Moleskine is the manufacturer and distributor of numerous branded accessories, including the famous notebooks used by several writers and artists, like Hemingway and Van Gogh.

In particular, the company operates three business lines:

a) Paper products

b) Writing, travelling & reading collections

c) Digital services.

Paper items have been the historical product category, offering (besides notebooks) diaries and home office products. The second group includes objects like bags, pens and reading glasses. Finally, digital services class refers to applications for smartphones and tablets and a smart notebook developed with Evernote Corporation.

The Moleskine brand is present in more than 90 countries today and the products are distributed through both DOS stores and third parties shops; also, the e-store of the brand is increasing its sales.

The IPO and the market

Syntegra Capital, a private equity fund, purchased a control stake of Moleskine in 2006 and started a process of “renewal” of the brand and development of the business. Following this successful move, and taking advantage of the good performance of stocks of luxury sector, the fund decided to IPO the firm, partly exiting the investment, in 2013.

That was a very profitable deal for the private equity vehicle: indeed, the IPO price range was €2.00 – €2.65 and the selected price resulted to be €2.30. Most of the shares of the IPO were secondary shares (88.7%).

Ever since the very first trading days, however, something has gone wrong and Moleskine has resulted to be one of the worst recent IPOs on the Italian stock exchange.

Initially, investors were divided: on the one side, some were convinced of the good equity story (demand for stocks in the IPO was 2.05x the offer). On the other side, others have never trusted the business model at all: 2.05x is a good demand, but it had been much higher for other “luxury” IPOs, as we pointed out in the article about the IPO of Moncler.

So far, we can say that the latter category was right.

Moleskine was listed at a price in line with its “peers”… However, are Brunello Cucinelli, Salvatore Ferragamo and Prada real peers for the company?

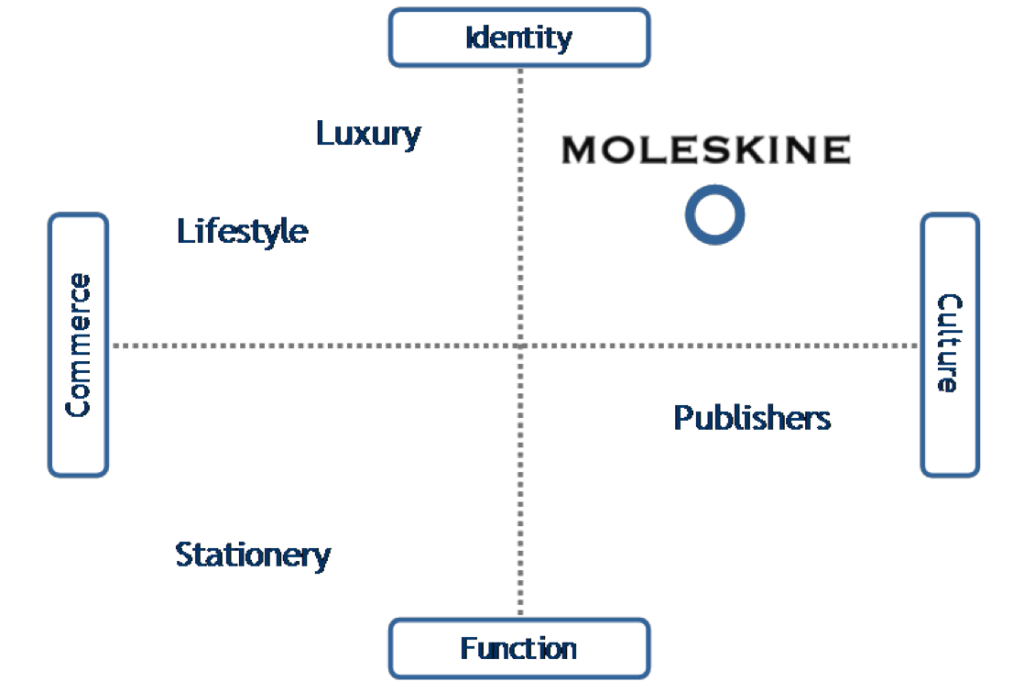

Peers selection can be weird sometimes, but still there must be a logic behind that; and, actually, that was the case. The notebooks firm had high growth rates (even close to those of Yoox, the e-commerce player) and good margins (like Salvatore Ferragamo), and a brand that was theoretically incredibly positioned: in particular, Moleskine brand was placed in a matchless way compared to other logos, according to a brilliant matrix presented in the IPO prospectus.

Source: company data

Nevertheless, the worries of the market were mainly about future developments and sustainability of the business growth. Indeed, the company has invested, especially in DOS stores worldwide, but sales and margins have almost never met consensus whenever quarterly results have been published from the IPO onward.

What’s next?

Having lost 44% from the IPO price and 26.5% this year so far, the stock has clearly underperformed the market.

Its performance is, however, similar to that of luxury stocks recently. Our belief is that Moleskine has followed a path similar to those shares being exposed to the growth of emerging markets, but it is no longer comparable to those firms: it is smaller and it has much less brand awareness. Furthermore, the growth potential is much more limited: the >200M potential customers are hard to be reached in our opinion, especially with the necessary loyalty to justify an exponential growth.

Those issues seem to be more relevant than the positive points that we could identify: for instance, we believe that it is correct (necessary) to strengthen the brand internationally, as well as diversify the product offering, trying to move towards apparel accessories rather than mere paper items.

But, still, it is not enough to enhance the brand awareness up to the level of pure true luxury players, like the peers that we mentioned in the previous paragraphs.

Stock path

So far, we have been focused on qualitative analysis of the business and we have concluded that it no longer justifies its comparison with medium – big luxury players. Now, we try to focus more on current levels and ratios, also to obtain empirical evidence of that.

Firstly, as concerns the stock price, Moleskine signed the historical minimum during March 14th: 1.28, with investors that have reacted extremely negatively since March 10th, after the publication of FY2013 results.

Technically, the downside pressure is still strong, and the historical trend is clearly negative: we would prefer to remain outside of this play anyway. Indeed, on the one hand, there could be a compression of volatility (that has exploded in the last trading days), before restarting to fall. On the other hand, investor may have simply lost interest in the stock and, once some long money investors that are still on the company will have exited the investment, markets may even forget this story, with volumes that may be lower in the future without any unexpected news.

Average target price for the stock has diminished as well. The first targets after the IPO were €2.70 on average and they had been kept stable after the first quarterly and semi-annual results of the firm (even though not stellar). Nevertheless, downgrades have started recently and the latest recommendation from one analyst is “underperform” with a target below €1.60.

Finally, we wanted to find also an empirical proof to confirm our opinions. Therefore, we computed a regression with the same inputs that we used for luxury stocks some weeks ago, but for a smaller sample, made of the mid-caps that were originally considered among the peers of Moleskine.

The results tell us that Moleskine and Yoox are outstanding compared to the sample. As regards Yoox, we said that it trades at acquisition multiples, while for Moleskine we consider the following:

1) It is not an appropriate sample for Moleskine

2) It is structurally undervalued

Clearly, we believe that the first reason is more reliable, because Moleskine brand is less prestigious than the sample components; moreover, there are also other factors involved: size and business proposal (in terms of pricing, for example).

In conclusion, we can state that the stock is not in our ideal preferred list, due to fundamental/qualitative concerns about the business; moreover, it is also true that it is difficult to identify a potential mispricing of the shares when the current sample of comparable companies does not fit well.

[edmc id=1532]Download as pdf[/edmc]

0 Comments