History is full of surprises, even regarding financial history. For example do you know that the only futures contracts you cannot trade are the ones on onions? This is not a joke but a serious piece of law, the Onion Futures Act passed on august 1958.

Indeed in 1955, two traders named Sam Seigel and Vincent Kosuga cornered the onion futures market on the Chicago Mercantile Exchange. As a response, onion producers lobbied the United States congress. Three years later futures contracts were banned. The law remains in effect today.

The most interesting thing with this financial delicacy is that it’s a unique opportunity to see the effects of futures contracts on the prices of the underlying (and impress your professor of derivatives). And the least we can say is that derivatives should be worshiped by both producers and consumers.

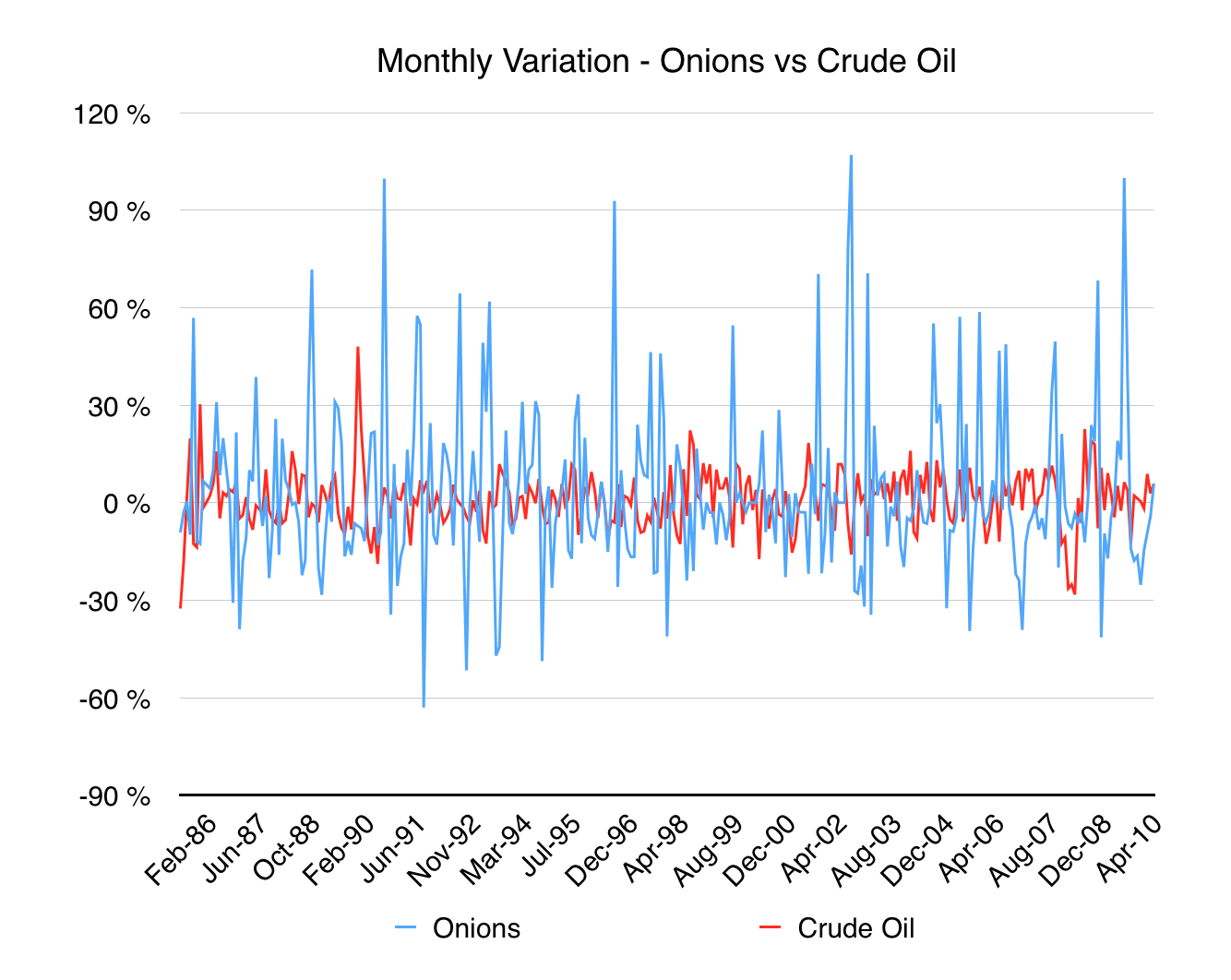

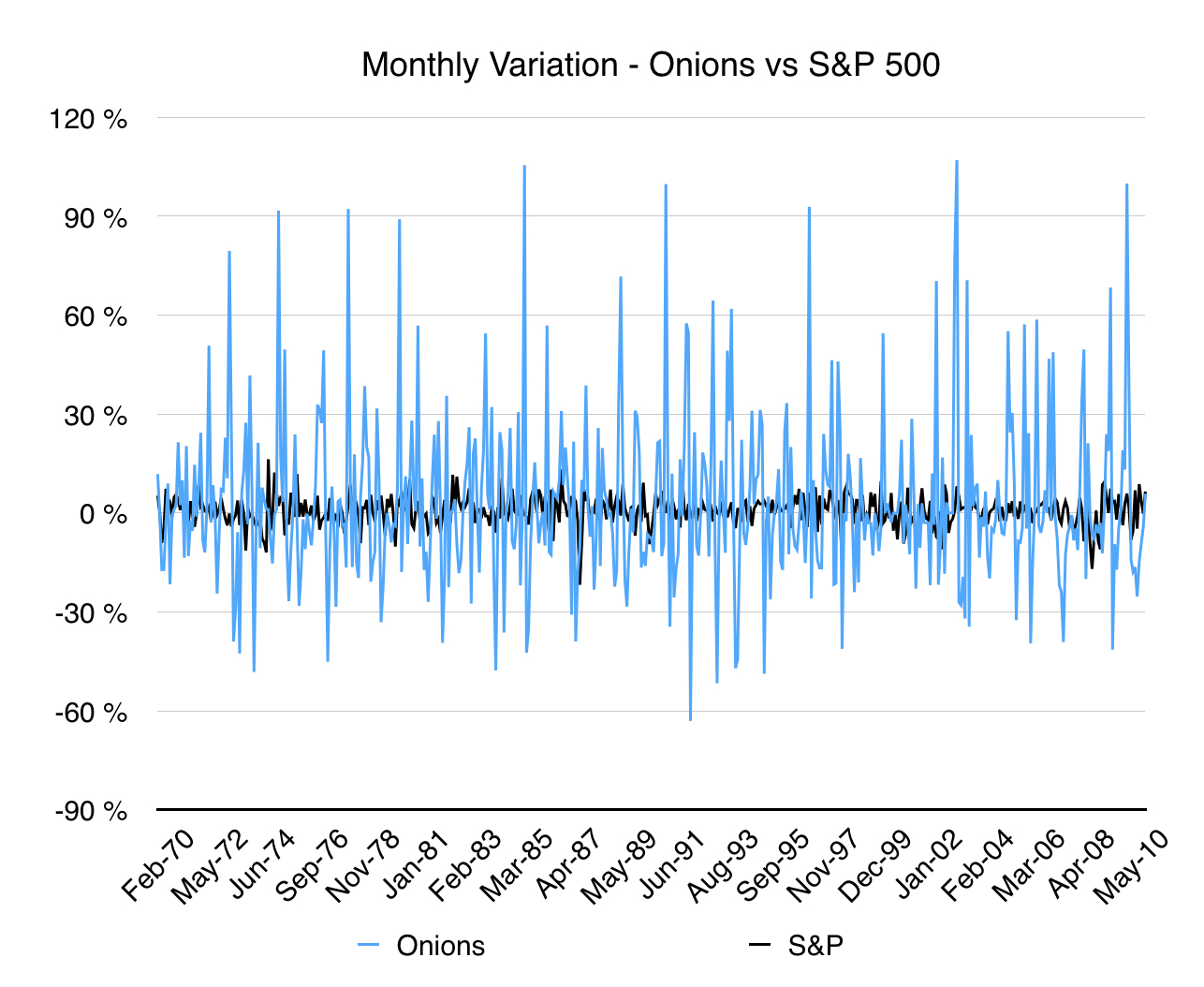

Let’s compare the monthly variations of the 50-lb bag of fresh onions in Chicago with other commodities or indexes:

– Crude Oil, the most traded commodity

– Corn, another popular food commodity

– The S&P500

The results and consequences of such a high volatility for producers are so disastrous that even the son of one of the onion producer who lobbied the congress 60 years ago wishes futures contracts were in places:

“There probably has been more volatility since the ban […] I would think that a futures market for onions would make some sense today, even though my father was very much involved in getting rid of it.”

Futures are not simply tools for traders. They also constitute a very effective way to decrease price volatility and secure the revenues of producers.

Sources:

USDA Onion Price Data – http://usda01.library.cornell.edu/usda/ers/94013/Table44.xls

Text of the Law – http://www.law.cornell.edu/uscode/text/7/13-1

http://money.cnn.com/2008/06/27/news/economy/The_onion_conundrum_Birger.fortune/?postversion=2008062713

Source: BSIC

Source: BSIC  Source: BSIC

Source: BSIC Source: BSIC

Source: BSIC

0 Comments