ICE LIBOR

Nowadays, LIBOR is administered by ICE Benchmark Administration, which publishes the rate for seven tenors (overnight, 1-week, 1-month, 2-month, 3-month, 6-month and 1-year) in five currencies (Euro, U.S. Dollar, British Pound Sterling, Swiss Franc and Japanese Yen). Currently, twenty panel banks submit their estimates between 11:05 and 11:40 am.

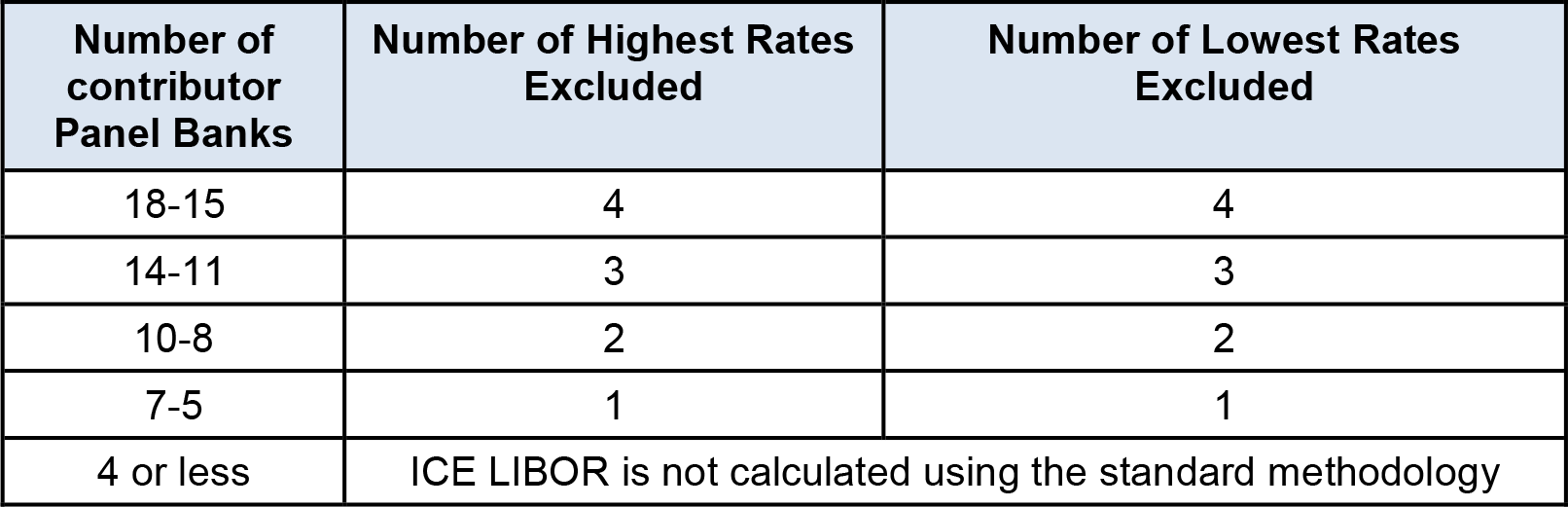

Each bank has its submission methodology, but it has to be compliant with the guidelines provided by The Wheatley Review of LIBOR. These state that banks should first rely on their transactions in the unsecured interbank market and, if necessary, take into account certificates of deposits and commercial paper transactions (both unsecured). If these data are not sufficient, transactions in other markets can be observed (OIS, forward rate agreement, interest rate options). The unavailability of relevant data allows the bank to rely on transaction made by other banks in the same kind of instrument, and, as a last option, to an expert judgment. IBA calculates the effective rate as an arithmetic mean of the submitted quotes, equally weighting the values for each currency and trimming the top and bottom quartiles. In this way, potential manipulated rates are removed, and volatility is contained. To be considered valid, a submission for a specific currency must include the values for each tenor, that is, if it lacks just one value, the others are not taken into account. Depending on the number of banks submitting for a certain currency, the number of trimmed values varies, as reported by the graph below. In case of fewer than 5 submissions, the Reduced Submission Policy operates: IBA has the possibility to re-publish the previous day value for each currency/tenor pair. In this case, it can adjust the rate on the basis of the change in the OIS rate or repo rate.

Number of trimmed rates relative to the number of submissions. Source: ICE Benchmark Administration

If such a situation persists over time, IBA has to inform and consult with the Financial Conduct Authority, the central banks of the impaired currency/ies and the chair of the LIBOR Oversight Committee.

The publication process follows precise rules: LIBOR is disclosed to the financial sector each working day at 11:55 am London time, whereas it is reported to the public a day later. Differently from the past, the banks’ submissions are revealed only three months after (daily): as the Wheatley Review of LIBOR suggested, in this manner banks cannot any more estimate the impact of an eventual low-balling on the final rate, neither they have an immediate incentive to show better creditworthiness. Also, at the beginning of each month, IBA publishes a document containing all the individual rates which have become public in the previous month.

Quickly, we can notice that this submission process lacks a precise methodology, which should be adopted in the light of what we discussed earlier. Effectively, in March 2018, IBA set out a new document, the Roadmap for ICE LIBOR, in which it proposes a new calculation methodology (the Waterfall Methodology) to make it more heavily anchored in transactions and resilient to market stress. This new framework also wants to improve the calculation transparency, making the entire submission process clearer using standardized criteria for the collection and the use of data. Since the publication, a process for developing and implementing the necessary infrastructure to support the new methodology has involved IBA and the panel banks, which, from September 15 to December 15, 2017, had to submit the values calculated under both the old system and the new one. Following this trial, a gradual transition to the Waterfall Methodology has been undergone.

The Waterfall Methodology

The Waterfall Methodology substitutes the LIBOR question with an Output Statement. The statement highlights the relevant instructions for the determination of LIBOR. The new submission methodology is a process that has to be strictly followed by contributing banks hierarchically. There are three steps (Level 1, Level 2 and Level 3); if the first one does not provide the rate, then the bank must use the second and so on. Level 1 of the Waterfall Methodology wants to reflect the original significance of LIBOR. In fact, it provides a rate that is anchored in unsecured funding. Transactions with new types of counterparties are considered. Now it is possible to take into account the price of a loan received from a non-financial corporation if its maturity is greater than 35 days, or non-bank financial institutions. The counterparties are banks, central banks, governmental entities, multilateral development banks, non-bank financial institutions, sovereign wealth funds and corporations.

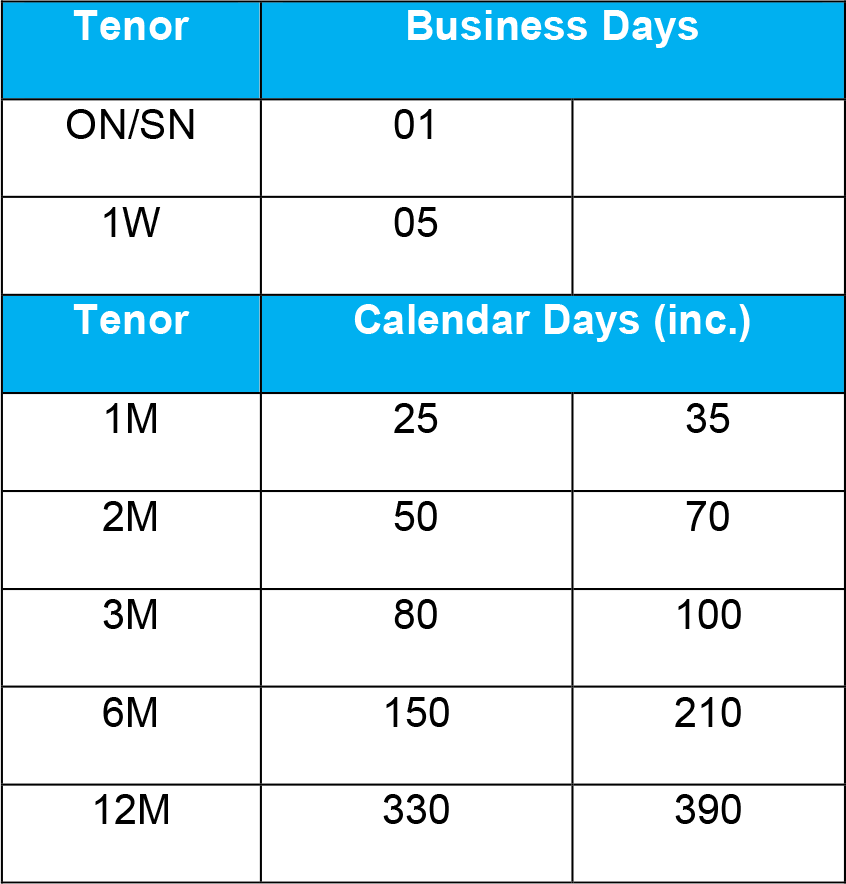

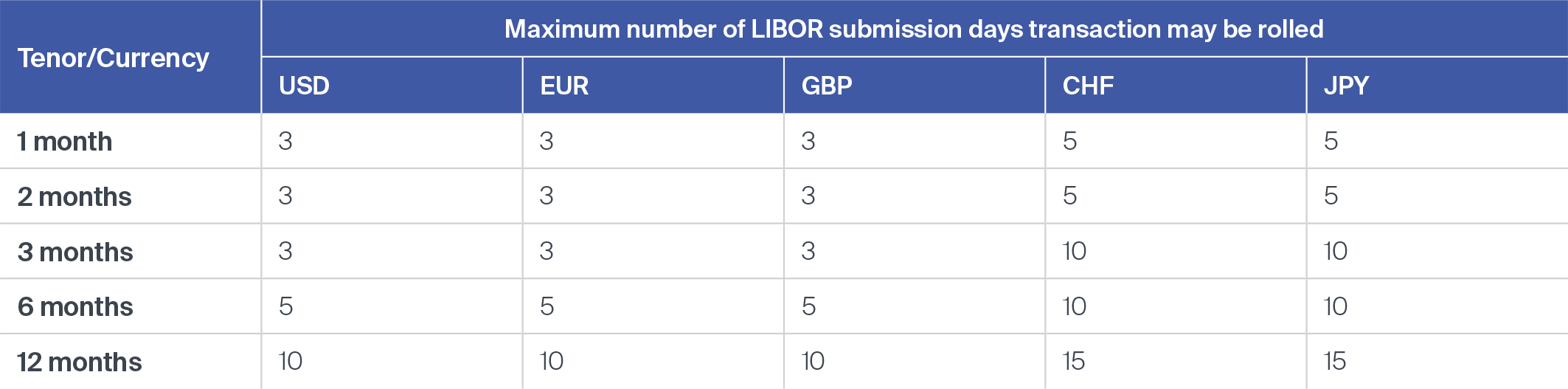

As in the traditional system, even fixed-rate issuances of commercial paper and certificates of deposit can be used in the calculation. The output rate is the volume-weighted average price of the transaction occurred in a window time of 24 hours (from 11:00 am, day 0, to 11:00 am, day 1) with a minimum size of 10m for USD, EUR, GBP and CHF and 1,000 millions for JPY. Older transactions with a shorter maturity are not considered as short-term deposits are often put in place for meeting capital requirements rules. As we can see from the table below, each tenor value is calculated from transactions with a definite maturity range, even if those with maturities not belonging to the brackets can still be utilized in Level 2 and 3 calculation. If the bank lacks sufficient transaction data in a currency or for a tenor, or volumes are too low, then it is allowed to elaborate its submission through the Level 2 approach. Public documents do not define when data are “sufficient”. However, from the Feedback Statement of the Evolution of ICE LIBOR, it appears that market participants judge one transaction to be sufficient for the application of the Level 1 methodology, as it is preferable to derive data. But, if there have been no transactions in the window time, then the previous’ day rate can be rolled-out with an adjustment based on the change of a correlated interest rate (e.g. OIS rate or interest rate futures). The roll-over policy can apply for a maximum number of consecutive days.

Tenor matrix for ICE LIBOR submission. Source: ICE Benchmark Administration

Maximum number of historical transactions roll-over. Source: ICE Benchmark Administration

In case it is still impossible to provide a rate for a specific currency/tenor pair, a different approach must be undertaken. If there are data from adjacent tenors (even historical), the missing rate can be calculated using a linear interpolation technique. In this case, data falling outside the brackets can be utilized to provide a better estimate. Such methodology can be applied only to the 2, 3 and 6-month tenors, as it is unsuitable for the shorter end of the curve, which has higher volatility. In addition, market activity in this slot is higher; thus, it is unlikely that such methodology has to be applied here. Instead, if transaction-based data are available only for a neighbouring tenor, the missing one can be extrapolated through a parallel shift technique based on the day-on-day change in the value of the neighbouring tenor’s rate. In the Feedback Statement of the Evolution of ICE LIBOR, IBA recognizes that The Wheatley Review permits subjective adjustments in the usage of the data. If the output of Level 1/2 calculation is merely unrepresentative of the market, for example, because of changes in the policy rates, or if it does not suit the real bank funding cost, because of a variation in its rating, there is the possibility to eliminate unreliable data or adjust the output rate, under a precise framework which prevents cases of misconducts. That being said, IBA does not confirm this possibility in the Roadmap for ICE LIBOR. Nevertheless, it is true that in the Level 3 submission methodology, an Expert Judgment must be used. This level is triggered by the impossibility to extrapolate the output from transactions or historical data. It operates searching for relevant information in other transactions (those non relevant for Level 1 and 2), other instruments (overnight index swap curve, interest rate swaps/futures, forward rate agreements, floating rate notes and floating rate certificates of deposits etc.), third party observations, market observations, macroeconomic factors, changes in credit standing and other factors, except those that cannot be evidenced and verified, or which present conflict of interests. The Expert Judgment has to operate through a formula, elaborated by each bank in a proprietary fashion and then authorized by IBA. Such a mechanism has been preferred to a unique formula provided by IBA, which would have helped operators to forecast the possible output of this methodology. Whenever it is utilized, the submitter must provide reliable motives for its adoption.

In each submission method, there could be operative errors leading to the wrong rate. If these are recognized and reported to IBA by 3:00 am London time, then there could be a re-fix of the published rate with a threshold of 3bps. Such an event would have undesirable consequences on the market, to the extent that basis risk would arise from contracts hedging the previous LIBOR rate, option exercise could be triggered against expectations and already made transactions should be re-balanced with the right LIBOR value.

Indeed, the revision made by IBA is the result of just a part of the FSB’s recommendations. As far as the remaining part is concerned, a huge work has been undertaken by other organizations to propose a new reliable alternative to LIBOR. As the OSSG suggested, each currency area has instituted its own independent research group: the Bank of England organized the Working Group on Sterling Risk-Free Reference Rates; Japan established the Study Group on Risk-Free Reference Rates; the European Union had already formed the Secured Benchmark Indices Joint Task Force in 2013 and Switzerland formed National Working Group. Each group has established its own alternative benchmark: the UK has opted for the reformed Sterling Overnight Interbank Average (SONIA), an unsecured rate; Japan has chosen the Unsecured Overnight Call Rate; the EU has built the Euro short-term rate, an unsecured overnight rate; Switzerland has selected the Swiss Average Rate Overnight (SARON), a secured one. It is interesting to notice the different nature of these rates from that of LIBOR: they are always overnight rate, secured or unsecured. As we will see analysing better the new USD reference rate, the preference for these is justified by big transaction volumes in their underlying markets and by their adherence to the derivatives environment. Nevertheless, the different nature introduces some problems to be addressed: shifting from a term unsecured rate to an overnight, even secured one, is not a straightforward conversion procedure.

We will then focus our attention on the recent developments in the US market since they are at a quite advanced stage in the migration process.

0 Comments