Introduction

The following article will investigate the peculiar phenomenon of excess market returns that seem to accumulate before FOMC announcements and that can hold, depending on the announcement itself, for several days after the decision.

The Federal Open Market Committee (FOMC) is the organ of the US Federal Reserve responsible for determining the target fed funds rate. Decisions on potential changes to this interest rate are generally made at scheduled meetings and are announced publicly afterwards. Due to the impact these decisions have on financial markets and the economy, a huge interest in the announcements has arisen among market participants and scholars alike. In academic research, a large body of literature has focused on dissecting the effects of FOMC on financial markets after they have been published (e.g., Cook and Hahn (1989), Bernanke and Kuttner (2005)); however, in recent years, asset price movements before FOMC announcements have also been studied.

In particular, Lucca and Moench (2015) first show a statistically significant positive return of up to 50 bps accruing from 24h before the announcement up until the day after both in the US stock market (by looking at the CSRP value weighted index) and in other developed economies (France, UK, Switzerland etc…). Later, Neuhierl and Weber (2020), show instead that such return is not only dependent on the kind of announcement that the FOMC will make, but can accumulate starting from 25 days before it until 15 days after.

Just as FOMC decisions seem to have an impact on the equity markets of other developed countries, we will focus on whether such an equity market drift is also present in emerging market economies. To do so, we first replicate some results from Neuhierl, Weber for US equity markets and then apply their methodology to different emerging markets.

Methodology

Our analysis will focus on a cross-section of emerging markets, chosen across different regions: we will track the MSCI Indices of China, Taiwan, India, South Korea, Brazil, Turkey, South Africa, Indonesia as well as the general MSCI Emerging Markets Index. All data on MSCI indices and that on fed funds futures and FOMC decisions is extracted from Bloomberg. For the US equity market, we use value weighted on the CRSP index.

The authors distinguish between expansionary and contractionary surprises in the following way:

Firstly, the effective fed funds rate is inferred from the front end fed fund futures contract. Mathematically:

![]()

Which represents a weighted average (by number of days before the announcement t) of the current rate ![]() and the expected value of the future rate after the meeting

and the expected value of the future rate after the meeting ![]() + a risk premium

+ a risk premium ![]() . From this, a surprise component is calculated as

. From this, a surprise component is calculated as

![]()

being the difference between the fed fund futures implied rate immediately after the announcement – that of immediately before; if this component is positive, we talk about a contractionary surprise, otherwise we have an expansionary surprise.

However, due to lack of access to intraday data, we use the opening quote and the closing quote for the leading fed funds future of a given FOMC announcement as a proxy to classify FOMC announcements in expansionary or contractionary surprise. In detail, we classify a decrease in the price of the fed funds future contract which corresponds to an increase in the implied rate as a contractionary surprise (remember that the prices of fed funds futures are quoted as 100 minus the effective fed funds rate. Conversely, an expansionary surprise corresponds to an increase price or no change in price. Note that every decision is therefore classified as either having an expansionary or a contractionary surprise component.

We start our analysis in 1994 which has a peculiar reason. While one is nowadays used to official communication of the Federal Reserve on what the decision on the target interest rate is, this was not always the case: before 1994, market participants had to infer the policy decisions from open market operations of the Fed in the days following the decision. Therefore, the surprise component cannot be inferred from fed funds futures for meetings before 1994, making them useless for our analysis. We furthermore follow the literature in excluding multiple other FOMC decisions from our analysis, namely those decisions made at meetings in which nominal interest rates were at the zero-lower bound and decisions made outside of regularly scheduled meetings. Due to constraints on data availability and for our data analysis to be consistent over all different time-periods around FOMC decisions, we also exclude the first FOMC announcement in 1994 (Feb 1994) as well as the latest three announcements as of writing this article (Nov 2022, Dec 2022, Feb 2023).

Following Neuhierl and Weber, we first calculate a cumulative average return time series for each index for a time frame of 45 days before and 45 days after a given FOMC decision in order to get a visual representation of the FOMC drift in different economies. To econometrically evaluate a possible pre-FOMC drift for a given index, we regress the cumulative return for different time periods ![]() around FOMC decisions on a dummy variable

around FOMC decisions on a dummy variable ![]() that is active for expansionary surprises and inactive for contractionary surprises as can be seen below. Specifically, we consider cumulative returns

that is active for expansionary surprises and inactive for contractionary surprises as can be seen below. Specifically, we consider cumulative returns ![]() from

from ![]() to

to ![]() , with s ranging from 5 to 30, that is, up to 15 days after the FOMC meeting. In this analysis,

, with s ranging from 5 to 30, that is, up to 15 days after the FOMC meeting. In this analysis, ![]() , i.e.,

, i.e., ![]() corresponds to the day of the FOMC decision.

corresponds to the day of the FOMC decision.

![]()

With this regression, we check whether a statistically significant drift in prices can be observed in the given time frames. In particular, the ![]() coefficient should be interpreted as the average cumulative return for contractionary monetary policy surprises while the

coefficient should be interpreted as the average cumulative return for contractionary monetary policy surprises while the ![]() coefficient should be interpreted as the differential drift in prices for a time frame for expansionary surprises compared to contractionary ones.

coefficient should be interpreted as the differential drift in prices for a time frame for expansionary surprises compared to contractionary ones.

The FOMC Drift in the US Equity Market

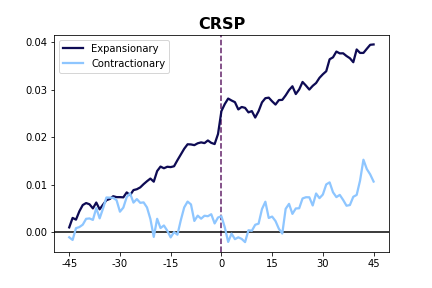

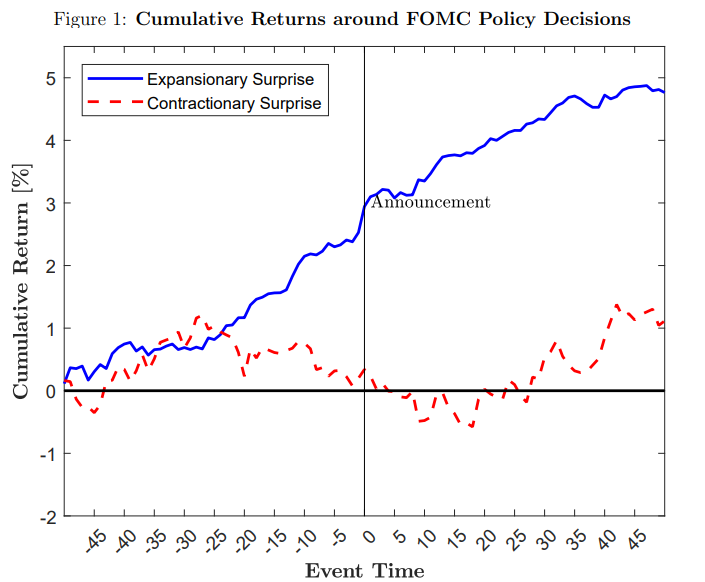

In the case of the US market, despite the lower quality of our proxy for market surprise due to the lack of intraday data, our calculations closely replicate the average cumulative return from CRSP value weighted index:

Figure 1: Average cumulative returns for the CRSP index from 45 days before to 45 days after FOMC announcement, separating for policy decision.

Source: Bocconi Student Investment Club (left), Neuhierl, Weber (2020) (right)

Note that Neuhierl and Weber include data up to March 2019, while we extend this timeframe up to September 2022. From the graph, we can see that a significant differential drift happens as far as 25 days in advance of the FOMC announcement date in the case of what later would be discovered as expansionary surprises, whereas the same does not apply in the case of so-defined contractionary ones. The regression run by Neuhierl and Weber also gives insights on the robustness of such a phenomenon, which also has important economic ramifications: the very definition of an expansionary surprise implies that market pricing was proved wrong by actual FED announcements, meaning that despite being wrong in their expectations, markets still start trending higher with such a wide time horizon.

Indeed, the authors analyse the reaction of Fama and French factor portfolios and find no statistically results for the size, value, profitability or investment factors. Indeed, almost the totality of the drift seems to be explained by CAPM betas.

The FOMC Drift in Emerging Economy Equity Markets

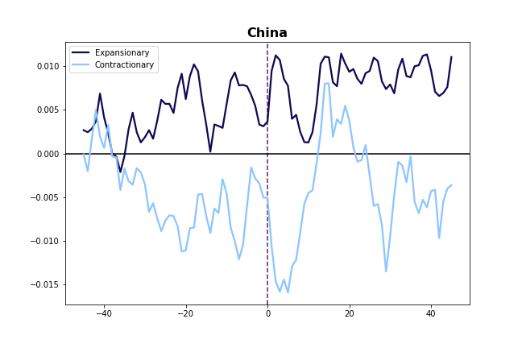

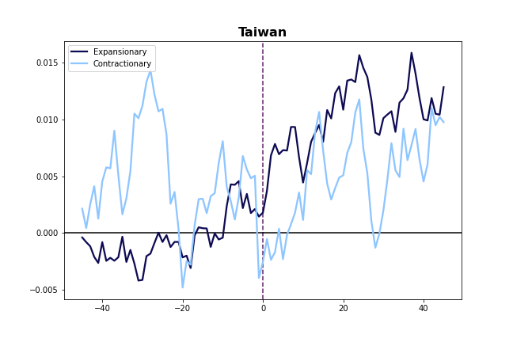

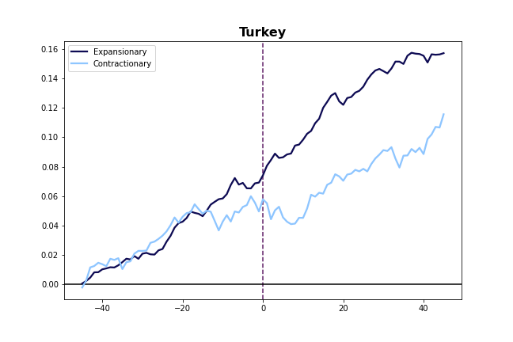

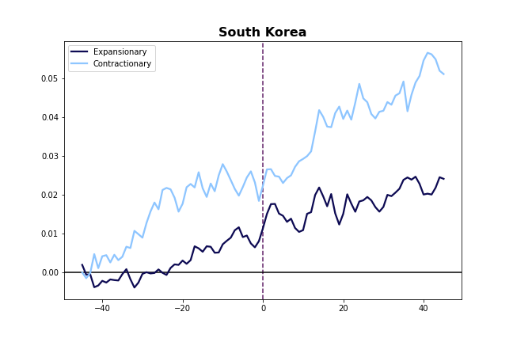

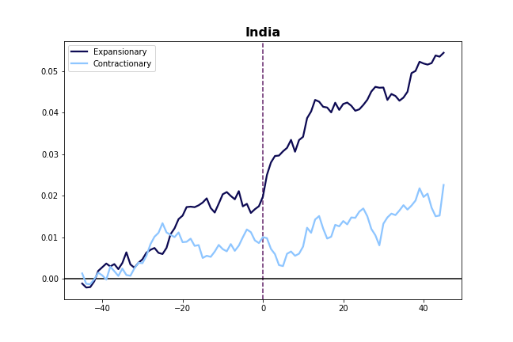

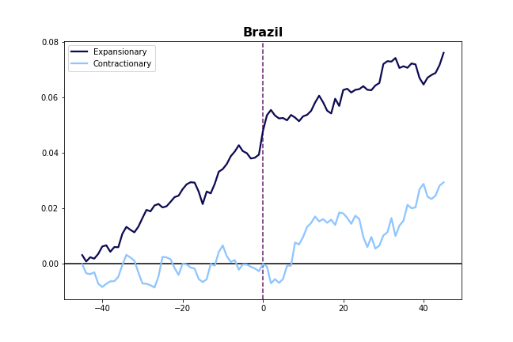

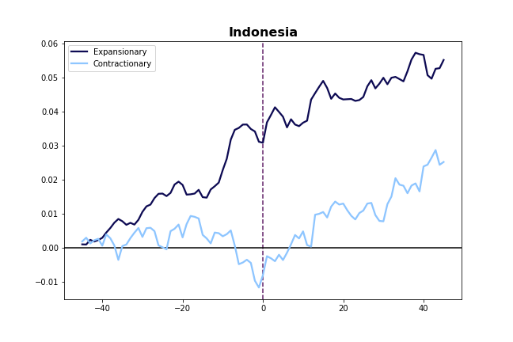

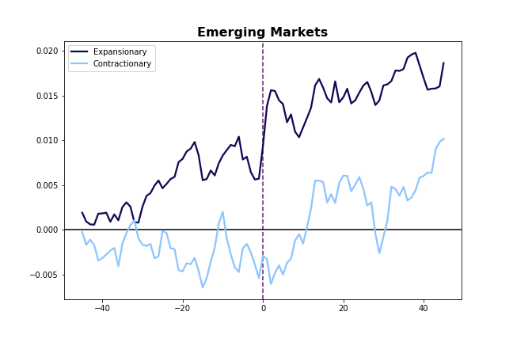

After having chosen our pool of representative EM markets across all world regions, we replicate the same graphical analysis on average cumulative returns distinguishing between expansionary and contractionary surprises using our fed funds proxy. Our results are shown below:

Figure 2: Average cumulative returns for China, Taiwan, Turkey, South Korea, India, Brazil, South Africa, Indonesia and broader EM Markets MSCI indexes from 45 days before to 45 days after FOMC announcement, separating for policy decision.

Source: Bocconi Students Investment Club, Bloomberg

The drift is not present in all countries equally but rather seems to vary across countries. Visually, the cumulative average returns seem to drift higher before and after FOMC meetings for the stock markets of following countries: Turkey, India, Brazil, Indonesia, and the EM index. Opposite, ambiguous, or no drifts appear to be present in China, Taiwan, South Korea, and South Africa.

Although a more in depth analysis of the single countries is needed, one might for example propose that a country such as China seems to be less influenced by US Federal Reserve’s monetary policy stance because of its more independent and less “free-market oriented” economy. Conversely, countries such as Brazil seem to display a much closer relationship with the announcements, particularly with expansionary surprises, as the economic ties with the US are much tighter due to the prevalence of dollar denominated debt and a strong dependency on dollar denominated resource exports.

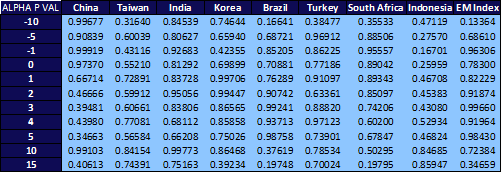

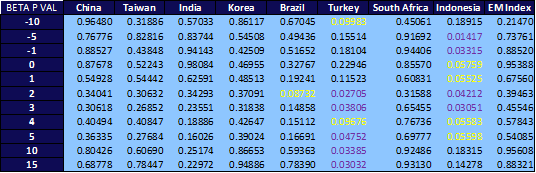

In a similar fashion to what was done by Neuhierl and Weber the for the CRSP index for the US, we analyse our pool’s behaviour running the above dummy variable regression using different time horizons before and after the shift to check for a potential drift around FOMC decisions.

Figure 3: (From left to right) Alpha and Beta values of the dummy variable regression and below their respective p-values highlighted with 10% level of significance (yellow) or 5% (purple). Rows represent different time horizons of the regression always starting from 15 days before the announcement, where 0 represents the announcement day.

Source: Bocconi Students Investment Club

To reiterate: the coefficient of the regression represents returns during contractionary surprises, whereas represents the excess return of expansionary surprises compared to contractionary ones during the chosen timeframe.

Surprisingly, the results of our statistical analysis appear to contradict our graphical intuition: only a few regression s seem to be statistically significant at a level below 10% and not all countries that we visually identified as candidates exhibit a significant relationship. Still, those countries that exhibit statistically significant coefficients are also those that have the most pronounced differential drift. Take Indonesia and Turkey as two examples: Stock market prices in Indonesia seem to drift upwards long before the FOMC date, which is corroborated by statistically significant positive ![]() s of up to 3% before the announcement. Meanwhile, a differential drift appears to only take place after the FOMC decision in Turkey, which matches the pattern of coefficients only becoming significant after the FOMC decision.

s of up to 3% before the announcement. Meanwhile, a differential drift appears to only take place after the FOMC decision in Turkey, which matches the pattern of coefficients only becoming significant after the FOMC decision.

We believe that explanations for these results could stem from two different effects: Firstly, the return drift that is present in different developed economies around FOMC decisions could actually not be present in most emerging market economies. Secondly, this absence of a drift could also be due to constraints on data availability: since our analysis does not use intraday data, our classification of expansionary vs. contractionary surprises differs from that of Neuhierl and Weber which impacts the regressions. This statement is supported by the fact that we were also not able to replicate the regression results of Neuhierl and Weber for the US market with s for the US market being smaller and of lower significance.

Regardless, it is apparent that some sort of pre- and post-FOMC drift can be somewhat found also in some emerging markets even though more research into this phenomenon is in order.

Potential Explanations and Conclusion

Different explanations for this pre-FOMC drift have been proposed by scholars. While we did not investigate these explanations as potential drivers for a pre-FOMC drift in emerging economies, we believe that it is important to give a short overview of these proposals and their economic rationale.

One of the most popular explanations is the idea of a resolution of uncertainty about the announcement. The specific rationale is that heightened uncertainty before an announcement is compensated for with additional returns (see Laarits (2019) for example). This “heightened uncertainty” explanation is also investigated by Neuhierl and Weber: they find that most of the returns before and after FOMC announcements come from periods in which the VIX is higher than usual. Another explanation brought forward by Ying (2020) is that informed investors trade on private information and create an order imbalance that has an impact on prices before the FOMC decision is announced.

Lastly, we want to highlight some further areas of research regarding the movements of asset prices around FOMC decisions for emerging markets. Firstly, a thorough investigation into the topic should be done using intraday data for fed funds futures in order to check for evidence of a drift in emerging markets including a look at the above explanations. Not only should the unconditional drift of Lucca and Moench be analyzed but also the conditional drift of Neuhierl and Weber. Furthermore, it should be investigated whether there are country and stock market characteristics that determine if a pre-FOMC drift is present in a given market or not. Furthermore, it has been pointed out that the unconditional pre-FOMC drift seems to have disappeared after the paper of Lucca and Moench was published (see Kurov et al. (2021)). This should also be investigated for emerging market economies. A last research proposal could be a trading strategy that tries to anticipate post-FOMC price changes depending on the pre-FOMC announcement drift.

In conclusion, we find some potential evidence for an upwards drift of stock market indices in emerging markets before FOMC decisions take place conditional on whether the following decisions come as an expansionary vs. a contractionary surprise. However, we also stress that this further research is necessary in order to come to specific conclusions.

References

[1] Cook and Hahn, 1989, “The effect of changes in the federal funds rate target on market interest rates in the 1970s”

[2] Bernanke and Kuttner, 2005, “What Explains the Stock Market’s Reaction to Federal Reserve Policy?”

[3] Lucca and Moench, 2015, “The Pre-FOMC Announcement Drift”

[4] Neuhierl and Weber, 2020, “Monetary Momentum”

[5] Laarits, 2019, “Pre-Announcement Risk”

[6] Ying, 2020, “The Pre-FOMC Announcement Drift and Private Information”

[7] Kurov et al., 2021, “The disappearing pre-FOMC announcement drift”

0 Comments