USA

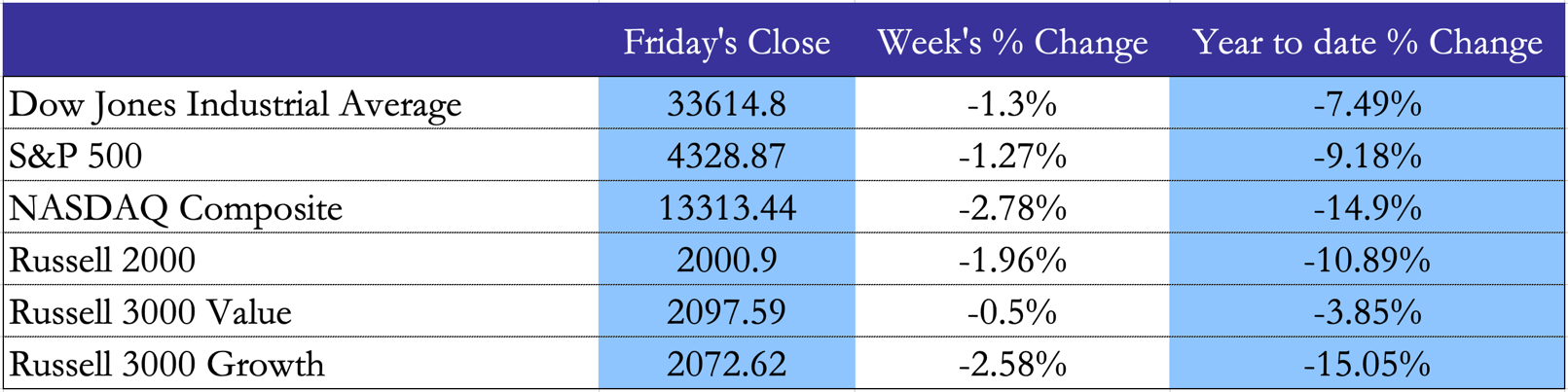

US main indexes ended another week in red territory, with the S&P 500 down 1.27% and the NASDAQ Composite losing more than double this figure. The worst performers mainly pertain to the financial, technology and communication services sectors. The energy industry shined instead, yielding huge gains thanks to rising oil and gas prices. Healthcare and consumer defensives also had a positive week, marking a continuation of investors’ shift from growth to value stocks.

Uncertainty still seems to be dominating in markets, with the CBOE Volatility Index (VIX) steadily above 30. The Ukrainian crisis remains the main source of concern, particularly for the inflationary pressures that limited exports from Russia and potential supply chain disruptions are posing. The week started with Russia’s president message of having set “nuclear deterrent forces on high alert”, which sent a fresh warning to western countries. Financial sanctions against Russia are also starting to show their repercussions on western banks: on Wednesday, Citigroup (NYSE: C) disclosed that it risks losing as much as $4bn because of its exposure to Russia. Putin’s advance has also become even more brutal towards the end of the week, as airstrikes started to aim at densely populated cities. On Thursday evening, US futures tanked following the news that Russia’s missiles had hit Europe’s biggest nuclear power plant, to then stabilize after acknowledging the absence of radiation leaks.

On both Wednesday and Thursday, Federal Reserve’s chair Jerome Powell testified in front of the Congress, addressing some of the key aspects of FED’s monetary policy. He recognized that the Ukrainian crisis is forcing the FED to act with caution regarding upcoming interest rate hikes but confirmed his commitment to proceed with a 25bps rate increase in March. The Labor Department posted strong results: Nonfarm Payrolls published on Friday amounted to 678k, largely beating expectations of 400k and giving further grounds for the FED to stick to its gradual quantitative tightening.

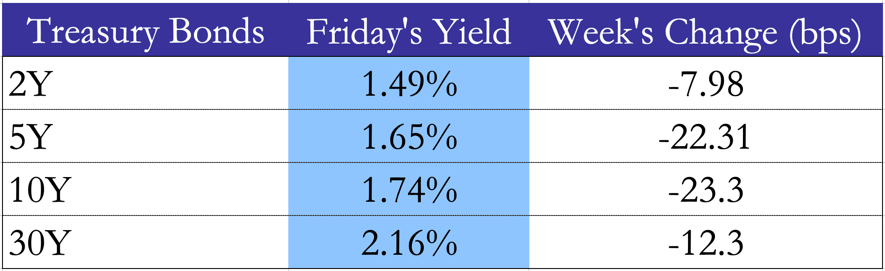

10Y Treasury Bond yields sharply retreated this week at all maturities, with the largest drops in the 5Y and 10Y securities, decreasing more than 22 and 23 basis-points respectively. The prolongment of Russian invasion and its increasingly uncertain outcome have spurred investors to continue their flight from equities towards safe-haven assets, pushing bond prices higher. Moreover, investors may have positively weighed Powell’s testimony, which almost completely ruled out the chance of a more hawkish 50bps rate increase in FED funds in March.

Europe and UK

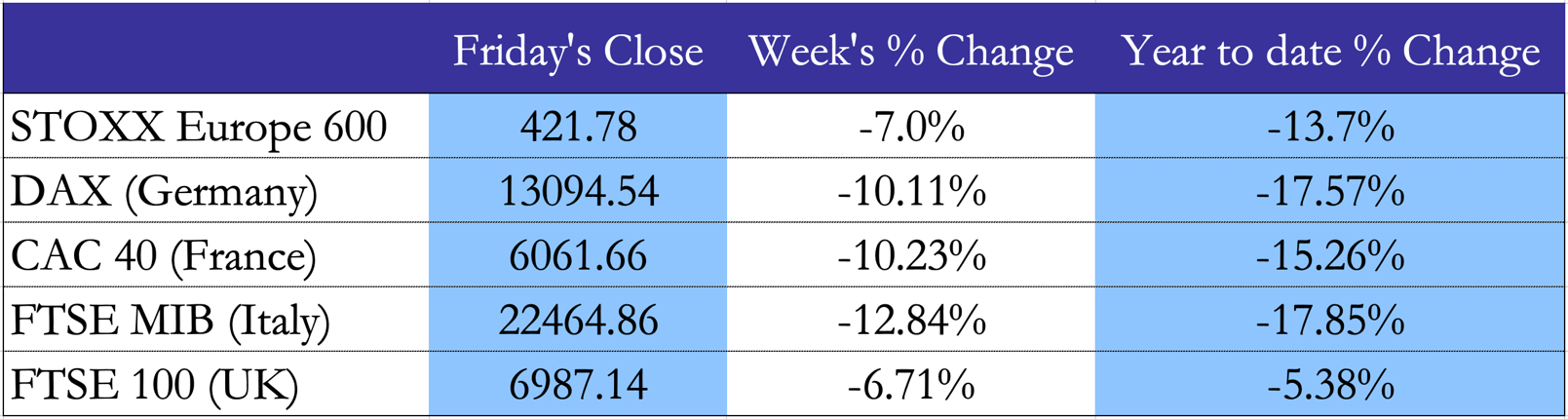

The continuation of the Russian invasion of Ukraine is imposing a heavy toll on European equities, which recorded their worst week in 2022. The STOXX Europe 600 index plunged 7%, while losses amounted to over 10% for German, French and Italian stock indexes, with the latter down 6.24% on Friday alone. UK’s FTSE 100 limited losses compared to its continental counterparties, ending the week at -6.71%. Putin’s nuclear warning and the increasing brutality of his offensive have rattled markets, which on Thursday saw the specter of a nuclear catastrophe when Zaporizhzhia nuclear power plant – Europe’s biggest – was reportedly damaged by a Russian shelling. Despite the apparent absence of radiation leaks, investors were scared more than ever by Putin’s unpredictability, and sent stocks sharply lower on Friday. The financial services sector was among the most heavily punished, with several banks highlighting their substantial exposure to the Russian market. UniCredit (BIT: UCG) – the second-biggest credit institution in Italy – lost more than 28% during the week. Sanctions from western countries also included removing some Russian banks from the SWIFT payments messaging system.

Investors in Europe are also increasingly worried by uncontrolled inflation, which is being reinvigorated by the Russian invasion. The European energy industry is heavily dependent on Russia, with about 41% of gas imports coming from the former Soviet Union. Rising tensions between the two blocks have consolidated fears that Europe will have to find alternative sources for its grids, to avoid a massive shortage of energy. The EU Consumer Price Index (CPI) for January was published on Wednesday, showing a record 5.8% increase year-over-year and beating expectations by half a percentage point. This raised concerns that the ECB may soon adopt a more hawkish tone regarding rate hikes, to honor its mandate of maintaining price stability in the eurozone.

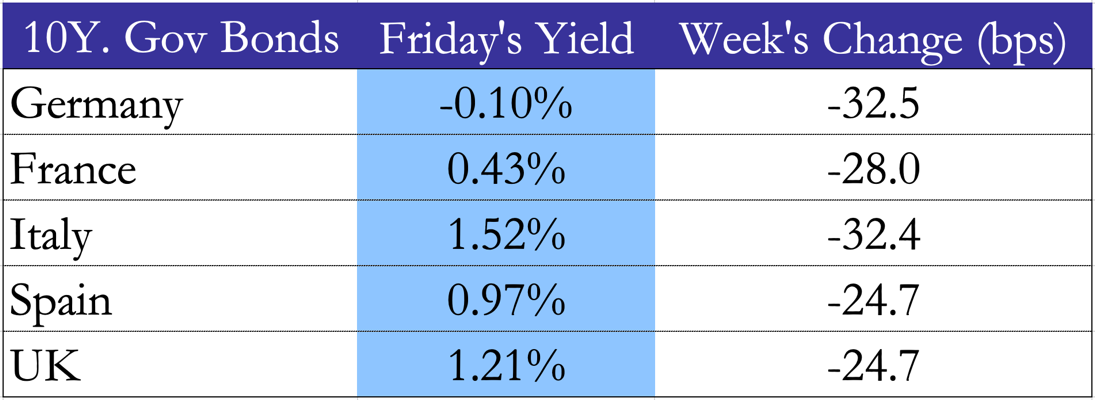

Yields on 10Y government bonds slid sharply and quite uniformly across all European countries, highlighting an increasing risk-aversion of investors who have massively abandoned equities to find safety in high-grade debt securities. In particular, German yield turned back into negative territory, ending the week at -0.10%. BTP-BUND spread remained historically high at around 160 basis-points.

Rest of the world

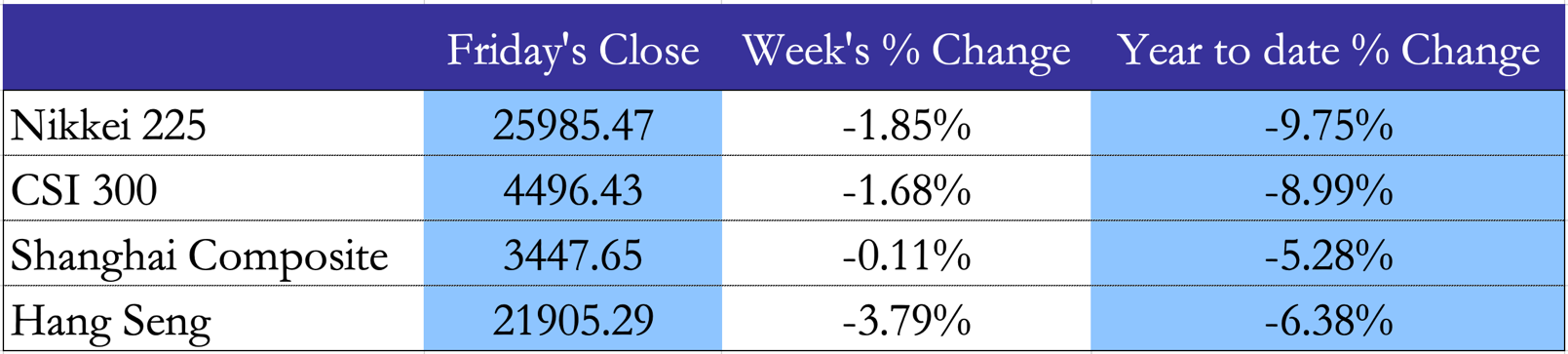

Major indexes in Japan and China lost some ground this week over rising tensions at an international level following the Russian invasion of Ukraine. Japanese Nikkei 225 has lost almost 2%, and both Chinese CSI 300 and Shanghai Composite ended in red, with the former shedding 1.68%. Hong Kong index Hang Seng was hit the hardest, losing 3.8% over the week.

Japan joined western efforts in imposing sanctions, jointly cutting several Russian banks off the SWIFT payment system and reducing high-tech exports towards Russia. Prime Minister Fumio Kishida also unleashed a series of measures to mitigate the effects of rising oil prices. Falling stocks have been accompanied by a decline in 10Y government bond yields from 0.20% to 0.15%.

In China, 10Y government bond yields rose by 6 bps to 2.86%. The country has not joined western countries in imposing sanctions against Russia, with which trade volumes reached a record $147bn in 2021. Domestically, the liquidity problems in the property sectors continue to unfold, with a growing number of developers being downgraded by western rating agencies.

The remaining major world stock indexes posted a positive week. Mexico, Brazil and South Korea’s country indexes all gained more than 1%, while Australian ASX 200 and Turkish BIST-100 advanced 1.61% and 1.96% respectively. On Tuesday, the Reserve Bank of Australia announced it would keep its key rate at 0.10%; on Wednesday, the country posted a higher-than-expected 3.4% increase in its Gross Domestic Product over the last quarter. Both Turkey and Brazil have confirmed a brilliant start of 2022, with their stock indexes up more than 7% and 9% respectively in the current solar year.

FX and Commodities

The Ukrainian crisis is inflicting a major shock on commodity prices, especially of oil, gas, and wheat, i.e., Russia’s main export products. Dutch TTF Gas Futures more than doubled in price this week, reaching a record-high level at 192.55 at Friday’s close, as European countries struggle to secure alternative supplies in face of worsening ties with Russia. Brent Crude Oil futures rose more than 25%, closing at $118 per barrel. Russia and Ukraine together account for about 30% of the world’s traded wheat, whose futures rose over 40% during the week, totaling a rise of more than 57% over the last two months. Gold consolidated the gains it had shed during the previous week, rising 4.3% and closing at $1970.95 per ounce on Friday evening.

The US Dollar Currency Index posted another week of gains, advancing 0.80%, as investors shift towards safer currencies as winds of war do not seem to end. On the contrary, the Euro (€) showed an alarming weakness, losing almost 3% against the US Dollar ($) and more than 3.6% against the Japanese Yen (¥). The Russian Ruble continues its freefall, losing more than 30% against the US Dollar ($); one greenback is now worth 122.9 Russian Rubles.

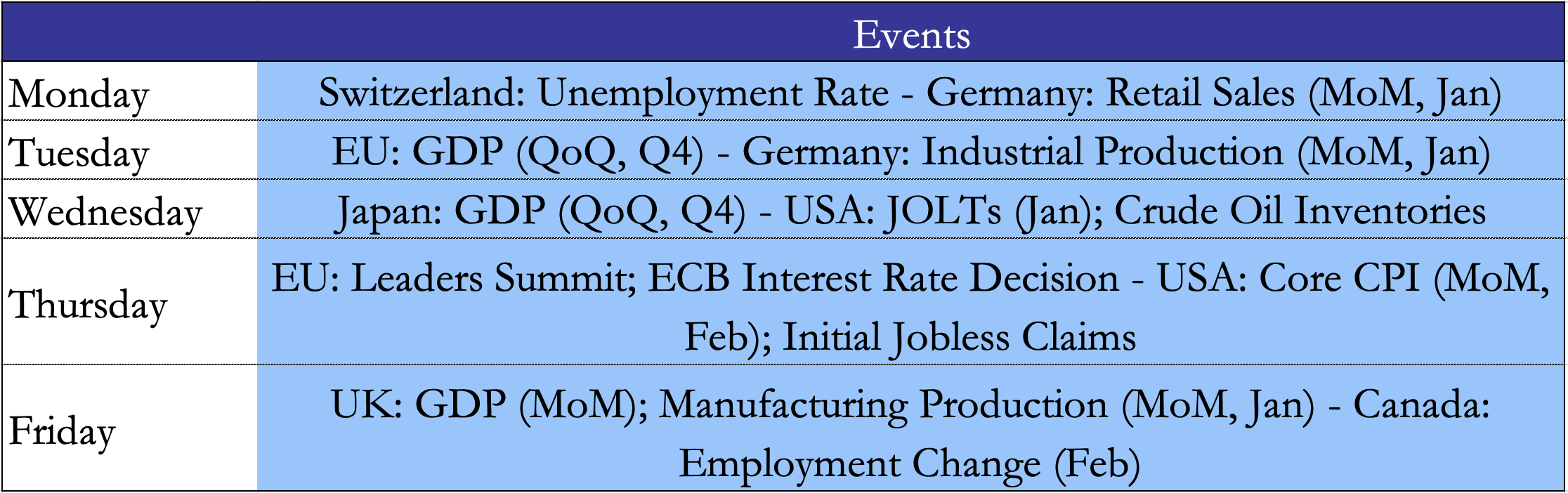

Next week’s main events

Next week main events are concentrated in the second half of the week. On Thursday the 27 Heads of State of the European Union will convene a two-day summit in Versailles, mainly to address the key topic of how to handle current and future European defense policy, whose outcome may also influence Putin’s actions in the following days. Moreover, the ECB will announce the level of its two key interest rates – Marginal Lending Facility and Deposit Facility – and likely issue guidance about its future policy. In the US, Job Openings will be released on Wednesday, while Core CPI and Initial Jobless Claims will follow on Thursday; CPI will be closely watched to have a hint on how much the energy crisis in Europe is weighing on consumer price level in the US.

Brain Teaser #19

In a deck, there are n cards. Some of them lie upside, the rest – downside. In one move, it is allowed to take several cards from the top, turn them over and put them again on top of the deck. What is the minimum number of such moves, given any initial arrangement of cards, to ensure that all the cards face downside?

Solution:

We will first prove that it is always possible to make all the cards face down with n moves. To do this, let’s divide the deck into groups of cards that all face in the same direction, either top-up or top-down. Every time we select the top group and make a move, the number of groups will be reduced by one. We will keep repeating this technique until only one group remains, i.e., all the cards in the deck lie in the same direction. Since there were maximum n groups at the beginning, this will take no more than n-1 moves. If required, the last group can be flipped over one more time to ensure that all cards face down.

Next, we will show that there exists a configuration of cards for which at least n moves are required. Because each step only decreases the number of groups by one, a deck with n groups may be reduced to one group in at least n-1 moves. Now consider a deck in which the bottom card is face-up, the second card from the bottom – face down, and so on. If each step lowers the number of groups by one, after n-1 moves, the deck will be reduced to one group in which all the cards are face up. To ensure that all the cards face downsides, one last move is needed, which increases the total to n moves. Hence, n is the minimum number of moves to guarantee that the problem’s condition is satisfied.

Brain Teaser #20

Inside a square with a side length of 1, there are 51 dots. Given any initial configuration of the dots, can you draw a circle with the radius of 1/7 that contains at least 3 dots?

0 Comments