US

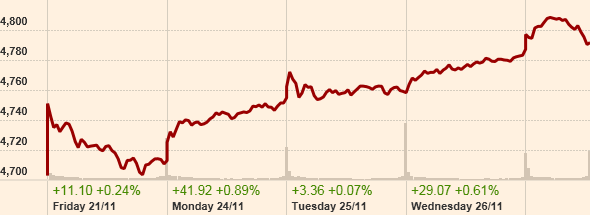

The week just past us was one of slight gains in US equity markets, with most volume on Tuesday and Wednesday due to the Thanksgiving holiday on Thursday. The week opened with a soft print of the US services PMI, then trading became jittery for the S&P 500 as on Tuesday the growth rate of the US economy was revised upwards (3.9% compared to an initial estimate of 3.5% and an expected downward revision to 3.3%), only to be paired with disappointing figures for consumer confidence and house price gains. After having touched a new all-time high at 2,075.76 on Friday, the S&P 500 was dragged down by losses on energy stocks due to plunging oil prices, to later close marginally higher than last week at 2,067.56. The NASDAQ index was instead pushed upwards by tech firms and ended the week with a 1.67% gain (see chart below).

Source: FT

In US Treasuries space a marked bull flattening was seen despite the positive news on GDP growth. Indeed, the whole section of the yield curve past 6 months was lower than last week, with securities with a 10-year maturity yielding 15 basis points less. To make sense of the fall in yields, it is worth to note that part of the revision of the GDP growth figure was due to inventories buildup ahead of the holidays season and thus it should weigh down on the next measurement, especially if weak consumer confidence does not make the bet by retailers pay; furthermore, figures for estimated wage growth were again revised downwards and the prospect of weak oil prices in the medium term significantly diminishes inflationary pressures. In other words, while the US economy seems on track to withstand a first rate hike in the second half of next year, the road ahead looks a lot less clear.

As regards currencies, the US dollar continued its appreciation trend against the Japanese yen, so that at the moment one dollar is worth 118.65 yen. The greenback kept instead unchanged its value in British pounds terms and lost half per cent of its value vis-à-vis the euro.

Next week will be definitely richer in terms of macroeconomic news: other than manufacturing PMIs on Monday, we are looking out for the number of non-farm payrolls and the unemployment rate on Friday. Furthermore, it will be interesting to see the average hourly earnings figure, as its departure from a so far low trend could prompt monetary policymakers to act sooner than expected. As a result of the breadth of indicators that will be diffused and of the fact that the largest indices have tested their limits, we do expect a clustering of volatility for equities with an asymmetric profile of returns to the downside unless all data really shine.

UK

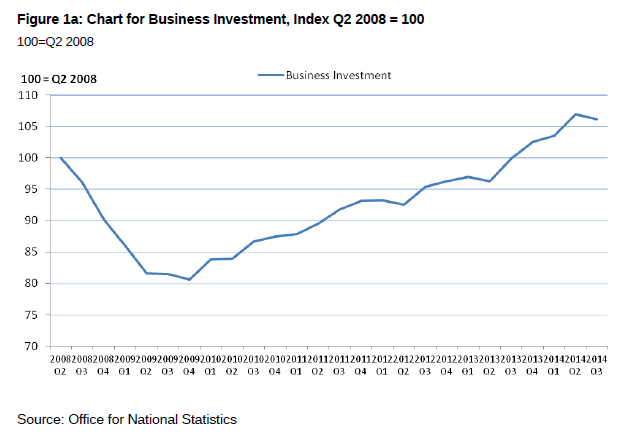

This week’s data confirmed a solid 0.7% growth of the UK economy in the third quarter of the year, though this figure was mostly due to an increase in private consumption (+0.8%) and government spending (+1.1%, expected +0.2%), whereas net exports and investments showed a sharp fall. The fall in business investment (-£0.3 bn) raised concerns over the balance of the UK recovery, though according to recent surveys investment intentions of companies remained solid. According to the Office for National Statistics the biggest contribution to the slide in investments was the drop in intellectual property products.

Source: Office for National Statistics

Average UK house prices hit a new record (£189,388, up by £55) in November according to end of the week data, but the annual increase rate slowed down from +9% in October to 8.5%: Nationwide Building Society stated there is a growing difference between the housing market and national economy indicators.

On Thursday 27th, the OPEC’s decision to leave the cartel’s crude production unaltered at 30 mln barrels affected heavily Oil-related stocks all over the world: concerning the UK, on Friday BP opened down 2.1 per cent at 417.6p, Royal Dutch Shell also fell 2.1 per cent to £22.20, BG Group lost 4.8 per cent to 938.8p. On the other side, EasyJet shares were up 5.7% and shares in other travel companies also benefited from the fall in oil prices. Currently (13.30 Friday 28th ) the FTSE 100 is down by about 0.38%.

Eurozone

This week Europe saw, on the one hand, good business confidence and economic data, in particular in Germany, while on the other, Europe assisted to another weak reading in CPI (0.3%). In general, equity markets continued last week rally, with the DAX up 2.6% on the week, while several government bond yields explored new record lows, with the German 10yr below 0,7%, the French 10y below 1% and the Spanish 10y below 2% for the first time.

On Monday, the German IFO Business Climate figure came out at 104.7 vs 103 exp. and confirmed that the economic environment in Germany is improving after a negative second quarter and this sentiment was confirmed later on Friday by the strong Retail Sales reading at 1.9% vs -2.8% prev. Indeed, the “flash” estimate of Eurozone headline inflation came in at just 0.3 per cent year-on-year for November, down from 0.4%, but in line with estimates. Next month, headline inflation may fall towards zero, with a distinct possibility that it may turn slightly negative at the beginning of 2015 if oil prices fail to recover somewhat. With top ECB officials recently giving their strongest signals yet that “full-blown” QE could well be on the cards, all eyes will be on the central bank’s policy meeting next week.

Japan

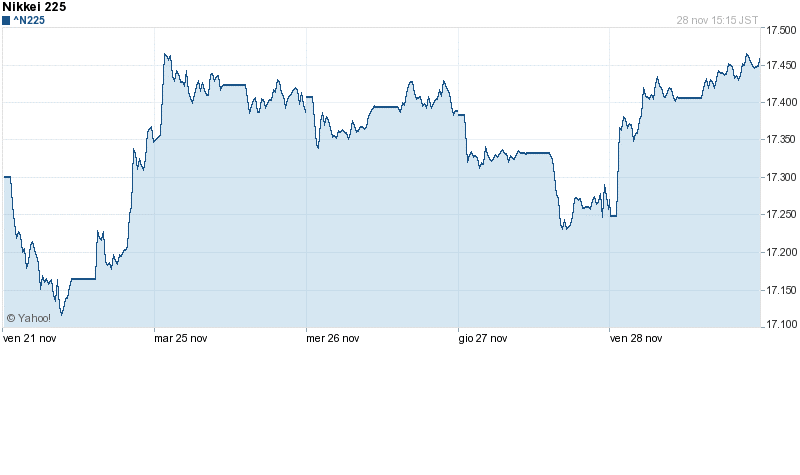

Many macroeconomic data affected the Japan’s economy this week, increasing overall the volatility of Nikkei 225. The equity index opened on Monday at 17248.50 and closed Friday at 17459,85, achieving a weekly rise of 1,22% that reflects the weak Yen and the fall of the price of oil.

Shinzo Abe, after having digested the disappointing economic data about GDP growth last week, decided to definitively reschedule the tax increase on April 2017, in order to boost family expenses, item which decreased by 4% in October. It remains also open the possibility that the Japanese central bank will further increase the QE policy, that currently has a target of ¥80,000 billion each year to achieve the inflation target.

The most important news on Japan this week regards inflation: the objective for core inflation is 2% in the country, but this week has been confirmed that it didn’t meet the target, in fact the level of core inflation is currently at 0,9% on an annual basis, the lowest figure since last year.

The Yen continue its downward trend due to the heavy QE policy and to disappointing news about inflation. The USD/JPY exchange rate opened on Monday at 117.66 and closed on Friday at 118,64, registering a slightly increase of 0,83%. The Yen remains weak also against other major currencies: GBP/JPY closed at 185.64 (+0.82%), while EUR/JPY at 147.69 (+1.39%).

0 Comments