US

Big news has struck the US economy this week and in particular the ones oil-related has had a strong effect on the market. The US economy has been once again the main driver of the fall in oil prices this week as the country’s stockpiles of crude last week increased by 7.7 million to 425.6 million, marking the sixth straight week of historical highs. Oil lost slid sharply week moving from $54.06 per barrel on Monday to $50.81 on Friday night (-6.01%). Lower prices for oil continue to hit the main American oil producers and in particular Exxon, which lost its most famous shareholder Warren Buffet.

Despite weaknesses in oil, the industrial production of US rose less than forecast in January and home construction fell, showing the U.S. economy is off to a slow start in 2015. This weakness is with a high probability related to weak economic environment overseas, as well as to the strong dollar, for these reasons it is expected growth to slow down in the first quarter of 2015. As a consequence of these weak data the Federal Reserve remains on the same position as last month. The renovated decision not to lift interest rates comes as there remain more downside risks from an earlier rate rise, rather than a later one.

The equity market edged higher this week, with dominating themes the uncertainty that is reigning on oil prices and the political situation in Greece. The S&P 500 opened the week at 2,096.47 closing at 2.110,30, marking a record close on Friday while the NASDAQ index moved from 4,889.99 on Tuesday to 4995.97 on Friday. The Dow Jones index followed the trend of the other indexes, opening at 18,019 on Tuesday and closing at 18,140 on Friday.

The Dollar maintained its strength against Euro (last: 1.1385) as a consequence of the looming QE and possible rate rise in the US this year.

Eurozone

It was a volatile week in Europe with the attention focused on the Greece bailout talks and on some interesting economic releases. Sentiment on the Markets remained fragile as investors remained cautious as another round of talks with Eurozone finance ministers resulted inconclusive after Germany rejected a proposed bailout extension request from Greece. The Greek request included a pledge to maintain “fiscal balance” for a six-month period, in order to give it time to reach a new agreement on growth over the next four years with its partners in the euro zone. But German Finance Minister Wolfgang Schaeuble said it was “not a substantial proposal for a solution” and did not meet the criteria agreed on at the euro group meeting of euro zone finance ministers on Monday. We believe Greece’s commitment towards economic reforms is vital for a successful agreement because in the absence of it, there will be joyful celebrations in the Elyseè and in Rome too that will prevent economic reforms essential for a recovery of the Eurozone as a whole. On the other hand, the release of PMI on Friday provided fresh evidence that we may finally be heading towards an improvement in the economic scenario amidst falling energy prices, a weaker euro and the announcement of a landmark quantitative easing programme by the European Central Bank.

Later on Friday the EU finance ministers agreed on a 4-month bailout extension to Greece, the news sent the Euro higher against the Dollar, paring the losses for the day and closing the week at 1.1385.

UK

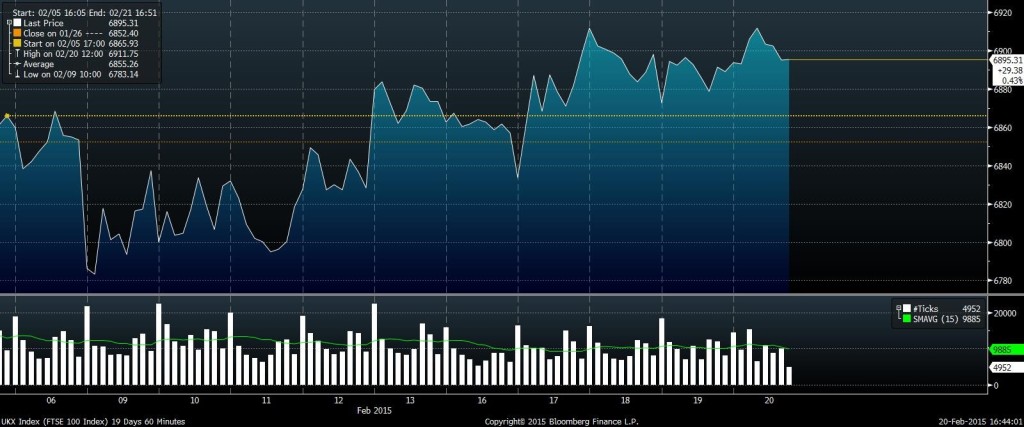

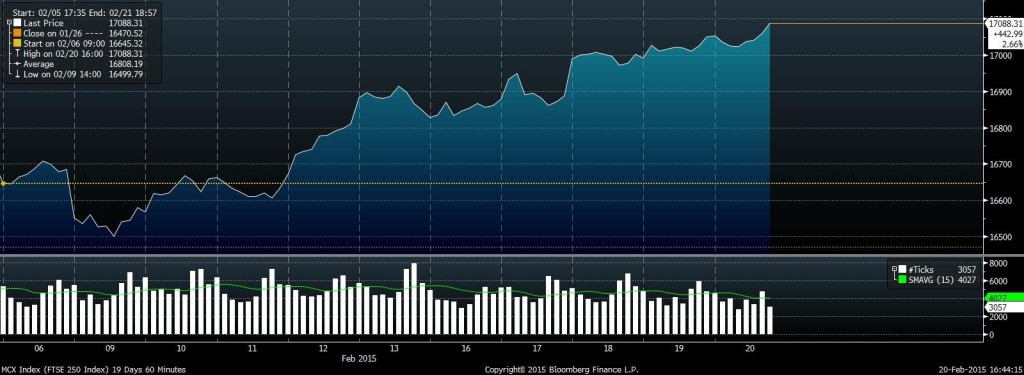

Though this week was primarily focused on Greece and the rest of the Eurogroup, the U.K. had its fair deal of data coming in too, moving the British markets accordingly. After the 12th Feb inflation report signalled lower inflation and dovishness of the BoE which they put down to energy, food and goods prices, the actual data came in on Tuesday at 0.3 %, a new low. While we let Mr Cameron and Mr Osborne boast these days on this piece of data, we prefer to focus on the wider picture. Much of the expected move –which is not so certain anymore- of the BoE had been given by strong GDP and economic recovery signs, but at the moment rate rises seem unlikely. Some may see the BoE hiking rates at the end of this year –but only if wage growth indicators, which stand at 1.7% YoY in December, were to continue growing. Both the FTSE 100 (Graph_1) and FTSE 250 (Graph_2) edged higher, though volatility was higher in the former, given the heat in the markets due to Greek uncertainty and the higher exposition of the primary British index to the international setting.

One immediate effect of the lower prices is that of boosting households’ spending power, but are we so sure? Apart from oil and food, which still make up an important part of the basket, on average all other prices went up, as shown by the 1.4 % YoY increase in core inflation. And is weak demand the issue here? Well, no. It has already been a few years that the UK food market has been engaged in an ultra-competitive price war. This has brought prices to ridiculous levels, one has just to take a stride in any average UK supermarket so as to understand. This is also the cause that led companies like Tesco’s to lose market share to the likes of Aldi, Lidl and Asda. So definitely, prices are lowering due to market competition forces, at least in the strong internal UK market.

The ONS also said house prices in Britain rose a yearly 9.8 percent in December, slowing a touch from November and adding – once again in line with our previous analysis – to signs that the property market is cooling.

During the week, the Sterling appreciated further with respect to the major currencies, touching an high of 1.3559 against the Euro.

[edmc id= 2385]Download as PDF[/edmc]

0 Comments