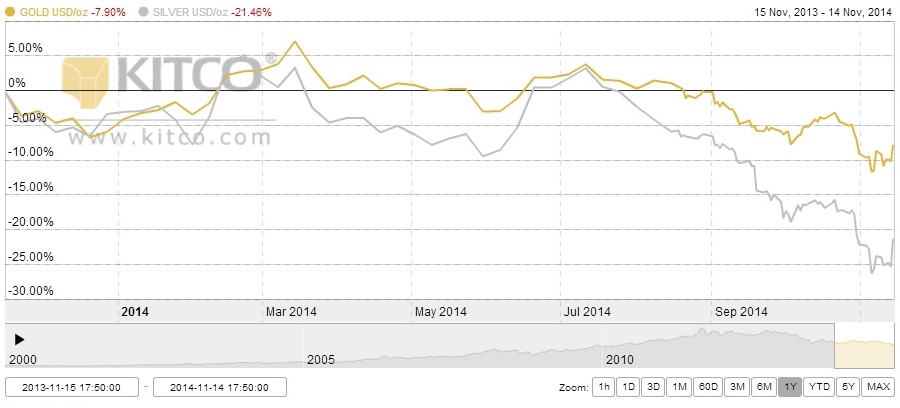

On normal market days, the (positive) correlation between gold and silver is quite high. Looking at the chart below, it looks like silver gives chase to the movements in gold and follows them quite closely. One thing we can observe though is that downside changes in gold reflect more heavily on silver prices, which lose out more on a percentage basis.

Source: Kitco.com

Source: Kitco.com

The gold markets have been rough in the past months., reaching a high in March of around $1382/oz then plunging over the summer down to its current levels of just south of $1190/oz. One could see this as a reflection of mild recovery in major economies (especially the US) in the first part of the year, lower risk economic environments, but most of all as hard evidence of the disappointing inflation reports coming from many developed countries in the world. With inflation at its lowest, demand for gold clearly has faltered. But how to link this to silver?

Silver, on the other hand, trades around $16/oz. The main difference in drivers compared with the bullion is the following: let us just remember that gold is unlike other consumable commodities, in that the mined amounts are stored and not actually utilized (except for a part which is indirectly hoarded in fabricated form -jewelry and works of art). Silver, instead, is consumed widely especially in technology driven economies: its conductivity makes it integral to the electronics industry, where its use varies from circuits to switches and so on.

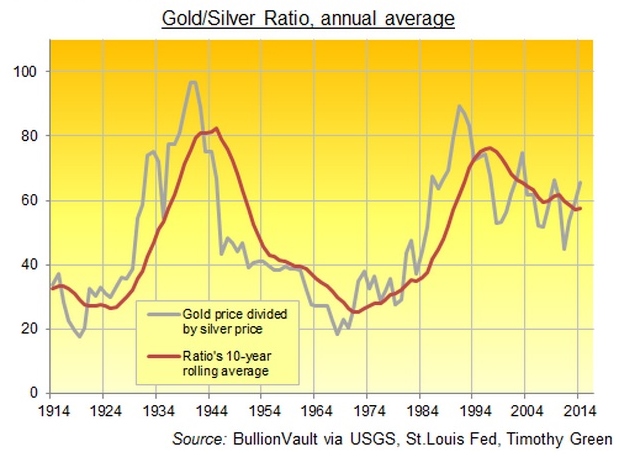

Source: BullionVault vis USGS, St. Louis Fed, T. Green

Source: BullionVault vis USGS, St. Louis Fed, T. Green

The ratio gold-silver is a popular one, and has been under the spotlight for decades. In the past 20 years it has averaged a value of 60 (that is to say, 60 ounces of gold to 1 ounce of silver), but now stands at 74, at 5 yr highs. Our idea here is that the ratio will come down and that we should long the silver-gold spread. The major drivers of this trade lie in the heavy drop (70% in dollar terms in the last 3.5 yrs) of silver, which looks pretty cheap right now. Though global demand may not pick up quite soon, we believe that demand for silver will be bolstered by technological innovation both from emerging markets and the U.S. Low inflation will keep gold prices low and the only downside risk one may experience is the Swiss Gold Referendum in two weeks which will decide if to peg 20 % of Swiss currency to gold. If this were to pass, one would expect the SNB to enter the market and higher its stakes in the precious metal, thus driving prices higher. This has pushed gold higher in recent weeks but we don’t expect the Referendum to yield a yes vote, and even so, there would be a 5 yr transition to gold being 20 % of Swiss reserves, so it would not seem too large an issue.

Coming to our conclusion, and to our final answer, can silver rise when gold falls? Historically, yes. Looking forward, it may be. Probably short term movements and factors may follow this trend, and these factors back our trade. Still, when spread trading, one is betting on over-performance of one asset over the other, and in the short term this may well happen given the line of reasoning mentioned earlier. Therefore, long Silver and short gold looks promising indeed at present.

[edmc id=2104]Download as PDF[/edmc]

0 Comments