US

Equity markets in the US lost ground this week, ending short of the fresh highs touched in the previous one. Macroeconomic data came in mixed, as a solid manufacturing PMI and positive data on new home sales on Tuesday and Wednesday were confounded by disappointing durable goods orders and continuing jobless claims on Thursday; the latter contributed to push the S&P 500 down by more than 1.5 percentage points on the day and VIX up as much as 20%. However, the final print of GDP growth data for Q2 came out on Friday above expectations (4.6% vs 4.2%), which confirmed that the US economy is on a firmer footing and helped dismiss the fears resulting from the Q1 dip as unfounded. Equity markets pared weekly losses on Friday, so that the S&P 500 ended 1.37% lower than last week, while the Nasdaq and the DJIA shed 1.48% and 0.96% respectively.

The US yield curve was little changed during the week, with only a hint of bull flattening to be seen. More specifically, while the front-end and the belly of the curve were anchored at their previous levels, the long and very long end rallied, with yields on the 10-year benchmark coming down by 5 bps and the ones on the 30-year benchmark coming down by 8 bps during the week.

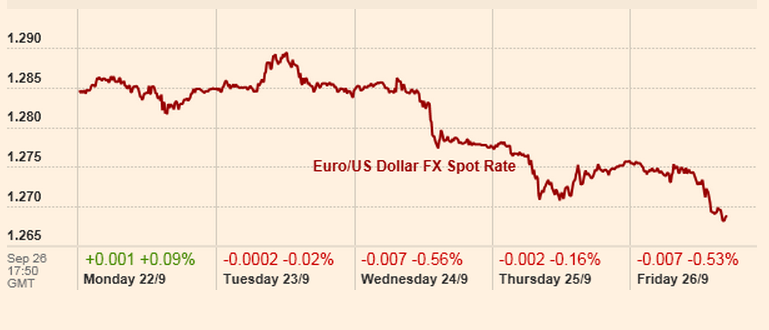

The continuing outperformer was instead the US dollar, which continued its appreciation against all major currencies. Most notably, it gained more than one percent on the euro, keen on a rising trend that has been in place for the last three months (as can be seen in the graph below, showing that the inverse ratio has gone down from 1.36 to below 1.28 since July).

Source: Yahoo Finance

Next week are expected fresh data from non-farm payrolls, unemployment, consumer confidence, personal income and spending. Expectations are for overall confirmatory signals pointing to economic expansion; however, since momentum has been dented already this week, contrasting data could result into another week on the down side.

Eurozone

This week all leading European indicators came below expectations, exception made for French Flash Manufacturing PMI. Concerns about the ability of Germany to continue to drive European growth as it did in the past few years have mounted, negatively affecting both the Euro and the Stock Indexes.

A general weakness of the Euro, which in the 5 days period lost against all major currencies, together with a strong dollar pushed the Euro to a 2-year low of $1.27.

Source: FT

Inflation is expected to fall to 0.3% in September, further increasing the risk of deflation in the Eurozone. Weak demand for the first TLTRO coupled with negative and declining economic indicators and the increased risk of deflation will spur the ECB to act. Draghi mentioned again the possibility of additional unconventional monetary policy in his speech in Lithuania today.

Though we expect that the next round of TLTRO, which is due only after the Asset Quality Review, will be more successful than the first one, a low inflation reading would add pressure on the ECB to act quickly and with faster instruments than the TLTRO. Yet, expectations are that the ECB will not act in the next meeting.

Bunds yield, which most closely track expectations about monetary policy fell 14 basis points over the week widening the Treasury-Bond spread to an all-time high. A divergence in central and peripheral yields might also reflect a “risk off” week with Spanish, Italian and Greek yields increasing over the past five days.

Expectations of looser monetary policy did not give enough support to equity, with the EUROSTOXX 50 losing 1.25% during the week.

Next week the inflation reading on Tuesday and the ECB press conference could be some of the most important catalysts for what concerns Eurozone.

UK

This past week was most significant in giving us a further understanding of the reaction to the Scottish independence vote cast on Thursday 18th, last week. We can say that the markets initially acted with relief to the results, with stocks going up and sterling rallying. Eventually, the new week showed greater signs of uncertainty with the FTSE 100 dropping more than 2 percent and the gilt gaining strength with yields falling to 2.47%. For now however, there does not seem to be any consensus towards a nearer rise in interest rates, but what we can likely assume is a renewed enthusiasm in the Scottish house market, which can now be boosted by a new interest and trust in the Scottish market. The fundamentals seem to be in place for a full recovery led by cities like Edinburgh, Aberdeen and Glasgow.

With regards to the Sterling, the Pound was quite flat towards a basket of currencies but gained with respect to the Euro. A rather easy trade we would suggest is going long the GBP w.r.t. the Euro, given the changing European economic landscape of the past few weeks and the renewed strength we may expect in the post-referendum U.K.

Japan

This week’s major market movements were linked to the strong weakening of the Yen and a read of an inflation rate slowdown in August, which is believed to lead the BoJ to provide further stimulus.

The Yen depreciated by 10% since early August (USD YEN is currently 109.28), helping exporters and boosting their share prices, but economists are questioning the value of further depreciation that would damage small business and increase energy prices.

In August the year-on-year nationwide rate of increase in core CPI (Japan’s main price index) stood at 1.1 per cent, which shows a slowdown from the 1.3 per cent rate recorded in July and is well below the BoJ 2% target. According to analysts, if this trend is confirmed it could push the central Bank into providing further stimulus. About a third of private-sector economists surveyed by Bloomberg expect the BoJ to extend its stimulus programme by the end of the year.

However, there is no consensus over the utility of further monetary easing: according to Goldman Sachs, Prime Minister Shinzo Abe is running out of short-term policy options, whereas Sumitomo Mitsui Banking Corp, Japan’s second-largest bank is continuing to take a bullish view on Japanese stock.

The Nikkei 225 hit a seven year high (over 16350 ) on Thursday as shares of exporters soared after the yen dropped, but lost 1.2% on Friday as the S&P 500 fell to a two month low.

Sources: Financial Times, Bloomber, Businessweek, WDJ

[edmc id=1902]Download as PDF[/edmc]

0 Comments