It is widely known that the USA and the EU are in different economic conditions: the American economy has risen from the crisis and the FED is tightening the policy, while Draghi, the president of the ECB, declared that they will keep the quantitative easing going. Unemployment in the US is near its natural rate, while in the UE the core inflation is far from the 2% target. However, recent macroeconomics reports showed that we might be wrong in our judgement over the two economics areas. Here, we want to analyse deeper in which way real figures beat or disappointed expectations.

Economic Summary

| Indicator | US | Eurozone |

| 2016 GDP Growth | 1.6% | 1.7% |

| 2016 Q4 GDP Growth | 1.9% | 0.5% |

| 2016 GDP Growth per Capita | 2.4% | 1.9% |

| Unemployment rate | 4.8% | 9.6% |

| Nonfarm Payrolls | 227.000 | |

| Labour Force Participation | 62.9% | 57% |

| Wage Growth | 3.57% | 1.6% |

| Capacity Utilisation | 75.46% | 82.5% |

| PMI Composite | 55.8 | 54.4 |

| Inflation rate | 2.1% | 1.8% |

| Core Inflation | 2.2% | 0.9% |

| Government Budget | -3.2% | -2.1% |

| Debt-to-GDP | 104.2% | 90.7% |

| Current Account Balance | -2.7% | 3.7% |

| Interest Rate 10y Government Bonds | 2.41% | -0.44% |

| Above expectations Under expectations | ||

(Source: tradingeconomics.com)

US: overly optimistic?

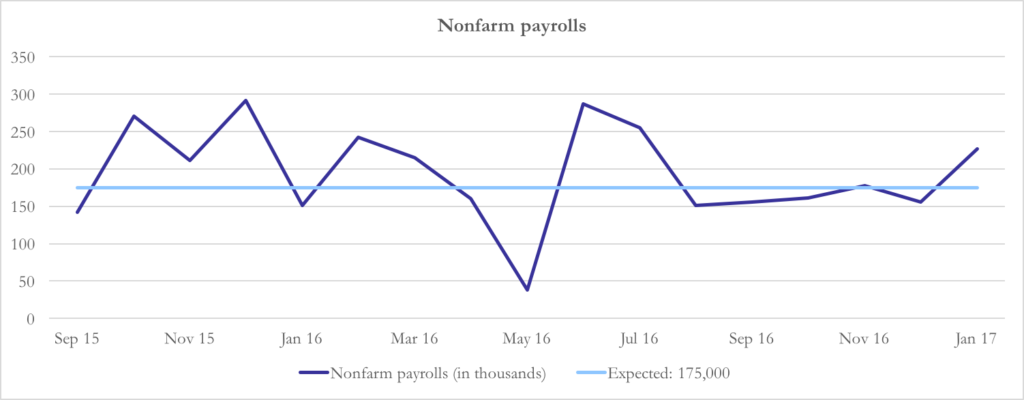

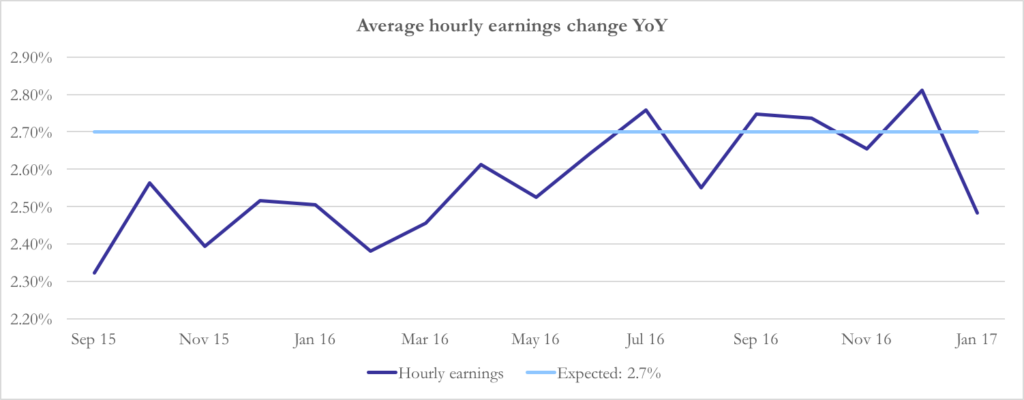

On Friday 3 February, the Bureau of Labour Statistics released the first report after Trump’s nomination and the outlook is contradictory. The brightest figure is nonfarm payrolls, which rose by 227,000 in January and exceeded both the estimated 180,000 jobs and December result of 157,000. However, the unemployment rate slightly increased by 0.1% to 4.8% and the average hourly earnings grew by 2.5% from last year digit and missed the expectation of 2.7%.

(Source: investing.com)

(Source: fred.stlouisfed.org)

After the rate hike in December, the eyes are focused on March 15th when the FOMC will declare if they will continue to increase the rate or they will postpone it to the following meeting. Because of the job market data we illustrated before, beliefs have been born that the FED will keep tightening the monetary policy on March. After the report release, the probability of a rate hike in March implied in Fed Fund futures decreased from 18% to 9% and is currently at 13.3%.

This all sums with a general disillusion on prompt fiscal stimulus from Trump presidency. After the elections, markets believed that his mix of government expenditure, tax cut and deregulation would boost growth and inflation and investments shifted to riskier assets. Doubts do not concern the effectiveness of those measures, but the time when they will be introduced, as Trump’s administration focus on the controversial travel ban could delay further in time the other decisions.

The major uncertainty comes from the ambiguous political attitude of the government about the dollar. Although the Treasury secretary said that they would support a strong dollar, the president accused China and Japan to have unfairly devaluated their currencies against the dollar. Markets have to wait for new clarifications from FED on their policy and from the White House about fiscal stimulus in order to determine with more clarity the short run future of the dollar.

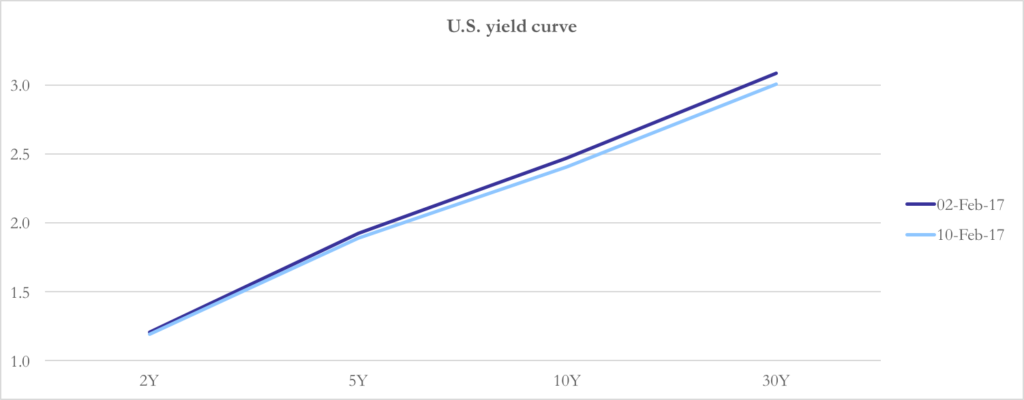

As a consequence, the yield curve on treasuries moved down since 5th February (the day before the job report release). The 2-year yield lost 0.7 bps and closed at 1.194% on 10th February, while the 30-years yield lost 8.9 bps and closed at 3.006% on the same day. The 10-years yield lost 6.3 bps and closed at 2.409% and on Wednesday it reached 2.340%, a new minimum after 18th January.

(Source: investing.com)

In the past months, the markets seemed particularly optimistic about Trump’s election and the positive effect on economic growth caused by the actions he promised during the campaign. The rate hike decided by the FOMC in December strengthened this view and was cheered by banks who demanded higher interest rates. The data just released partly disillusioned those high expectations and investors became more prudent and returned to safer assets. Even if the report considers just one month, the employment and wage figures suggest that there is more unused capacity in the labour market than previously thought, which in the end could delay the strengthening of monetary policy and slow down economic growth.

EU: outperforming pessimism

In general discussions of the world’s economic situation, the outlook for the Eurozone has been expressly pessimistic for the past few months. Comparing this perception to most recent indicators of performance, however, one has to admit, that the Euro area is no more the weak link of the developed world.

Estimates of GDP growth, inflation and unemployment have reached multiple year highs and repeatedly outperformed forecasts in the past month. GDP growth in the Euro area, standing 1.7% for 2016, surpassed the US value of 1.6%. An inflation rate of 1.8% in January 2017 YoY is nearing the ECB target of about 2%, however core inflation lags behind by almost one percentage point. Yet, unemployment reached a single digit level in the same month, for the first time in several years.

On top of these more technical indices, business sentiment has picked up and a high PMI composite for 2016 indicates strong confidence on the manager’s side. Non-increasing inequality figures also hint, that the economic growth is inclusive and felt by ordinary families, rather than only by top-notch employers.

To find the origin of such outperformance and success one does not have to look far.

On the one hand the ECB’s ultra-loose monetary policy is finally beginning to work. Continuous quantitative easing, and the consequent low interest rates encourage consumers and managers to take up credit, to spend and invest. A cheap Euro also made exports of the region more attractive, which may have contributed to a positive and growing current account estimate.

Fiscal consolidation and restructuring in the problem areas is showing the desired results by producing some of the highest growth rates in Ireland and Spain. Consumption and investment appetite are returning to these countries and alongside cautious fiscal expansions in other countries are fuelling economic growth.

Growth in almost all Eurozone countries has lead to the largest job creation in January for nine years. Continuously decreasing unemployment figures, despite large inflows of migrants and an increase in labour force participation, show plenty of slack from several years of crisis in the economy, which can still be absorbed by the unemployed.

Slight wage growth has contributed to rising inflation figures. However, a decidedly lower core inflation, far off the Eurozone target level of 2%, emphasises the dominant price growth in fluctuating sectors such as food and oil.

Lastly, a failure of any post-Brexit downturn in economic activity to materialise so far, has been unexpected. Consequently, on the other side of the channel, as well as in the Eurozone, pessimistic forecasts were surpassed.

Despite the positive developments of the past months, several problems of the monetary union persist. These might pose an obstacle for enduring growth in the future. Several country and sector-specific instabilities constitute individual growth obstacles for the respective markets but might also influence overall economic performance in the Eurozone.

An unstable banking sector in Italy frequents the news weekly and drove the yields on 10-year Italian government bonds much higher than those of the German equivalent, the 10-year bund. Investors prefer avoiding the Italian market at the time, which weighs on the economy. Consequently, Italy has been the only Eurozone country, that did not grow during the past year.

Another prevailing topic in the news is the discussion about Greece’s debt bailout, between the IMF and the Eurozone. After severe fiscal consolidation, that impaired growth prospects and inflicted some unknown hardships on the Greek population, a failure to reach an agreement would undermine all advances made by Greece since 2012.

The upcoming elections in several European countries have the potential to disrupt economic expansions and represent a more general threat to the Eurozone itself. Especially the parliamentary elections in France and Germany could turn out decisive for the future of the region. The inherent political uncertainty and outcome is influencing and will influence markets considerably.

Uncertainty about Brexit negotiations, regional elections and a potential phase-out of the quantitative easing scheme weigh heavily on forecasters. Besides a current debate about the economy reaching full potential, since rising wage growth accompanies any decrease in unemployment, might have a downward influence on growth predictions.

Following this analysis of recently positive performance and possibly inhibitory developments, it is unsurprising that forecasts for GDP growth in 2017 are lower than the level attained in 2016.

0 Comments