Microsoft (NASDAQ: MSFT) Market Cap as of 23rd April 2021 $1.96tn

Nuance (NASDAQ: NUAN) Market Cap as of 23rd April 2021 $15.16bn

Introduction

On April 11, 2021, Microsoft Corporation entered into a definitive settlement to acquire Nuance Communications in exchange for all-cash consideration of $19.7bn, representing the second-largest transaction for Microsoft, only behind the acquisition of LinkedIn. Upon completion, Nuance will be part of Microsoft’s Intelligent Cloud segment. The acquisition will allow Microsoft to target many new customers in healthcare, financial services, and telecoms, among other industries.

The deal comes two years after the two companies entered into a partnership, aiming to transform the doctor-patient experience by delivering ambient clinical intelligence technologies and reducing clinical burnout.

About Microsoft

Microsoft Corporation produces, licenses, and supports a range of software products and services. Its product portfolio encompasses operating systems, cross-device productivity applications, server applications, business solution applications, desktop and server management tools, video games, and certifications of computer system integrators and developers. The company recorded revenues of $143bn for the fiscal year closed June 2020, exhibiting an increment of 13.6% over FY2019. In FY2020, the operating margin was 36.9%, compared to 34.1% in FY2019. Finally, in FY2020, the company reported a net margin of 31%, similar to the 31.2% shown in FY2019. Performance was partially boosted by Microsoft’s central role in the fight against the pandemic’s spread as the company partnered with ImmunityBio to create a 3D model of Covid-19’s spike protein and by the significant shift to work from home which has quickened enterprises’ switch to cloud-based computing with Microsoft’s Azure cloud services growing 50%.

One of Microsoft’s critical strategies since its foundation in 1975 has always been trying to expand significantly through external growth. Microsoft made its inaugural acquisition in 1987, buying Forethought, PowerPoint’s developer, which allowed Microsoft to control the presentation software business. Up to date, Microsoft has reportedly completed 237 acquisitions, acquiring stakes in more than 60 companies. Strategic acquisitions are vital for the company to extend its business operations, sustain its competitive status, heighten products and services offerings, increase its customer base, and raise earnings.

Source: CB Insights

As to the latest transactions, in July 2020, the company acquired Orions Systems, a digital video and data management solutions provider. It guides the advancement of large-scale, hybrid intelligent vision systems powered by algorithms and human perception. This acquisition could boost Microsoft’s Dynamics 365 techniques. It would also make Power Platform and Dynamics 365 offer retailers a system to produce and train their artificial intelligence models. In June 2020, the company acquired ADRM Software, a provider of industry-specific data models. The purchase is in line with Microsoft’s focus on investing in the potential of artificial intelligence to innovate and magnify customer experience and partner growth. Finally, in May 2020, the company acquired Softomotive, the UK-based provider of robotic process automation solutions. Softomotive’s products would provide additional options to customers, enabling users to construct bots and automate Windows-based operations.

About Nuance

Founded in 1992 as Visioneer, Nuance is an American multinational technology corporation headquartered in Massachusetts, with an operational presence in 80 international locations and a sales presence in more than 85 countries. It mainly provides conversational artificial intelligence and focuses on the healthcare and enterprise business segments. Its vast array of applications goes from developing synthetic clinical speech to applying artificial intelligence to implement automated voice, web, and messaging channels.

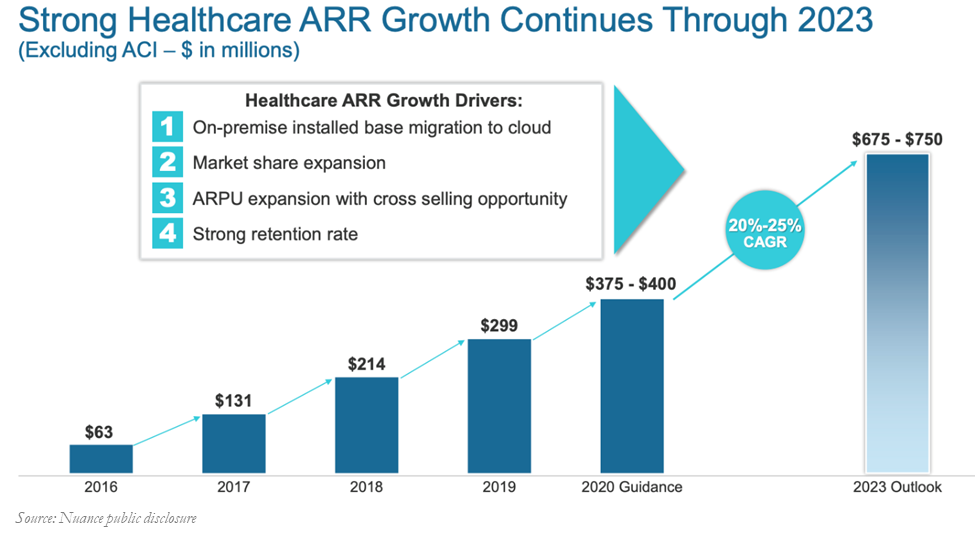

Nuance, generally acknowledged as one of the early developers of speech recognition AI. Its technology was used to power the voice responses in Apple’s virtual assistant, Siri. Over the last years, Nuance has streamlined its portfolio to focus on the healthcare and enterprise AI segments. In detail, its primary goal is now to secure a leading position in the realm of cloud technology applied to healthcare. AI is, in fact, increasingly making inroads in healthcare applications, assisting doctors and medical practitioners in various ways and Nuance seeks to expand its presence in international clinical markets to accelerate transitions to cloud technology. Thanks to this strategy, matched with a number of disinvestments and spin-offs of secondary business units, Nuance has been rebuilding around cloud-based systems for hospitals and doctors. Nuance solutions are currently used by more than 55% of physicians and 75% of radiologists in the U.S. and used in 77% of U.S. hospitals. At the same time, many new markets are opening, especially in emerging economies, leading to a forecasted CAGR of 20-25% for the healthcare ARR (annual recurring revenues) through 2023. That is why Nuance strongly focuses its R&D expenses on its cutting-edge product, i.e., the Dragon Ambient eXperience (DAX). It is a comprehensive AI-powered voice-enabled solution using ambient sensing technology to securely listen to clinician-patient encounter conversations. Estimates show how there will be 2-2.5x Revenue Uplift per year.

Source: Nuance Public Disclosure

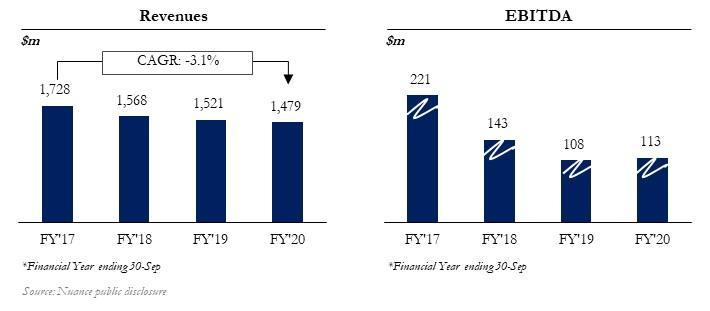

As to its financial performance, Nuance reported revenues of $1.4bn for the fiscal year ended September 2020, resulting in a decrease of 2.9% concerning FY2019. While EBITDA demonstrated a positive development increasing from $108m in FY2019 to $133m in FY2020. The company’s net profit was $21m, signaling a considerable drop compared to a net income of $213.8m in FY2019. Consequently, it is clear how the pandemic adversely impacted Nuance’s operating results. Indeed, at the outbreak of the pandemic, Nuance observed a significant contraction in the transaction volume of its medical transcription business and radiology solution and deferral in professional services and software license deals. As a result, the pandemic worsened an already difficult situation due to fierce competition with players often having higher marketing, distribution and support resources, and greater brand recognition, combined with higher financial capability.

Source: Nuance Public Disclosure

As to its main corporate strategy, the company has always pursued internal growth and tried to strengthen its core technologies in language and voice and enhance its offerings through solid R&D capabilities. Looking at data, in FY2020, the company spent almost 15 % of its revenues on R&D. Over time, such R&D expenses have facilitated the company to produce innovative goods meeting customer demands. It has expertise in NLU (Natural Language Understanding) and ASR (Automatic Speech Recognition) technologies that accouche a notable competitive advantage over its rivals, increased by many patents: as of September 2019, the company had more than 3,550 patents.

Industry Overview

It comes as no surprise that in response to the COVID-19 pandemic companies across the globe decided to proceed with rapid digital transformations. Combined with a sudden influx of new technologies available, it accelerated the already existing competition in terms of technology stacks. Only in the first quarter of 2020, the Cloud solutions spending was nearly triple that of the previous year and, by November, 70% of companies using cloud had plans to increase spending due to the disruption. Currently, revenues in the Software market are projected to reach $581bn in 2021, with CAGR 2021-2025 of 7.40%, resulting in a market volume of $773bn by 2025.

Yet, the global information technology industry as a whole took a small step back in terms of overall revenue in 2020. In August 2020, the research consultancy IDC corrected the projections of global revenue to $4.8tr for the year compared to their original estimate of $5.2tr. While the tech sector withstood the pandemic better than many industries, it was not immune to reductions in spending patterns and deferment of major investments. However, IDC forecasts that the technology industry is on pace to reach $5tr in 2021, representing 4.2% growth that would indicate a return to the trend line that the industry was on prior to the pandemic. Additionally, IDC expects the pattern to continue, estimating a 5% CAGR for the whole industry through 2024.

Looking from the tech industry customers’ perspective, according to the Accenture analysts, 77% of worldwide executives state that their technology architecture is becoming very critical or critical to the overall success of their organization. Enterprises also have more technology choices to make than ever before. Apart from the distribution of cloud deployments, other solutions such as different types of AI models, a wide range of edge devices and hardware constitute each layer of the stack allowing enterprises to expand into new dimensions. The abundance of “as a service” solutions, improvement in technology standards and growing cloud foundation has made taking advantage of these choices extremely accessible.

At the same time, the healthcare industry is going through a substantial change, part of this involves big tech companies moving into the sector and developing new solutions, particularly accelerated by the pandemic. Apart from Microsoft, in January Google completed its $2.1bn acquisition of Fitbit, a consumer electronics and fitness company. Google has also launched Care Studio for clinicians that is focused on organizing patient data. Additionally, Google Cloud and Amwell, a major telehealth platform, have entered a $100m partnership last year. Launched in 2019, Amazon Care, which was an exclusive service for Amazon employees, has recently been made available across the whole US, therefore covering millions of families. The service allows its beneficiaries to connect to medical professions for both virtual care and in-person assistance. What is more, Amazon also introduced Amazon Pharmacy in November 2020. Apple also has been involved in the development of health tech-related products as it introduced a range of wearables for health monitoring, including Apple Watch.

Deal Structure

Microsoft will acquire Nuance for $56.00 per share which implies a 23% premium to the closing price of Nuance on Friday, April 9 and gives an equity value of $16bn. The transaction is set to be all-cash, valuing the company at an enterprise value of $19.7bn

Microsoft anticipates the acquisition to be minimally dilutive, less than 1 percent, in the fiscal year of 2022 and to be accretive in the fiscal year of 2023 to non-GAAP earnings per share, which exclude expected impact of purchase accounting adjustments, as well as integration and transaction-related expenses.

The deal has been unanimously approved by the Boards of Directors of both companies and is intended to close by the end of this calendar year after the approval by Nuance’s shareholders, the satisfaction of certain regulatory approvals, and other customary closing conditions. Upon the completion of the acquisition, Microsoft is expecting Nuance’s financials to be reported as part of Microsoft’s Intelligent Cloud segment. In case of the cancellation of the transaction, Nuance will pay a $515m termination fee.

The transaction value results in Implied EV/LTM EBITDA of 71.4x and in an Implied EV/LTM Total Revenues of 13.3x.

Deal Rationale

This deal fits into a recent trend of increasing M&A activity at Microsoft, which is using its strong balance sheet to expand its core business: enterprise cloud computing services used by businesses and government.

Moreover, Microsoft’s acquisition of Nuance comes after multi-billion dollar acquisitions completed in the past four years, such as the $26bn acquisition of LinkedIn, the $7.5bn acquisition of GitHub and, for the same sum, Microsoft’s acquisition of ZeniMax six month ago.

This acquisition builds upon the successful existing partnership between the companies started in 2019, when the companies partnered to launch an AI system to help doctors with administrative tasks. Healthcare is one of Microsoft’s highest priority verticals, as it’s a growing and pervasive market.

Indeed, this deal will give Microsoft a way to target a large number of new customers in healthcare by augmenting the Microsoft Cloud for Healthcare, introduced in 2020, with Nuance’s solutions, doubling Microsoft’s total addressable market in healthcare provider space up to nearly $500bn.

This rationale was confirmed by Microsoft’s CEO, Satya Nadella, who stated that AI is technology’s most important priority and healthcare is its most urgent application. Microsoft made its initial push into healthcare over a decade ago but ended up retrenching and selling off most of the health assets it originally acquired. A couple of years ago, Microsoft announced it was creating a new healthcare-focused research unit, Healthcare NExT.

Beyond healthcare, Nuance provides AI expertise and customer engagement solutions across Interactive Voice Response (IVR), virtual assistants, and digital and biometric solutions to companies around the world across all industries. This expertise will create synergies with Microsoft’s cloud, including Azure, Teams, and Dynamics 365 and it will allow Microsoft to expand its cross-industry AI leadership.

Market Reaction

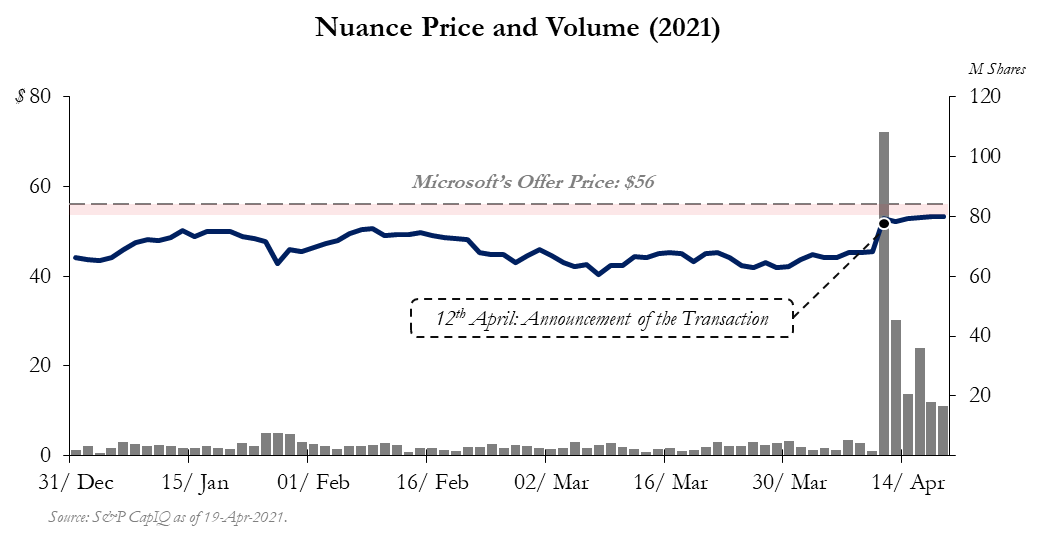

On April 12th, Microsoft announced its all-cash acquisition of Nuance. Microsoft’s share price reaction was rather neutral/slightly positive and the full effect of the transaction on the market valuation is hard to appraise due to the consistently positive movements in the MSFT’s share price. On the other hand, Nuance’s share price initially increased by approx. 16% up to the $53 level which is below Microsoft’s offer of $56 per share. Potentially, a slight discount of Nuance stock’s price compared to the offer is caused by the investors’ concerns about the transaction closing and specifically the obtainment of regulatory approvals.

Source: S&P CapIQ

Advisors

Goldman Sachs is acting as an exclusive financial advisor to Microsoft, while Evercore is advising Nuance.

0 Comments