15%. Logitech and HSBC were up respectively 7% and 3.5% following better-than-expected Q1 results.

The STOXX 600 gained 0.3% on Wednesday as speculation that the Fed may be done with rate hikes mounted and EU unemployment came out as 6.5% for March down from the previous 6.6% for February and better than flat expectations, even though a tighter labor market might point towards more rate hikes by the ECB in its fight with inflation. Pearson jumped 10.1% after Tuesday’s massive drop after BofA upgraded it to Buy from Underperform.

The ECB raised interest rates by 25bps on Thursday to 3.25%, slowing down from previous consecutive 50bps hikes this year. Lagarde stated that the ECB is not going to stop hikes as it continues to fight well above-target inflation. Andrew Kenningham, chief Europe economist at Capital Economics anticipates rates to peak at 3.75% with 2 more 25bps hikes. EU banks slid amid growing concerns for the US banking sector with the STXE 600 Bank Index falling 1.5%. Ferrari stock gained 4.7% as it beat Q1 earning expectations.

Friday was a good day for European markets, as the STOXX 600 gained 1.1%, the FTSE 1% and the DAX added 1.4% driven by strong results from Adidas, as the German sportswear maker gained 8.9%. The oil and gas sector recouped some of the weekly losses, gaining 2.7%.

Government bond yields closed the week without massive changes from last Friday, with the UK adding 6bps, while all other major EU economies stayed in a range of 2bps.

Rest of the world

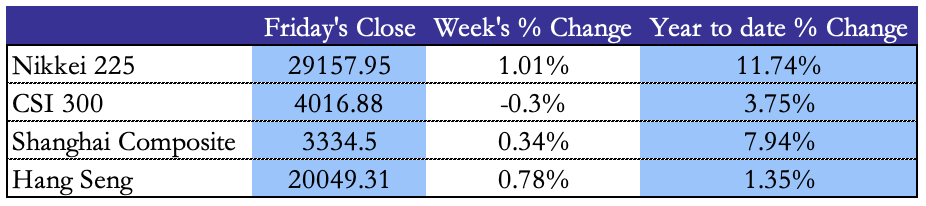

Asian markets closed a positive week, with the Nikkei leading the pack, adding 1.01%, the Hang Seng posting 0.78% gains and the Shanghai Composite up 0.34% for the week, with the CSI 300 being the only major index closing the week in the red. Chinese markets were mostly closed for Golden Week.

The week opened with weakening data from the Chinese economy. The manufacturing PMI declined to 49.2 in April from 51.9 in March, it is important to note that a level of 50 is what separates economic expansion and contraction. Markets remained closed for holidays.

Tuesday’s trading was mixed, with the Hang Seng gaining 0.2%, while Japan’s Topix fell 0.1%. The equities sell-off in the US on Wednesday was felt also by the open Asian markets, with the Kospi losing 0.9%, the Hang Seng 1.3% and the S&P/ASX 200 down 1%.

On Thursday data showed a 40.9% increase in Hong Kong retail sales, posting fourth consecutive month of growth after severe Covid restrictions and the reopening at the beginning of the year. The Asian financial hub is expected to grow 3.5-5.5% in 2023 after shrinking 3.5% in 2022.

On Friday the Australian central bank hiked rates for the 11th time in a row to 3.85% amid inflation worries, as core inflation currently stands at 6.6% driven by low productivity growth and high energy prices. The S&P/ASX 200 was down 1.22% for the week.

The Turkish BIST-100 fell 4.7%, bringing YTD losses to -20.12% as Turkish inflation slowed to 44% down from the 50% registered in March. In Latin America, the Mexican’s IPC was down 0.33%, while the Bovespa was up 0.69%, but still down YTD.

FX and Commodities

US economic data on Monday sent the Dollar Index up 0.39%, with the Euro down 0.44% and the Yen down 0.87%. Oil was down on the first day of the week, with Crude down 1.46% and Brent down 1.3%, while spot gold dropped 0.4% after US manufacturing data.

The dollar’s gains were reverted on Tuesday, with the Dollar Index down 0.25%, while oil continued dropping with Crude and Brent down 5.29% and 5.01% respectively. Spot gold was up 1.8%.

The downturn in oil continued on Wednesday as Crude and Brent were down around 4% again, while the dollar index was down 0.46% for the day, losing 0.74% against the Yen and 0.5% against the Euro.

After the ECB 25bps hike, the Dollar gained 0.41% against the Euro as the central bank slowed down its hiking pace and markets digested the news. Oil prices finally stabilized on Thursday, with Crude down 0.06% and Brent up 0.24%. Gold reached highest levels in years at spot $2050.66 an ounce as investors rushed into gold as a safe-haven asset amid banking turmoil.

The week closed with the Dollar Index down 0.06% on Friday. Oil priced jumped up with Crude up 4.05% and Brent up 3.86% boosted by the rise in energy stocks. While gold retreated after approaching all-time highs, down 1.7% for the day.

Next Week’s Events

Brainteaser #42

The cards in a stack of 2n cards are numbered consecutively from 1 through 2n from top to bottom. The top n cards are removed, kept in order, and form pile A. The remaining cards form pile B. The cards are then restacked by taking cards alternately from the tops of pile B and A, respectively. In this process, card number (n+1) becomes the bottom card of the new stack, card number 1 is on top of this card, and so on, until piles A and B are exhausted. If, after the restacking process, at least one card from each pile occupies the same position that it occupied in the original stack, the stack is named magical. For example, eight cards form a magical stack because cards number 3 and number 6 retain their original positions. Find the number of cards in the magical stack in which card number 131 retains its original position.

Source: 2005 AIME II – Problem 6

SOLUTION: Since a card from B is placed on the bottom of the new stack, notice that cards from pile B will be marked as an even number in the new pile, while cards from pile A will be marked as odd in the new pile. Since 131 is odd and retains its original position in the stack, it must be in pile A. Also to retain its original position, exactly 131 – 1 = 130 numbers must be in front of it. There are 130/2 = 65 cards from each of piles A, B in front of card 131. This suggests that n = 131 + 65 = 196, and the total number of cards is 196 x 2 = 392.

Brainteaser #43

An island is inhabited by 100 smart lions who are good at math. A lion likes eating a human, but doing so would turn the lion into a human. Assuming staying alive is the highest priority, if a human arrives to the island, will he be eaten?

Source: Isichenko, Michael. Quantitative Portfolio Management: The Art and Science of Statistical Arbitrage. 2021

0 Comments