US

After turmoil in the recent weeks US equities are back to all-time highs. Very solid data on consumer confidence and a Q3 GDP growth rate print of 3.5%, above a lower forecast of 3%, propelled the S&P 500 to 2018.05. Not even the completion of tapering on Wednesday stopped US equities during the week; the five-day gain was 2.72% for the S&P 500 and above 3% for the Nasdaq Composite and the DJIA.

Due to such positive expectations for US growth Treasuries took a hit – overall bear flattening was seen on the yield curve this week. In the two-to-ten year sector yields have gone up by around 10 bps, also reflecting the new forward guidance given by the Fed in the statement released after their meeting on Wednesday. While the end of QE was widely expected, Fed officials no longer defined the slack in the US labour market as significant and instead pointed to the resilience of the US recovery, also stressing that the path to monetary policy normalisation will be data-dependent. At the moment interest rate futures show the most likely time for a rate hike to be September 2015, one month earlier than what was expected before the meeting.

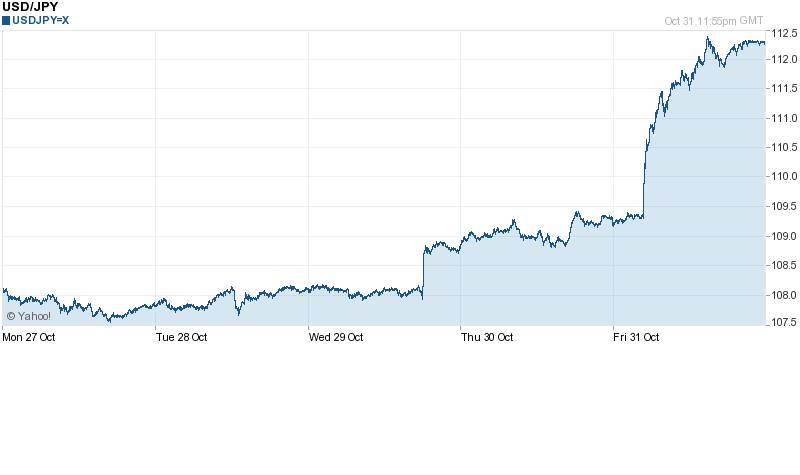

A surprise expansionary monetary policy action from Japan on Friday sent the dollar higher as well, adding to the gains after the hawkish Fed statement. While the weekly gain vis-à-vis the Japanese yen was extreme at 3.85%, the dollar is up against all its major trading partners, notably gaining 1.18% against the euro and 0.58% against the British pound. We show the two positive shocks to the value of the dollar against the Japanese yen and the new trading level above 112 clearly in the chart below:

Source: Yahoo Finance

Next week will be particularly heavy on the data: manufacturing and non-manufacturing PMIs will be coming out at the beginning of the week and data on the labour market, including non-farm payrolls and the unemployment rate for October, will come out on Friday. These figures will help tell whether the underutilisation of resources in the labour market is really exhausted, but it will be necessary to wait for harder inflation developments to guide new monetary policy.

UK

This October’s data were incredibly important for a sector that worried the UK economy throughout this year: the housing market. In fact, this month all the main private indexes have all been indicating that house prices are no longer growing at a rate above 10% and official data from the Land Registry published on Tuesday showed that prices edged down in seven regions out of ten in UK. This figures confirmed that measures taken by the Authorities to cool down the housing market, particularly the April’s Mortgage Market Review, are having a longer-lasting effect than many had anticipated. Moreover, the continuous decline in mortgage approvals from the January’s peaks shows evidence that buyer demand is dropping.

Weakness in demand can be noticed in most sectors of the economy. According to the club’s view, the main factor behind this weakness and behind the consequent downward pressure on prices is the UK’s low wage problem. In fact, while the labour market is recovering very quickly and the growth is picking up, average earnings are on a downward trend since 2007 and they are not showing any sign of recovery.

The softening in the pay and inflation data, together with the weaker external environment, for us suggests that the BOE can afford to maintain the current degree of monetary stimulus for longer than previously thought. As a consequence, this week the sterling pared its gains against the dollar and the dollar is trading again below the psychological level of 1.60.

Next week’s economic events will continue to provide evidence of the state of the economy with the PMIs and the industrial production data coming out in the first part of the week but the main event will be the Monetary Policy Committee statement published on Thursday.

Eurozone

The start of this week has seen a general fall in the share prices of the Eurozone banking sector with sell orders focusing on banks that had not passed the Stress Tests. Some general positions’ profit taking were also accentuated in the peripheral countries on rising concerns about recent sluggish growth indicators not supported by any ECB unconventional measures. However, after the US published a strong Q3 GDP, the main stock markets rebounded pushed up by the below expectations of the October German Consumer Price Index, which resulted in the Harmonised YoY value for 0.7% vs 0.9% predicted. This has seen to be as an increasing probability for the ECB to intervene more incisively in the economy. Furthermore, the BOJ QE expansion announcement has further increased investors’ hope in a surprising announcement of Mario Draghi next Thursday consolidating a +2.75% for the Euro Stoxx 50 index. On the FX side, the EUR-USD has weakened further to 1.2525 nearing again the 2-year low level reached at the beginning of the month at 1.2501. The government bonds have also benefited a good week with the German Bund yield consolidating a 0.83% of yield and Italy’s BTP yield at 2.351%.

AQR Special

On Sunday 26th the ECB revealed the results of the so-called comprehensive assessment, the yearlong review of Eurozone banking system consisting of the traditional stress-test, which simulate the consequences of economic collapse on banks’ balance sheets, and of a more comprehensive audit, the Asset Quality Review. While the first had already been carried out in the past with mixed results, the latter is a new, more detailed ECB scrutiny: based on the 2009 US tests, it is limited to the biggest 123 banks only, and is aimed at cleaning up bank’s balance sheets and credibility, at the expense of a little turmoil in the short-term. Analysts believe AQR will stake the ECB’s regulatory reputation at the time it inherits responsibility over Europe’s banking system.

The ECB found €136 billion of troubled loans banks had not disclosed, for a total of €836 billion, the biggest share of which is Italian (€12 billion). 25 undercapitalized banks failed the comprehensive assessment, and once more Italy leads with 9 institutions, one of which, the troubled Monte dei Paschi, requires over €2.1 billion of fresh capital. Though the final outcome of the assessment was quite in line with expectations, during the last week European banks performed quite badly, with the Stoxx Europe 600 bank index dropping more than 1% Thursday, taking declines in October to almost 6%; Monte dei Paschi lost 40% of its share value during the last week (see image below).

Japan

Given the booming in Japanese retail sales y/y and preliminary industrial production, which has beaten the forecasts, it pushed the Nikkei 225 up of 500 points. However, what was really unexpected for the market is the decision, on Friday afternoon, to expand, even more, the monetary easing program. The BoJ increased its bond purchase program up to Y80tn a year from the previous Y50tn. If the Nikkei 225 did well until Friday morning due to positive information, which delineates a boost both on consumer and industrial production, the announcement pushed the index up to 16,483 points, almost 5% since Monday. The common goal is is to haul Japan out of more than a decade of deflation. The Prime Minister Abe thinks to target communications towards individuals ranging from 20 to 30 years old, who are normally not that easily convinced that prices can actually keep on rising.

[edmc id=2033]Download as PDF[/edmc]

1 Comment

Wise Trader · 2 November 2014 at 11:49

With regard to Japan: do you really think retail sales was the only driver in the Nikkei rise? Considering that BoJ’s move on Friday was widely unexpected, I would argue it is due to GPIF allocation. I don’t see any reference to this: do you think the news was negligible for the markets?

In addition, you state that Abe is thinking to target 20s and 30s. Does this come from market expectations or he said anything explicit?