[edmc id=1589] [/edmc]

[/edmc]

US

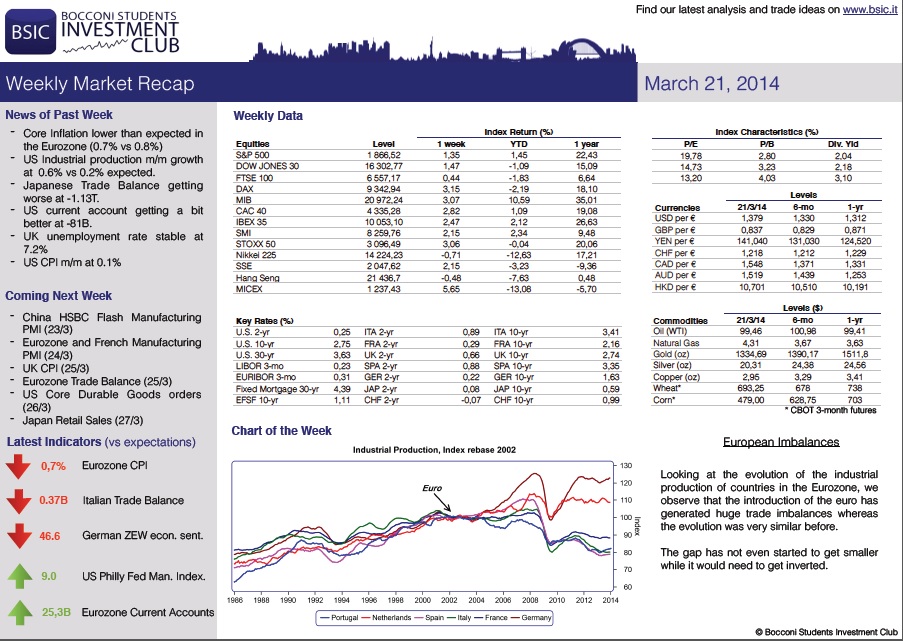

Another volatile week for the markets and for the U.S. ended on Friday amid concerns over Russia. As was expected, Crimea voted for annexation to Russia on Sunday 16th and this led to further sanctions to a group of Russian wealthy individuals that rattled Russia’s economy on Friday. Equity benchmarks in U.S. though were mostly moved by Janet Yellen’s speech more than being moved by Eastern Europe concerns.

Asset purchasing was cut down to 55 billion per month, and Janet Yellen gave her polished speech on Wednesday, which did not have great depth as expectable apart from several parts in which she let slip moments of confusion as to where the Fed stands with regards to monetary policy. The biggest slip was her letting out an actual time period, six months, between when Q.E. would halt and when interest rates would be raised. It is not important how she then sugarcoated it, traders heard “six months”. And that would mean that given a stop in asset purchasing in October, rates would hike in March-April 2015. “It’s a date”, some would say. Equity indices dropped but later on rebounded and closed the week in positive territory, the S&P 500 rising 1.3 % over the week and the Dow 0.82.

Source: FT

Especially the 2-year notes and the 5-year notes, which are the most targeted by the Fed’s monetary policy, tumbled after the previously mentioned facts, and the sell-off may continue next week with $96 billion worth of 2-5-7 year treasury notes auctions coming up.

Eurozone

The eurozone was not severely affected by concerns over Crimea and Russia, which we already said were highly expected, and surely the additional sanctions put into place this week lessened risk aversion and facilitated the upside, as they were not extremely heavy. Them being too serious in fact would mean a fallback on Europe too. Eurofirst 300 rose 1.8 per cent over the week, though the major equity indices were also set back by monetary policy reassessments on Wednesday. The German Dax also rose to 9342 points this week and the FTSE Mib closed higher after reaching a very good high of almost 21’200 points.

European CPI was lower than forecasted at 0,7 % YoY in February and we will receive the Markit PMI for Europe on Monday 24th. European yields lowered especially in the long part of the curve, and the Current Account surplus widened to € 25,3 billion. Euro appreciated w.r.t. its primary counterparts and crossed 1,379 to the dollar.

UK

This week UK has witnessed two extremely important speeches, which catalysed UK markets Tuesday. In the first one Carney, the Head of the BoE, announced radical changes in the structure of the central bank itself. A new deputy, with the mandate of overseeing both the markets and the banking sector, will be created.

This change is intended to better integrate the recently acquired regulatory functions of the BoE, and will be probably be accompanied by a new external director instead of Fisher, the current executive director of markets.

In the other speech Osborne, Chancellor of the Exchequer, revealed its plans to change the UK pension system, allowing retirees to immediately withdraw all their contributions without penalising them with extra-taxation. This news abruptly pushed down all the Insurance companies that offer annuities in the UK.

Osborne also boosted growth forecast to 2.7% (from 2.4%) y/y, the biggest upward revision in three decades. Yet, this strong GDP growth is not producing the usual increase in tax revenue, leaving UK with a £9.3 bln deficit in February. This data, above analysts’ expectations, poses serious doubts on the possibility of a long lasting recovery, especially downward revision of US and Chinese growth from January.

Unemployment was steady at 7.2%, in the expectation’s range.

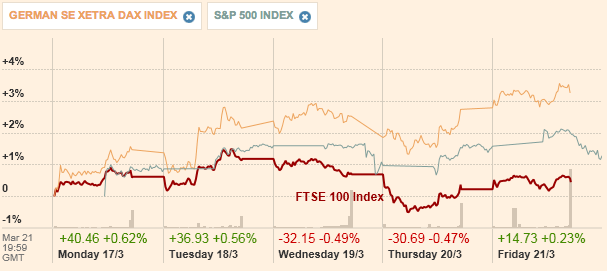

The speeches, which basically meant increased regulation and deficit, negatively affected the FTSE100, which after Tuesday lost the pace of the S&P 500 and of the DAX50.

Source: FT

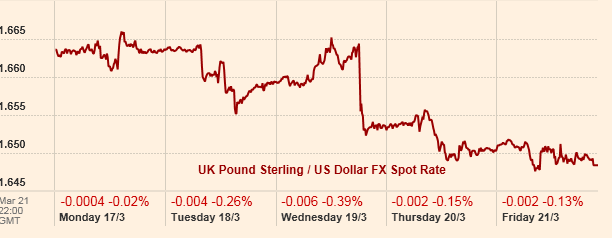

The pound lost nearly 0.8% against the USD. This loss was nearly entirely due by the more hawkish than expected first speech of Janet Yellen, who not only continued to taper but also hinted to a possible rate hike in 2015. The GBP/EUR was flat instead.

Source: FT

Interest rates on the 10y UK bond rose accordingly, up to 2.74% from the previous 2.67%.

Next week there will be plenty of data about UK: CPI y/y (consumer price index), HPI y/y(house price index), retail sales m/m and current account m/m. Given that the recovery seems quite strong, at least for the moment, this data will be extremely important to evaluate inflation and house prices, which are growing rapidly especially in London.

Japan

As anticipated last week, on Thursday we saw the result of the survey that detected the change in the land-prices in more than 26.000 sites in Japan. Commercial land prices in Tokyo, Osaka and Nagoya, three major metropolises, rose by 1.6% in 2013 reversing a decline of 0.5% the year before. However, average land prices of Japan as a whole fell 0.6%. It is definitely a good news, but it highlights the difference between metropolitan and rural areas and, according to us, one of the reason for many areas underperforming is population decline.

However, this week the markets focused mainly on the new Federal Reserve’s forward guidance that pushed the Yen up to 102.42 against the dollar. Despite a weaker currency, the Nikkei 225 didn’t rebound and closed the week barely unchanged as investors pulled out of the country a lot of money. Net sales of Japanese stocks by overseas investors last week came to Y1.09tn ($10.8bn), topping big weekly sell-offs in March 2008 and June 2010, and bringing this year’s total exodus to $19.5bn. That highlights the worst start to a year since a $42bn outflow in the first quarter of 2009, in the trough of the Lehman crisis.

Next week we will see other important economic releases: Household spending y/y, Core CPI y/y and finally the Unemployment Rate. They will be very important indicator to see if the economy is reacting to Mr. Abe stimulus.

Emerging Markets

As far as Emerging Markets are concerned, the week closed with a slight decrease in the value of the MSCI Emerging Market Index, which slipped 0.78%. The performance of those markets has been mainly determined by Janet Yellen’s speech on Wednesday, after which the Index fell by 1.04%. This was caused by a perceived opinion that interest rates will rise sooner than expected triggering renewed pressures on capital outflows from EM. Also EM currencies suffered the outlook proposed by the Fed: the Philippines peso sank 1.5 percent to 45.31 per dollar this week, Malaysia’s ringgit fell 0.9 percent to 3.3085 and Taiwan’s dollar slid 0.9 percent to NT$30.652. Indonesian rupiah lost 0.6 percent to 11,423, South Korea’s won weakened 0.7 percent to 1,080.4 and Thailand’s baht dropped 0.3 percent to 32.381. India’s rupee climbed 0.4 percent to 60.9250. Therefore, it appears that markets continue to fear the possible damages that a surge in US interest rates will cause on EM countries, especially those who are characterized by a current account deficit.

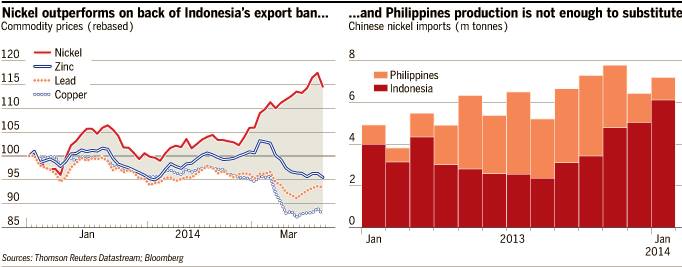

As pointed out in our last Market Recap, this year commodities are suffering a lot due to the slowdown of the economic activity in China. However, one of them, nickel, is not following the same track. Since the beginning of the year, nickel has outperformed all its metal peers, increasing in value of roughly 15%. This performance is heavily determined by Indonesia. At the end of last year, the country has in fact approved a ban on export of nickel. Indonesia is undoubtedly one of the main supplier of nickel in the world and this ban has strongly reduced the available quantity of the commodity to be traded, provoking an increase in the price. Notwithstanding the position of the Philippines, which is an important exporter of nickel, especially for the Chinese market, it seems that the importance of Indonesia is not going to diminish and, accordingly, if the ban is going to persist, the price of the nickel is going to continue to increase.

Source: Thomson Reuters, Bloomberg

China

This week two main indicators have been released for the Chinese economy. The housing Price Index has increased by 8.7% while 9% were expected and the Foreign Direct Investment has increased by 10.4% y/y.

Growth this year is expected to slow down because of tightening of credit since last year. However, looking at historical patterns and some economic surprise index we observe that China’s economic data are usually worse than expectations at the beginning of the year and get better around the middle. Markets anticipations seem now too pessimistic according historical patterns and buying the Hang Seng index or recent DB ETFs that allows to bet on Chinese Companies may be a good trade for the next 3 to 4 months.

Pressure on commodities may be less than expected, especially regarding iron ore. Recent drop in prices are the results of a lower expected demand that lead steel mills to get rid of their stocks by lowering their price. However, Chinese environmental policies and credit tightening may offset the demand downside pressure by putting an upside one on the supply side. Once more historical patterns suggest this to happen by the middle of the year.

Sources: Financial Times

[edmc id=1588]Download as pdf[/edmc]

0 Comments