Introduction

The recent developments in the Russian invasion of Ukraine have led to an exponential increase in energy prices. This is due to the threat that Russia’s war poses to energy supply, as the country is one of the biggest worldwide players in crude oil, natural gas, and solid fossil fuels exports. The impact of this conflict certainly represents a turning point in the evolution towards a more sustainable future.

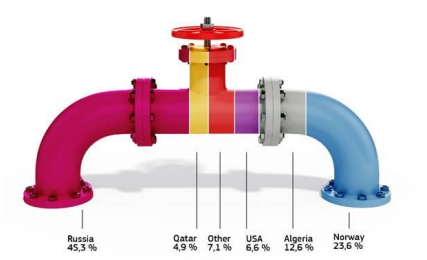

European countries are set to suffer the most from the spike in energy prices, as they heavily rely on Russian imports. Currently, 40% of the total gas consumption of the European Union is provided for by Russia, which also serves 45% of coal imports and 25% of oil imports. However, on March 8, the European Union has outlined a plan to significantly reduce its dependence on Russia’s fossil fuels; to generate more affordable, secure, and sustainable energy.

Share in EU natural gas imports, 2021

Source: European Commission

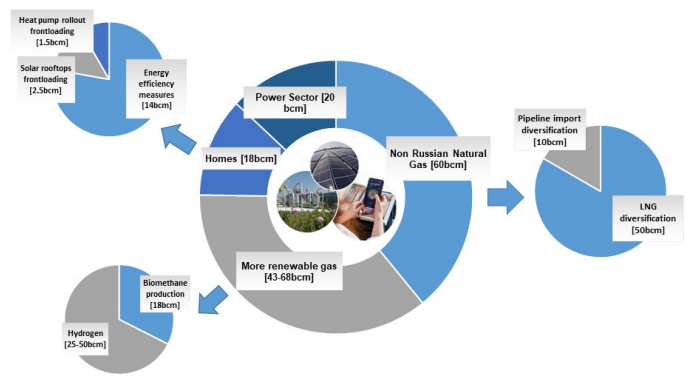

The steps proposed by the European Commission aim at eliminating the demand for Russian fossil fuels by the end of the decade, starting with a two-thirds reduction of gas imports by the end of the year. As highlighted by the Commission President, Ursula von der Leyen, the European Union must act immediately to diversify its gas supplies, mitigate the impact of the current energy prices, and incentivize the development and adoption of sustainable energy sources. In the meantime, the European Commission has also been taking emergency measures to minimize the impact of rising energy prices on consumers and energy-intensive companies. Immediate action is needed to guarantee enough resources for the next winter: a legislative proposal is expected in April to fill gas storage by October 1st up to a level of at least 90% of its capacity.

The long-term success of the “REPowerEU” plan is based on two pillars: the first being the diversification of gas supplies, thanks to a significant increase in the share of Liquefied Natural Gas imports, non-Russian pipeline imports, and biomethane and renewable hydrogen production and import. The second is focused on accelerating the reduction in the use of fossil fuels by incentivizing the shift to renewables, electricity, and encouraging energy savings and efficiency. The plan forecasts a gradual reduction of more than 155 billion cubic meters (bcm) of gas usage (40% of current gas consumption), which is equivalent to European gas imports from Russia in 2021.

Short-term action is believed to have the potential to reduce total gas consumption by 30%, i.e., 100 bcm, which corresponds to two-thirds of Russian imports.

REPower EU summary graphic – Substitutes to 155bcm of Russian Gas

Source: Source: European Commission, Goldman Sachs Global Investment Research

The European Commission had already proposed the “Fit for 55” plan in July 2021 – with the objective of reducing greenhouse gas emission by 55% by 2030 – and now, the “REPowerEU plan” has upgraded many of the previous targets. Following these developments, we are bullish on two of the main drivers of the expected renewable energy investment cycle: LNG and Green Hydrogen.

Investment Thesis

The purpose of our analysis is to propose a long-term investment idea by going long firms involved in the Liquefied Natural Gas (LNG) activities and, with a lower conviction, Green Hydrogen processes.

After a prolonged period of under-investment in energy, starting from the peak in 2014, there has been a 35% reduction in global primary energy investments. According to Goldman Sachs Research, a new cycle of energy investments is now expected to begin – driven by renewables and LNG – with an 11% pa growth to 2025E, exceeding the previous $2trn peak by 2024. Investments in clean energy, compared to hydrocarbons, are more capital intensive, but they can ultimately benefit from a lower cost of capital thanks to regulatory incentives. On the other hand, hydrocarbons are experiencing increasing costs of capital for long-term projects, which should cause a reduction in oil & gas supply.

An important distinction to be made is that capital investments in LNG represent an immediate response to the current crisis, while green hydrogen, despite being at the center of a net-zero carbon future, cannot possibly have a short-term major impact on European energy import demand. This is because it will take decades to build the required infrastructure, while LNG production is already showing consistent growth.

We must highlight that the current energy crisis presents a strong cyclical component, as winter demand for gas is more than twice that of the summer. In this regard, renewables suffer from 2 problems: intermittency and seasonality. The first can be solved through utility-scale batteries, which are the most developed technology for intraday power generation storage. The latter could be better-tackled thanks to hydrogen, which implies that both technologies are complementary in the shift to a net-zero carbon economy. During the development of the necessary infrastructure, LNG represents the best alternative to sustain the future energy transition.

Impact of seasonality on European energy production and consumption

Source: Eurostat, Goldman Sachs Global Investment Research

Concerning Liquefied Natural Gas, the worldwide exporting leaders had long been Qatar and Australia, capturing almost half of the total market share. However, the United States is outpacing them, and, according to the US Energy Information Administration projections for the growth of the industry, the United States could become the biggest global exporter of LNG in 2022. Specifically in Europe, the US has become the largest source of LNG imports, accounting for 26% of European supply, closely followed by Qatar and Russia. Major US producers, like Cheniere Energy [LNG: NYSE], have already signed several long-term deals that are allowing them to develop multi-billion projects to consistently expand their production.

Green Hydrogen, on the other hand, is the long-term answer for Europe’s diversification of gas supplies. “REPowerEU” proposes a substantial upgrade for the production of green hydrogen: from the “Fit for 55” target of 5.6 Mt by 2030 to 20 Mt in the same period. Already at current spot EU natural prices, green hydrogen is at the same cost as grey hydrogen (natural gas-based).

Liquified natural gas (LNG)

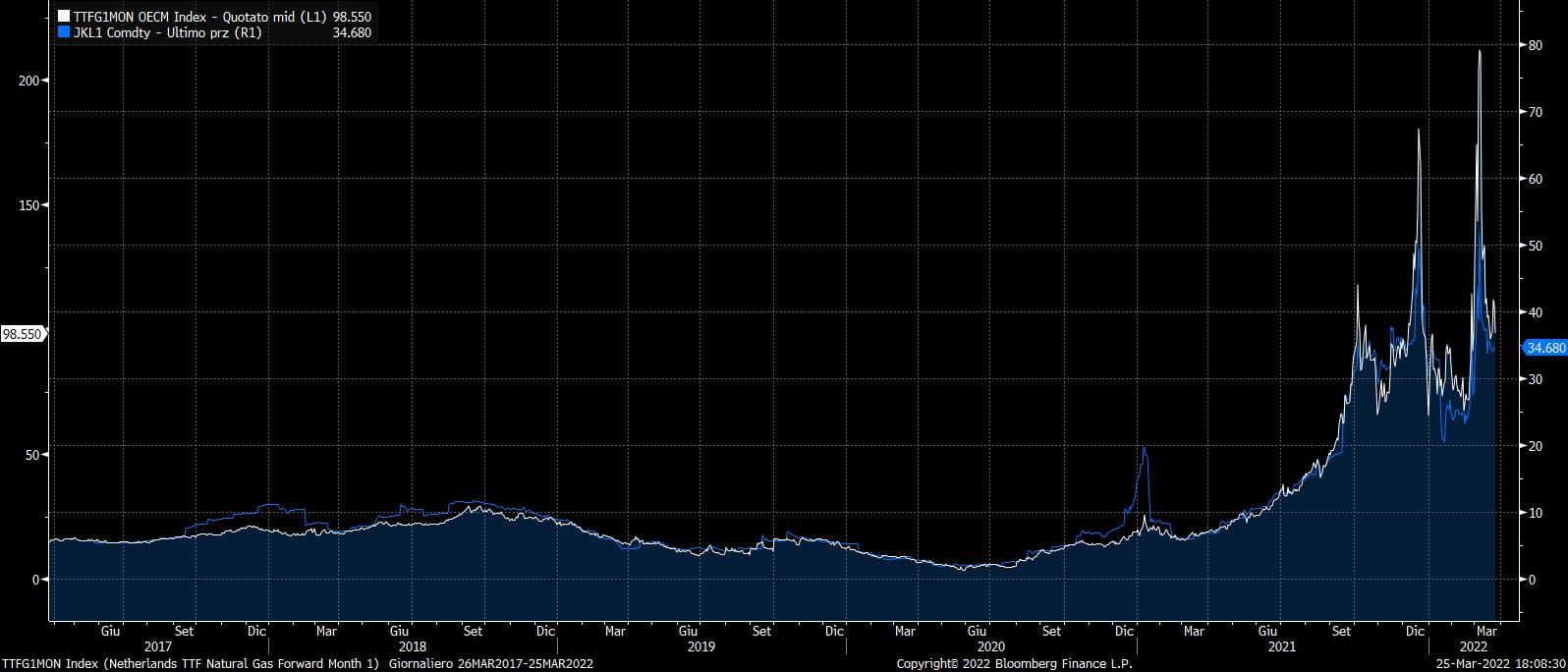

Even though liquified natural gas is still seen as a controversial choice due to its carbon emissions, it will certainly be adopted as a transition fuel since it improves the security of supply, and produces less carbon than coal-fired power generation. For this reason, Shell forecasts that the global LNG demand will double by 2040, reaching 700 mm metric tonnes, and BNEF expects a 6.6% increase in 2022, reaching 400mm metric tonnes, with China and emerging Asian markets being the main drivers of this demand growth.

According to Goldman Sachs Research analysts, as the focus shifts from energy sustainability to energy security and affordability, natural gas and LNG will recover from the period of under-investment that started in 2014. For this reason, they consider LNG to be an area of capex increases in the period 2022-2024. For instance, following Europe’s plan to gain independence from Russian gas imports, on March 25 the US confirmed that it will deliver at least 15bn cubic meters of LNG to Europe by the end of 2022, together with a commitment to deliver additional 50bn cubic meters in the future. Unsurprisingly, the US is said to be accounting for 40% of the supply increase of 2022.

Disruption in the gas market and prices of TTF and LNG

Source: Bloomberg. White line (LHS) Netherlands TTF Natural Gas Forward Month 1 (EUR/ MWh), Blu Line (RHS) LNG Japan/Korea Marker (Platts) Swap futures, 1st generic future (USD/ MMBtu)

We have selected a few stocks that in our opinion could benefit the most from the increasing LNG import volumes and prices. Our analysis was mainly based on (i) the purest plays on LNG (trying to avoid conglomerates), and (ii) firms with positive analyst recommendations. We highlight:

- Cheniere Energy Inc [LNG: NYSE] is a producer of liquefied natural gas in the US, exporting LNG to customers in over 30 nations around the world. The company purchases natural gas and processes it into LNG and offers customers the option to load the LNG onto their vessels at its terminals, or it delivers the LNG to regasification facilities around the world. Over 70% of revenue comes from outside the US.

- Chart Industries Inc [GTLS: NYSE] is a leading independent global manufacturer of highly engineered equipment servicing multiple applications in the Energy and Industrial Gas markets. Its unique product portfolio is used in every phase of the liquid gas supply chain, including upfront engineering, service, and repair.

- Golar LNG Limited [GLNG: NASDAQ], with a fleet of about a dozen vessels, provides marine transportation of liquefied natural gas. Liquefaction plants, located near major gas deposits, cool natural gas to reduce its volume so it can be efficiently transported by sea. Most of Golar’s revenue comes from deploying its fleet on time charters, or long-term contracts, to major LNG producers.

- Gaztransport Et Technigaz SA [GTT: FP] is an engineering firm specializing in membrane containment systems dedicated to the transport and storage of liquefied gas worldwide.

- Exmar NV [EXM: BB] is one of the largest independent shipping groups in the world serving the international oil and gas industry. It currently manages a fleet of more than 40 LPG (liquefied petroleum gas) tankers including ethylene, mid-sized gas, very large gas, pressurized, and semi-refrigerated carriers. The vessels transport liquefied gases such as anhydrous ammonia, butane, petrochemicals, and propane. A smaller fleet of carriers transports liquefied natural gas.

Green hydrogen

This natural resource hasn’t attracted only the European Union, but also China, a global leader in green hydrogen production, which on March 23 has announced a new target to produce up to 200k tonnes of green hydrogen by 2025. However, it’s important to point out that almost 80% of China’s hydrogen production (33M tonnes) comes from highly polluting coal gasification and steam methane reforming.

From a markets point of view, the current spot prices for natural gas have pushed the green hydrogen to reach cost parity with grey and blue (fossil-based) hydrogen. According to ICIS figures, in the UK it has been like this since mid-September 2021, with the Ukrainian war being only an additional boost. More recently, a recent BNEF study outlines that the situation in the US is very different from the one in EMEA and China, since in America natural gas prices have only risen 60% over the past year.

Source: BSIC elaboration on BNEF’s study

This pattern is reflected in green and grey ammonia’s prices as well. The main advantage of ammonia is that its supply chain is already established, hence it can be a feasible alternative before hydrogen pipelines become viable.

As we already mentioned, green hydrogen addresses a crucially important problem regarding energy flow management, namely, seasonality. The reason for this is intrinsic to the resource’s method of production: during periods of power deficit some backup power can be provided by hydrogen that had been produced during periods of oversupply from excess electricity thanks to electrolysis. Even though this process consumes c.60% of the total energy, it’s still an improvement concerning the currently used diesel generation.

Moreover, dozens of companies, such as Dominion Energy [D: NYSE] and Sempra Energy [SRE: NYSE], are focusing on the blending (from 2% to 5%) of green hydrogen with natural gas, making it unnecessary to completely rebuild grid infrastructures from scratch. However, a study of the Fraunhofer Institute published in January raises some serious concerns about this technique: at a blending level of 20%, the increase in end costs can be as high as 43% for industrial end-users and 16% for households, while the greenhouse gas savings are only about 7%. More moderate blending levels (up to 5%) show modest price increases and the physical detrimental effect of hydrogen on pipes’ lifetime is lessened.

For these reasons, we decided to focus on companies that operate in the following businesses: production of electrolyzers (which will have 4x sales growth in 2022, according to BNEF), hydrogen-fired gas turbines, and fuel cells, seasonal energy storage, and backup power supply.

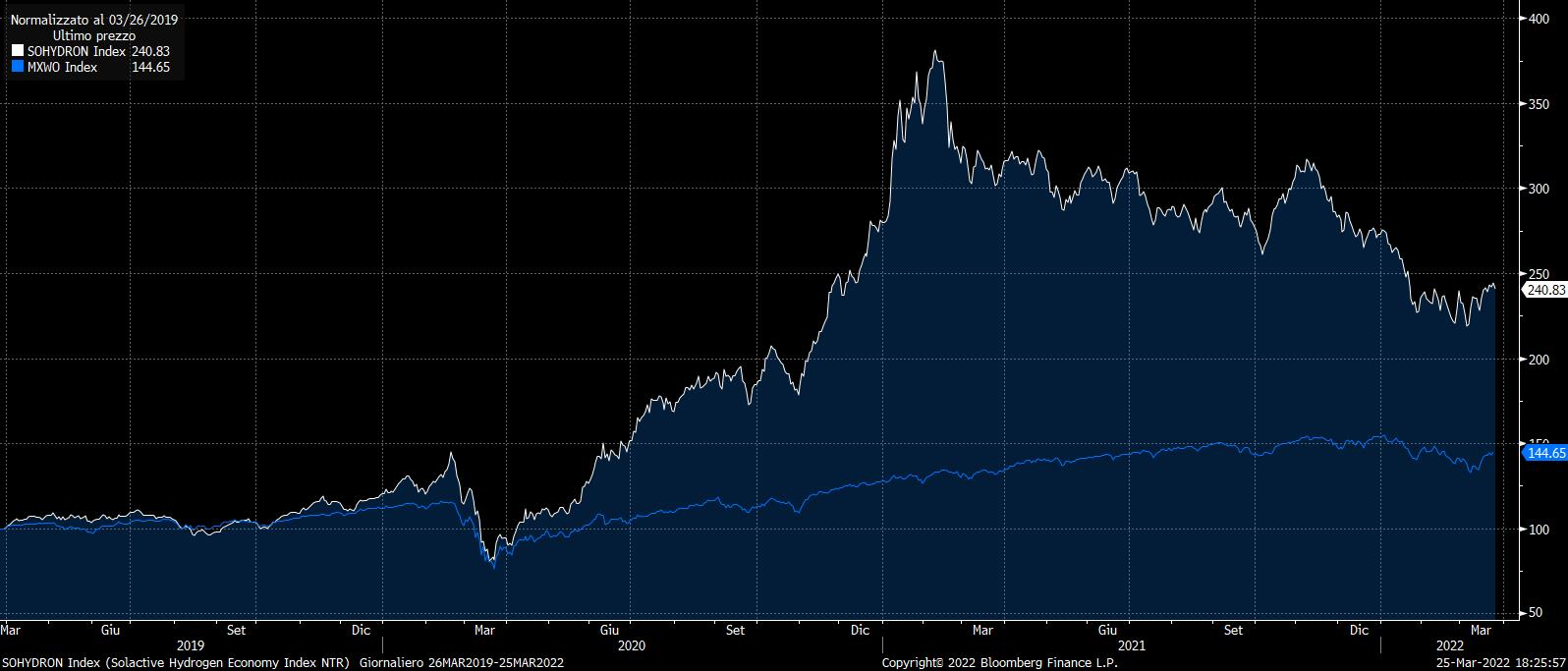

In this trade idea, we have a far lower conviction, as the Green Hydrogen infrastructures are far from being complete and this is reflected in the financials of the firms engaged in the Green Hydrogen Economy. Currently, these companies have negative EBITDA and mounting losses. Despite this, they trade at EV/Revenues multiples higher than 10x! Moreover, their stock prices have sharply lowered and are now far from the highs of one year ago.

Solactive Hydrogen Economy Index vs MSCI World Index

Source: Bloomberg. White line: Solactive Hydrogen Economy Index NTR, Blue Line: MSCI World Index. Both Normalized at 100 on 03/26/2019.

We have selected a few stocks among the Green Hydrogen Ecosystem. Our analysis was mainly based on (i) the purest plays on Green Hydrogen, (ii) firms with positive analyst recommendations and expected to have positive EBITDA sooner, (iii) bigger and less volatile companies. We emphasize the following firms:

- NEL ASA [NEL: NO] is a global provider of hydrogen-related technology for industrial and energy purposes. Its main products are hydrogen production plants based on water electrolysis, complete hydrogen distributors for transport, and solutions for the storage of renewable energy.

- Plug Power Inc [PLUG: NASDAQ] is a leading provider of comprehensive hydrogen fuel cell turnkey solutions. The company is focused on hydrogen and fuel cell systems that are used to power electric motors primarily in the electric mobility and stationary power markets. It includes electric forklifts and electric industrial vehicles.

- McPhy Energy SA [MCPHY: FP] manufactures hydrogen energy storage components. The company offers electrolyzers, hydrogen storage systems, and customized solutions for manufacturers and energy markets. It serves customers all over the world.

- Bloom Energy Corporation [BE: NYSE] manufactures and markets solid oxide fuel cells that produce electricity on-site and could benefit from the electrolyzers trend.

References:

[1] Goldman Sachs Research, “Carbonomics: Security of Supply and the Return of Energy Capex”

[2] Fraunhofer IEE, “The limitations of hydrogen blending in the European gas grid”

[3] Rechargenews, “Green hydrogen now cheaper to produce than grey H2 across Europe due to high fossil gas prices”

[4] Rechargenews, “Ukraine war | Green hydrogen ‘now cheaper than grey in Europe, Middle East and China’: BNEF”

[5] Rechargenews, “China unveils national 2025 target for green hydrogen and new strategies for further H2 growth”

[6] Reuters, “U.S. natgas companies put hydrogen to the test”

[7] BNEF, “Hydrogen – 10 Predictions for 2022”

[8] BNEF, “Gas & LNG – 10 Predictions for 2022”

[9] Financial Times, “US agrees to ramp up gas exports to EU”

0 Comments