The latest weeks have been full of news for the UK economy. Some of the news, like the dovish stance of the Bank of England, were on average expected by the financial markets, whereas others, such as the latest inflation figure of 1.2% for September, were not expected. Actually, the Bank of England expected the September inflation rate to be 1.7%, 0.5% higher than the actual rate. During the press conference, Bank of England governor Mark Carney raised the possibility that inflation could fall below 1% due to lower import prices and weaker than expected growth in the Eurozone and many other trading partners. Therefore, according to Mark Carney, the financial markets are “right in expecting low interest for a longer time period.” But are import prices the only underlying forces currently moving inflation in the UK? While they certainly have the ascribed effect, we believe that productivity is another –perhaps stronger- underlying force that is keeping prices low.

Why is labor productivity relevant in macroeconomics?

Productivity is usually defined as the amount of income produced per unit of labor, or more concretely as the amount of GDP produced per 1 hour worked.

Productivity is studied under both micro and macroeconomic theories for many reasons. In the long run, technological progress, which increases productivity, is probably the most important factor of growth, allowing the economy to produce more goods and services and people to have a higher standard of living. In the medium-run, when prices change as demand and supply in the aggregate economy adjust, productivity is also important as it defines the amount of goods and services an economy can produce given a certain endowment of labor and capital. Therefore, for two economies equal in every respect except productivity, the economy with the higher productivity will be able to produce more and ceteris paribus, prices in that economy will be lower. Therefore, productivity matters for central bankers because it can affect price growth and therefore shape the yield curve. More concretely, central bankers watch for increased productivity because a positive productivity shock might lower prices by a lot and therefore pose a threat to the usual inflation target. In other words, central bank monetary policy is shaped by productivity patterns.

Labor productivity patterns in the UK since 2008

Labor productivity generally grows over time, and most growth models ascribe three factors that make productivity grow. The first one is technological efficiency, usually called the Total Factor Productivity, which measures how efficiently the inputs in a production process are used in order to produce output. As technological growth increases– due to innovations in production processes for example – technological efficiency increases and this allows an economy to be more productive, e.g. to produce a larger amount of goods and services under constant capital and labor.

The second factor that drives productivity growth is capital per unit of labor. Generally, as an economy grows, it saves a portion of the income it produces and invests it in physical and intangible capital which will allow the economy to produce even more in the future. The higher the capital per unit of labor, the higher will labor productivity be, although the pace of productivity growth will slow as capital increases.

The third factor that drives productivity growth is factor utilization. This means that the higher the proportion of capital utilized and effort put in by workers, the higher will labor productivity be.

These three factors are very important because as already mentioned, they shape both the economy’s medium-run and long-run growth. However, these three factors have different effects and undergo changes under different circumstances.

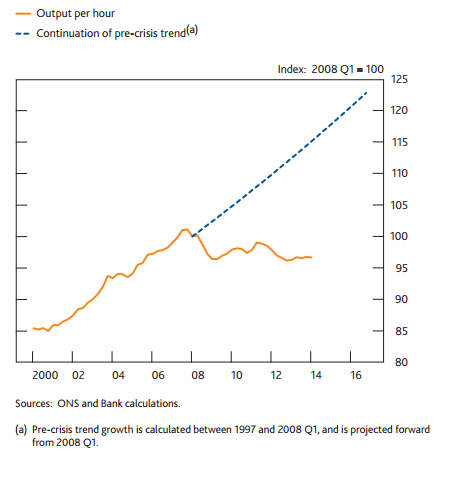

In the UK, labor productivity, as measured by output per hour worked, has generally been increasing over time until 2008, when the world slipped into a severe recession. From 2008 onwards, productivity has consistently decreased, and currently it is severely below where it should have been had its trend continued (around 16% lower).

Source: ONS and Bank Calculations

Source: ONS and Bank Calculations

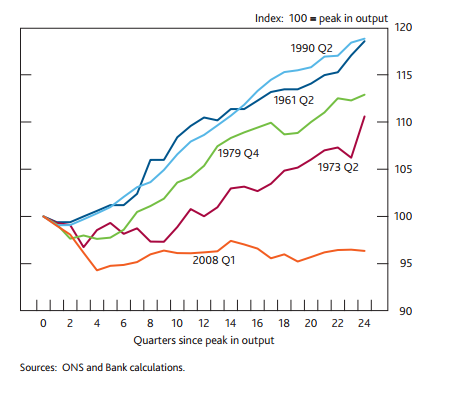

While it is true that in times of economic recession labor productivity usually falls and picks up during the recovery, during the last crisis, labor productivity has decreased and is not picking up despite the strong recovery in the UK. The graph below shows how labor productivity has behaved in the quarters following different recessions in the UK. In all the recessions, except the 2008 recession, productivity has started to pick up about 3 – 4 quarters after the peak in output. Why is productivity behaving so differently this time?

Source: ONS and Bank Calculations

The ‘Cyclical Argument’

The weak pickup in labor productivity (up to now) can be partly explained by studying the cyclical elements of the crisis and how companies in the UK behaved following the crisis. Studies done by the Bank of England validate that UK companies have responded to the crisis by avoiding to cut the labor force (on average), despite the severity of the crisis (which we know was one of the most severe crises of all times, easily comparable to the Great Depression). Although it sounds nonsensical, a study done in 2014 confirms that a proportion of UK companies, despite the recession, began to hold employment flat. According to this study, by 2010 about 20% of the businesses in the UK held employment flat. The same group of businesses made one of the largest downward contributions to productivity growth. This behavior of UK firms was made possible by an increase in the labor supply in the UK that caused real wages to fall, and so UK firms could actually afford to hold on to labor by keeping employment flat. Facing falling demand, UK firms that held employment flat adjusted their supply by underutilizing labor and capital. This underutilization, which can be seen as a lower fraction of capital utilized, led to a partial decline in labor productivity.

The ‘Structural Argument’

The other effects that the recession had on productivity are more structural than the effect that factor underutilization had, although these effects themselves might be driven by cyclical changes. As already mentioned, there are three factors that affect labor productivity: the total factor productivity, the capital per unit of labor and factor utilization. We already explained how factor utilization fell despite a large percentage of firms’ holding of constant employment. The other two factors that affect productivity, total factor productivity and capital per unit of labor, have more structural effects in the sense that these effects will be more persistent. However, total factor productivity and capital per unit of labor are heavily influenced by the weak demand conditions during a recession. The weak demand during the post-2008 period led firms to reduce investment in capital and to rely on labor. The weak gross investment in the capital stock, coupled with capital depreciation, over many quarters, actually led to a decline in capital per unit of labor, which destroys productivity growth. As a study done by the BoE suggests, if business investment had continued to increase by 1% per quarter (which was the pre-2007 average), capital per worker would have been about 8% higher than what the BoE had estimated for 2013 Q4.

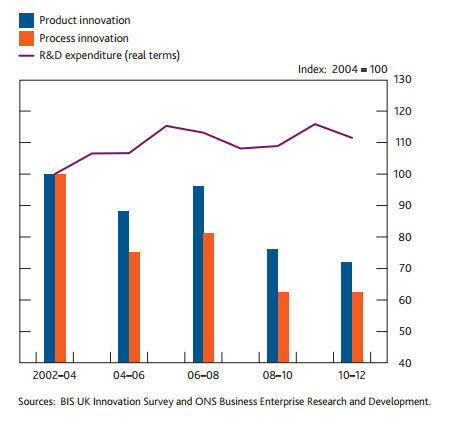

If we analyze investment in intangible capital, which includes brands and intellectual property rights, we get some interesting results. First, it should be emphasized that investment in intangible capital affects the total productivity factor, also known as the technological efficiency, which was mentioned earlier. Investment in intangible capital leads to innovations in production processes, which lead to an increased efficiency of the production process, and therefore to higher labor and capital productivity. During the post-2008 period in the UK, investment in Research & Development was quite constant. However, both product and process innovation constantly fell after 2008. Because of this, what logically ensues is a downward pressure on total factor productivity. However, we have to be careful when interpreting the trend in product and process innovations: firms in the UK have probably waited for demand to pick up before investing more in intangible capital and before implementing product and process innovations they might have.

Source: BIS UK Innovation Survey and ONS Business Enterprise Research and Development

Forecasting labor productivity?

After reading the macro analysis above, you might ask: ‘How does the BSIC macro-team think productivity will behave in the future’?

We believe that productivity has seen a low and that it will pick up in the future couple of months. The underutilization of capital and labor (explained in the ‘Cyclical Argument’) cannot continue as aggregate demand and real wages continue to pick up. Therefore, we should see a larger fraction of the capital being utilized, which is a positive shock to labor productivity.

Furthermore, because of the strong growth the UK has seen in the past couple of months and is expected to see in the future (based on BoE forecasts), business investment in physical and intangible capital should pick up at a fast pace as firms try to increase production in order to capture the increase in demand. Therefore, we should see an increase in capital per worker, and an increase in the total productivity factor (although the latter might take a longer time to adjust). All these effects should push productivity higher in the future months.

Conclusion

Since we expect labor productivity to increase in the upcoming months, and since we also expect the capital stock to grow as firms try to expand production, we expect aggregate supply to grow faster than demand. Therefore, we predict a positive output gap in the UK and therefore, we predict a strong downward pressure on prices despite strong GDP growth. To this we should also add the ramifications that the low price of oil has had and will have on inflation if it continues to be low: not only because oil is part of the consumption basket in the CPI, but also because oil is used in most production processes, and therefore a low oil price can be seen as a positive supply shock. As a conclusion, we predict low interest rates for quite a long period of time, with a possible first rate rise no earlier than next November as BoE tries not to weaken the recovery.

[edmc id=2136]Download as PDF[/edmc]

1 Comment

Jurgen · 21 November 2014 at 16:33

I see the club now has a macro research division in it. good stuff