US

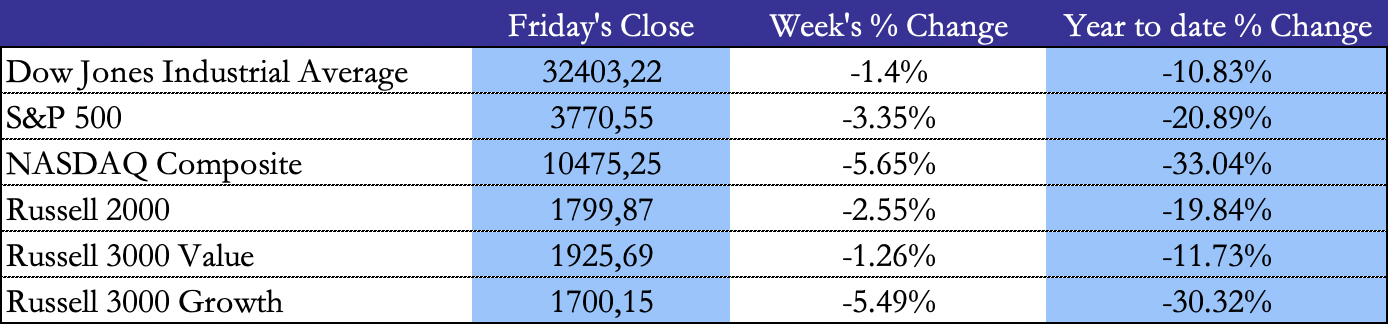

The month of October ended with the Dow Jones recording its biggest monthly percentage gain since 1976. However, these gains soon evaporated as all US major indexes ended the week down following the 75bp increase in interest rates by the Fed and a mixed job report on Friday, putting the fed funds rate at a range of 3.75% – 4.00%. The Dow Jones Industrial Average ended the week down 1.4%, while the NASDAQ dropped by 5.65% over the week, now back below its 50-day moving average. The Russell 3000 Growth index lagged behind with a WoW change of -5.65%, while the Russell 3000 Value just dropped 1.26%. Lastly the S&P 500 followed its peers in the downtrend and closed the week 3.35% lower. The S&P 500 implied volatility, conveyed by the VIX dropped to 24.5.

The worst performing sectors this week, on a relative performance basis, included communication services (down 6.84% WoW), technology (down 6.75% WoW) and consumer cyclicals (down 3.63% WoW). The best performing sectors this week were basic materials (up 3.01% WoW), energy (up 2.32% WoW) and utilities (up 0.11% WoW).

Demand for US workers rebounded in September as employers posted 437,000 job openings, showing that the labor market might be more resilient to the Federal Reserve’s efforts to cool the economy than expected. US JOLTS came out higher than anticipated at 10.7m (forecast 9.75m) on Tuesday. Furthermore, the US manufacturing sector slowed in October to a two-year low as demand fades caused by higher inflation and interest rates. The index tracking factory activity dropped to 50.2 (forecast of 50.9) and it is close to falling below 50.0, which would indicate a contractionary environment.

Major earnings of Wednesday included ABNB and UBER.

ABNB had a solid Q3’22 earnings report with a slight beat on both bookings/revenue and an upside surprise on adjusted EBITDA, as well as FCF due to a mix of summer travel trends. Management remains highly convicted in their view that travel as a % of GDP is continue to grow in a post-pandemic world. However, Q4 revenue guidance (1.80bn – 1.88bn) wasn’t as high as expected resulting in a 13% drop on Wednesday.

For UBER, both the Q3’22 results and Q4’22 guidance were beyond investor expectations, driven by robust mobility profitability and strong incremental margins in delivery. Active drivers are now back at 2019 levels and trending upwards, with October tracking to be Uber’s best-ever month (for both Mobility and total gross bookings). Major headwinds include FX and a lower-than-expected Q4’22 gross bookings guide (5% below consensus). These results led to a 12% jump on Wednesday.

On Wednesday, the Federal Open Market Committee lifted the federal funds rate to a new target range of 3.75% to 4.00%, intensifying its grip on an economy which is proving more resilient then expected. The Federal Reserve raised its benchmark policy rate by 75bp for the fourth time in a row. US stocks reversed initial gains and tumbled at the end of the trading session as Fed Chair Powell said that it was “very premature to think about pausing rate hikes” and indicating that “interest rates need to be higher than previously expected”, showing no signs of a pivot. The S&P 500 index fell 2.5% and the Nasdaq Composite closed the day with a 3.4% loss. However, while Powell added that rate hikes will continue, he stated that slowing the pace of increases “as soon as the next meeting or the one after that” was likely.

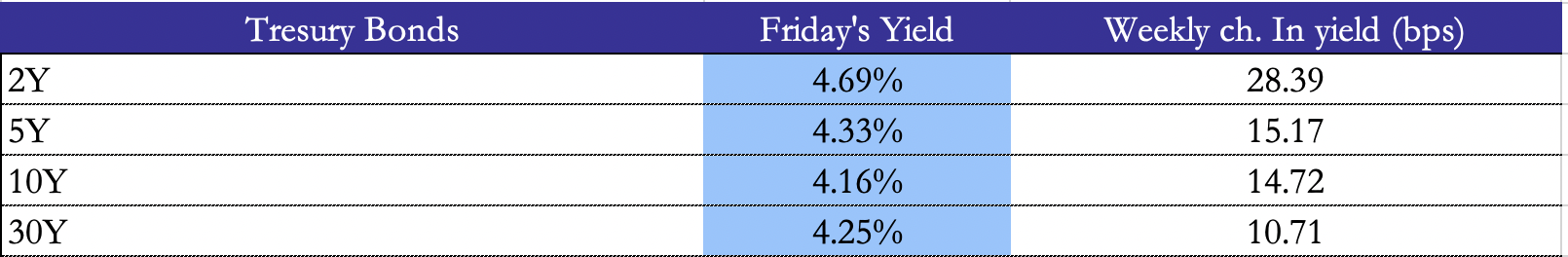

Overall, this was a hawkish surprise from the FOMC and the bond market reflected that as well: the yield on the 10-year US Treasury note, which dropped as low as 3.97%, surged back to 4.09% and the 2Y Treasury Yield which is very sensible to monetary policy expectations rose 0.06% to 4.60%. The target rate probabilities for the December 14 Fed meeting indicate a 52.8% probability of the federal funds rate range moving to 4.50% – 4.75%.

On Thursday, Qualcomm shares fell 7% following a cut in revenue guidance for the rest of 2022, as weak consumer demand for smartphones and an inventory glut has hit its core mobile chip business. “The rapid deterioration in demand and easing of supply constraints across the semiconductor industry have resulted in elevated channel inventory” the management said. Other earnings on Thursday included BWM and Stellantis which both reported surging revenues thanks to strong demand for vehicles and higher prices.

Further, major tech companies announced new measures for cost reductions which mostly included hiring freezes and layoffs. Amazon said it would pause hiring corporate workers. Apple has paused hiring for all roles other than R&D. Lyft also said that it would terminate the contracts of 13% of its employees. Stripe is also firing 14% of its workforce and Twitter laid off around 50% of its workforce on Friday.

To close the week, on Friday, Nonfarm Payrolls showed that the US added 261k jobs in October. This constituted an unexpectedly strong print with analysts forecasting a mere 200k increase. Despite these gains, the unemployment rate went up to 3.7% while analysts expected an unchanged 3.5% level. Average hourly earnings rose 0.37% month-over-month and 4.7% year-over-year just above September’s increase. Payroll growth was supported by continued strength in healthcare and social assistance (+71k vs. +80k prior 3-month average), whereas job growth in leisure and hospitality (+39k vs. +55k) and professional services (+35k vs. +70k) slowed but remained solid.

The markets’ initial reaction to the data was positive, with both the S&P 500 and the Nasdaq composite opening higher. The US dollar index, which tracks the currency against six major peers was down 1.94% following the news, the largest one day drop since March 2020. The stock market managed to climb higher on Friday after a very volatile day (at one point erasing a 2% gain).

EU

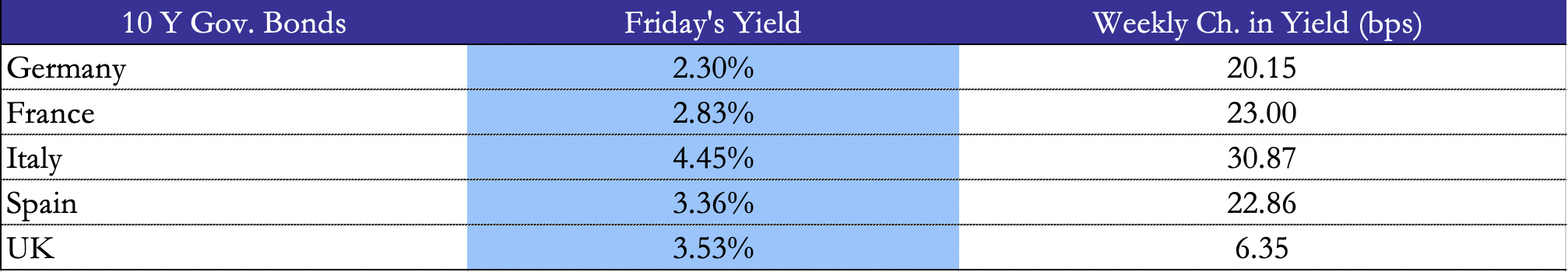

Europe clearly outperformed the US market this week with the STOXX Europe 600 closing the week 1.51% higher. FTSE 100 outperformed its peers following a 75bp increase in policy rates in the UK and an announcement of less rate hikes in the future. FTSE MIB increased 3.34% and CAC 40 jumped 1.63%. The DAX lagged behind with a 1.63% WoW increase.

Eurozone inflation surged to a record of 10.7% in October, keeping the pressure on the ECB to continue raising interest rates despite a sharp slowdown in growth. Gross domestic product figures confirmed slower growth in the third quarter, rising 0.2% (in line with consensus) from 0.8% in the previous quarter. The higher-than-expected eurozone inflation, despite a sharp fall in energy prices in recent weeks, is likely to make it harder for the ECB to considering stopping its tightening cycle anytime soon. Core inflation rose to 5% from 4.8% in the previous month.

On Thursday, Norway’s central bank eased the pace of interest rate increases as they said that inflationary pressures are decreasing and there were signs of an economic slowdown. In September, Norges Bank raised interest rates by 0.5% to 2.25% and in October it increased its main interest rates by 0.25%, indicating that a further increase was likely next month.

Manufacturing activity in the UK slipped to its lowest since the initial phase of the pandemic. The PMI fell from 48.4 in September to 46.2 in October. A level below 50.0 shows that the companies surveyed believe that activity is contracting.

On Thursday, the Bank of England raised its benchmark interest rate to 3% (a 75bp increase in the policy rate), marking their strongest move to tame inflation for more than 30 years. Additionally, the BoE Monetary Policy Committee said that financial markets’ expectations of interest rates peaking around 5.25% were too high, and instead gave guidance that interest rates do not need to rise much further to bring inflation to the 2% target. The pound slipped following the news, extending losses against the dollar to trade 1.7% lower at $1.12. The EUR/GBP now trades at £0.86. Gilts rallied as investor now believe in a lower peak in UK interest rates next year. FTSE 100 closed the trading session up 0.6%.

Rest of the world

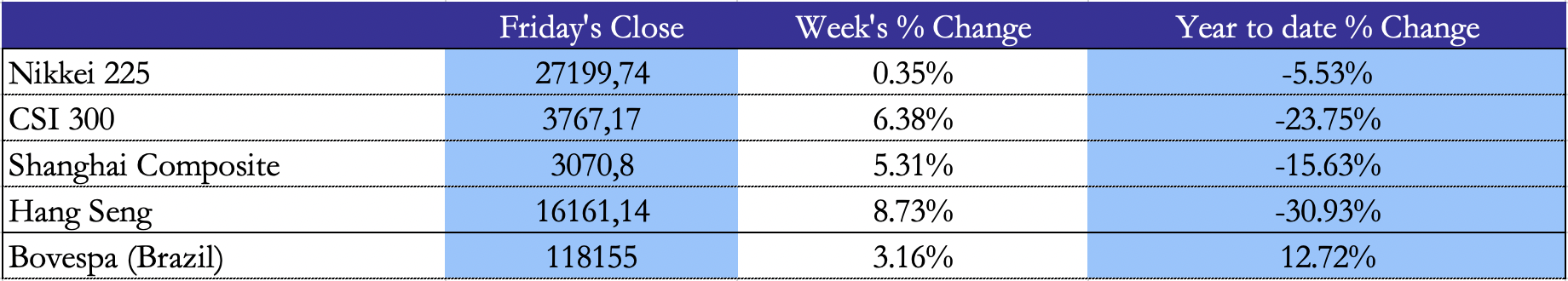

Hong Kong’s Hang Seng was the best performing index on a global scale, together with CSI 300 and the Shanghai’s Composite after speculations on a turn away from the zero-Covid policy. The best performing sector was technology with the Hang Seng Tech Tndex adding as much as 8.5%.

On Monday, Luiz Inàcio Lula da Silva has claimed victory in Brazil’s presidential elections, defeating Jair Bolsonaro by a narrow margin of less than 2%. This sealed the dramatic comeback of Lula who was president between 2003 and 2010 but was later tried for corruption. The MSCI Brazil Index rallied 4% on the news on Monday.

On Tuesday, the CSI 300 Index in Shanghai and Shenzhen jumped 3.6% while Hang Seng climbed 5.2% on rumors that the Chinese government had put together a task force to consider reopening plans for next year. Furthermore, UBS chair Kelleher says that banks are very “Pro-China”.

Turkish price inflation surged 85.5% in October after the central bank cut its benchmark interest rate to fuel economic growth ahead of Turkey’s presidential elections next year. Russia’s economy shrank by 5% on an annualized basis in September, a sharper contraction than the 4% recorded the previous month.

FX and Commodities

On Monday, Russian president Vladimir Putin decided to pull the plug on a deal that unblocked the passage of millions of tons of grain via southern Ukraine. The decision led to a spike in wheat prices by 6%. Natural gas futures also spiked on Monday by 9% following the news. On Wednesday, however, Russia agreed to rejoin the UN-backed initiative to allow exports, ending a threat to a food crisis. Wheat futures dropped 6%, erasing gains of the previous day.

Industrial metal prices rose on Friday on the rumors of China’s reopening, putting some commodities on track for historic daily gains. The three months contract for copper rose 8% to touch $8,000 a ton for the first time in two months. Natural gas contracts also spiked 8.1% following the news and WTI jumped 5.02%.

All these commodities price increases will put further pressure on inflation as the US CPI is set to release next week. This could put even more pressure on the FOMC to continue raising interest rates if they do not see a peak in inflation, the combination of both will continue to put downward momentum on equities.

In FX markets, there was some downward momentum on the US dollar on Thursday and Friday, following the releases of NFP and the unemployment rate. The DXY (index following the US dollar against major peers) was flat this last week, showing a 0.03% increase. EUR/USD closed at parity while the GBP/USD finished the week down 2.07% to close at £1.14.

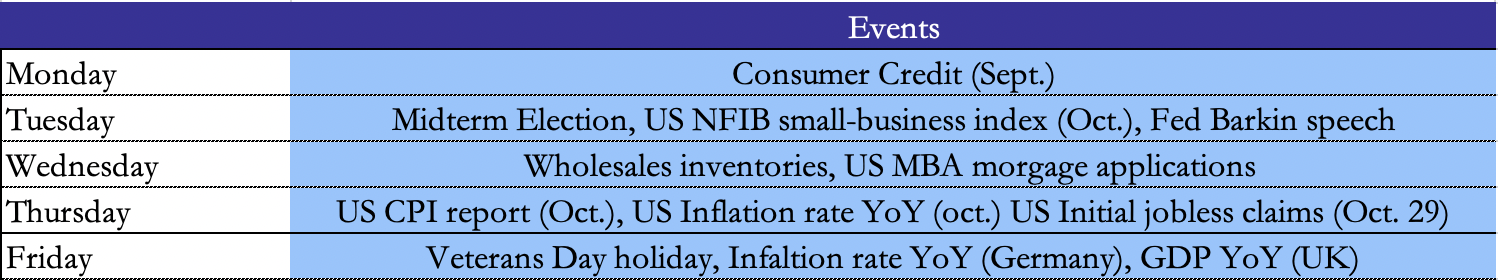

Next week’s main events

The key event next will be the release of the US Inflation rate on Thursday. The headline forecast for October is 8.1% and the core inflation rate is expected to show a 6.7% YoY increase in prices. It is essential for the markets to see inflation cool down on a monthly basis as a decrease in inflation might indicate that the Fed’s aggressive hiking starts to limit inflation momentum. An increase in the inflation rate is likely to result in a more hawkish Fed in the upcoming meeting to bring inflation down to the 2% target level. Other key events to watch in the market are the German inflation rate and the MBA mortgage applications.

Brain Teaser #29

Twenty-five BSIC members are seated at a round table. Three of them are chosen – all choices being equally likely – to write the upcoming article. Let P be the probability that at least two of the three had been sitting next to each other. If P is written as an irreducible fraction, what is the sum of the numerator and denominator?

Problem source: AIME 1983

Solution: We will first calculate the probability that none of the three BSIC members sits next to each other, denoting it with K. As the desired probability P is the complement of K, we will only need to subtract K from 1 to obtain P.

Consider that 22 members are already seated at the table, and we only need to place the remaining three. If we arranged them without any restrictions, there would be 22 options for the first member, 23 for the second one, and 24 for the third. On the other hand, if we aimed for the three members not to sit next to each other, there would be 22 options for the first member, 21 for the second one (as the second cannot sit next to the first), and 20 for the third.

Therefore, the probability K is equal to ![]() , and hence

, and hence ![]() . The sum of the numerator and denominator is 57.

. The sum of the numerator and denominator is 57.

Brain Teaser #30

Determine the last four digits of ![]() .

.

0 Comments