Since the beginning of the year, a sector rotation seems to have started: cyclical stocks, especially those that are more exposed to Europe, have taken advantage of the improvement of the general feeling, while non-cyclical securities have experienced a general downturn.

Among the latter category, luxury stocks (that have outperformed the market for months) have been damaged the most. Through this article, we will try to understand whether there is still room for those stocks to grow or not.

Following the announcement of the biggest Italian IPO of 2013, which we covered at the end of the last year, companies of the luxury industry have reached their historical peaks. After that, however, a huge correction has started and prices have come back to much lower levels. We have found three possible explications for that:

1) Sector rotation, which we briefly mentioned before

2) End of M&A wave

3) Lower expectations and quarterly results below consensus

There is not a lot to further comment about the rotation: it is just part of the game, and it might have created some buy opportunities in the luxury industry.

Nonetheless, it is interesting to focus on the other two factors.

Recent transactions in the industry have been carried out at crazy multiples: just to quote the noisiest of 2013, we can stress that LVMH acquired Loro Piana for a price equal to 22.7x the expected EBIT of 2013 and 3.9x the sales of the cashmere sweaters maker.

Such multiples were higher than those of most luxury traded companies, but it was feasible since they included a kind of control premium. However, the closest competitor of Loro Piana, which is Brunello Cucinelli, was trading at a value of around 25.2x its EBIT on the day of the deal announcement: given the similar business profile, there was not any clear reason for increasing even more the value. But, we know that markets are often irrational, thus luxury stocks have continuously grown for the following months: this was probably due to two main “motives”. The first was simply the expansion of the M&A wave, with different stocks that were trading at acquisition multiples, while the second was due to their anti-cyclical nature (which is now affecting them in the opposite way).

Of course, markets like changes, so the enthusiasm about new big deals in the industry has diminished, as well as the upside potential has appeared to be smaller. Consequently, the sector has entered a vicious cycle: LVMH, the first big player to publish its quarterly results, missed the consensus; as a consequence, several research analysts had started to cut guidance for the entire industry. After that also other main players, like Kering and Tod’s, missed the market expectations, but at the same time, other firms, like Brunello Cucinelli and Salvatore Ferragamo, published results that were at least in line with the guidance.

Nonetheless, we can easily note that the correction has been quite standardized: both stocks that met consensus and those that failed to do so have faced a negative period. It is also interesting to note the strong effect that the IPO of Moncler had had on some mid-caps of the industry; but it was just a matter of few weeks.

That is the situation so far… But our task is different: what about the future?

In order to generate a trade idea, we performed a two-factor analysis on a sample of luxury stocks.

First of all, it is important to note that three clusters can be identified within the sector:

– Big conglomerates, like LVMH or Kering: large caps that hold several brands;

– Medium caps, like Tod’s or Salvatore Ferragamo, which are growing through investments (especially in emerging markets);

– Small firms, still local, that serve some niches of the market (like Piquadro).

This is an important classification that bears the differences in ratios.

The main multiples for the industry are basically two: on the one side, EV/EBITDA is relevant especially for those stocks that can be potential targets for acquisitions; on the other side, PEG is a good benchmark, since it takes into account the strong growth rates of the industry. Being focused on the short-medium term market performance, we decided to develop the analysis of the PEG, regressing it against the ROE.

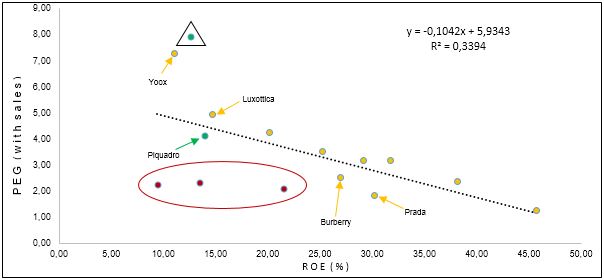

The vertical axis represents the PEG (with sales), while the horizontal axis is the ROE of the stocks.

The red circles are the big conglomerates, mid caps are yellow, while small players are green.

The goal of the analysis is to understand whether there can be a good momentum for some stocks or not: indeed, the growth rate used in the PEG computation is that of sales of next year, which seems to be the most sensitive data to markets in the short period; coherently, the ROE is that of the next period. So, it is not about valuation (also because it would not be totally appropriate to combine sales with P/E in that case), it is just about market opportunity.

The regression line is a quite good approximation of the plot distribution, but further analysis would be required to be sure of its significance (we had just few observations).

Anyway, we can note the following: the three big players appears as standalone values, while mid-caps are well-shaped by the regression line. Consequently, some trades could be: long Burberry, long Prada, short Luxottica.

However, another result seems to be more interesting: the green circle in the triangle is Poltrona Frau, for which a bid has recently been made. Its multiples are of course high, but they can be taken as a proxy for new acquisitions. Assuming that the PEG (with sales) is actually relevant for short-term movements (while the acquisition price would be probably based on other ratios, like EV/EBITDA), we can note that Yoox is already pricing a potential takeover (so, the upside risk seems to be limited). However, we can reason about new targets: the other green circle is Piquadro, for which the upside potential seems bigger.

So, in conclusion, we can state the following: we believe that there are still some buy opportunities in the luxury industry; however, stock picking will become more important than before, since investors have started to look to other sectors. Two possible drivers for picking the right stocks may be 1) the possibility that a company may be acquired (especially, niche players) and 2) a good business analysis to identify the different (and better) positioning of certain players compared to the others.

Sources of data: Bloomberg (http://www.bloomberg.com), Financial Times (http://www.ft.com)

Source of graphs: Bloomberg (http://www.bloomberg.com)

[edmc id=1300]Download as pdf[/edmc]

3 Comments

The (un)stardardised banking sector : BSIC | Bocconi Students Investment Club · 9 March 2014 at 7:57

[…] we analysed luxury stocks, we stressed that the industry has faced a downturn, probably due to a kind of sector rotation. The […]

Moleskine: are pages already finished? : BSIC | Bocconi Students Investment Club · 22 March 2014 at 14:42

[…] opinions. Therefore, we computed a regression with the same inputs that we used for luxury stocks some weeks ago, but for a smaller sample, made of the mid-caps that were originally considered among the peers of […]

A harmonic price pattern for trading YOOX : BSIC | Bocconi Students Investment Club · 10 May 2014 at 12:40

[…] marginally analysed YOOX in some previous articles (https://bsic.it/how-to-trade-moncler/ and https://bsic.it/luxury-stocks-expensive/), and the main outcome was that the e-commerce player was trading at acquisition multiples, not […]