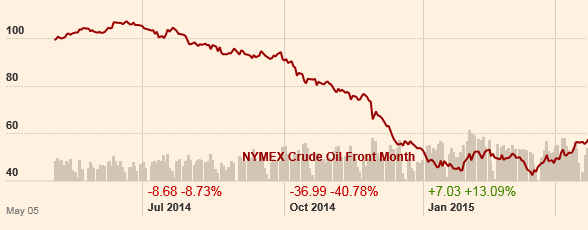

In 2014 oil prices crashed. In June 2014, the price of Western Texas Intermediate[1] oil was $115.12 while in December it was $53.77. There are several reasons for abrupt decline in price. The main cause was the rapid supply growth which overwhelmed moderate demand. The political turmoil in Iraq and Libya did not affect the countries’ output. US has increased its production due to the new technologies of fracturing and drilling. Also, Saudi Arabia, the largest oil producer played a crucial role in OPEC decision not to cut supply and to protect market share.

More recently, oil prices stopped falling and reversed the trend. This week the prices jumped to the highest level YTD. Brent[2] headed towards $70 a barrel, while WTI climbed above $62. However, we believe this rally won’t last and the market will experience a drop in oil prices in the next period.  Source: FT

Source: FT

Next OPEC meeting is scheduled in June but it is unlikely that they will change the level of supply as Saudi Arabia’s oil minister clearly indicated that they are not going to cut their own production, which is now above 10m barrels per day.

Saudi Arabia’s military intervention in Yemen fuelled oil price rally in April. However we are convinced that the market overreacted. It is improbable that this will have further impact on oil prices because globally Yemen is a negligent oil producer. It is producing around 150,000 barrels per day or one-twentieth of Texas’ production.

Iran and USA are near an agreement on Iranian nuclear enrichment activities and this could bring another large player into the oil market on the supply side. In 2006, sanctions were imposed after Iran refused to suspend its uranium enrichment program. Sanctions initially targeted oil, gas and petrochemicals. The lifting of oil sanctions would expand Iranian exports which have been capped by sanctions in recent years. Currently Iran is producing 2.8 million barrels a day, but Iran also has 30m barrels in floating storage. This might pose a threat to oil prices in case they ramp up their oil production and export. However, Iranian oil will not have an immediate and dramatic impact on oil price as it needs first to acquire Western technology. according to U.S. government’s energy agency the end of Iran sanctions could cut oil prices in 2016 by $5-$15 a barrel.

US Oil storage is at record high level, as high as 489 million barrels. Comparably, the US and Saudi Arabia combined production is about 20 million barrels per day. At some point large oil stockpile will eventually flow into the market causing an increase in oil supply and adding downward pressure to prices.

Another indicator of possible decrease in oil prices are market expectations. Even there is a surge in futures for immediate delivery, the long-dated oil futures traded at New York mercantile exchange are falling. Two months ago the crude oil for January 2019 delivery was traded for $68, while today the price of crude oil for January 2019 delivery is $66.

Emerging markets have been extremely influential in world energy markets. But now economies of emerging markets, China in particular, are experiencing a slowdown. Considering all aspects about supply, it is hard to believe that demand side will be enough to mitigate large supply level.

Given all these consideration we recommend not to expect this rally to last forever. We warn that despite the 2015 rally, there remain more risks on the downside than on the upside. We expect price of oil lower than 60$ again by the end of 2015.

[1] Western Texas Intermediate is a benchmark for most of the oil produced and traded in the United States

[2] Brent is an international benchmark for oil produced worldwide

[edmc id= 2794]Download as PDF[/edmc]

0 Comments